Question: 1. Capital allocation process The capital allocation process involves the transfer of capital among different entities that include individuals, small businesses, banks, financial intermediaries,

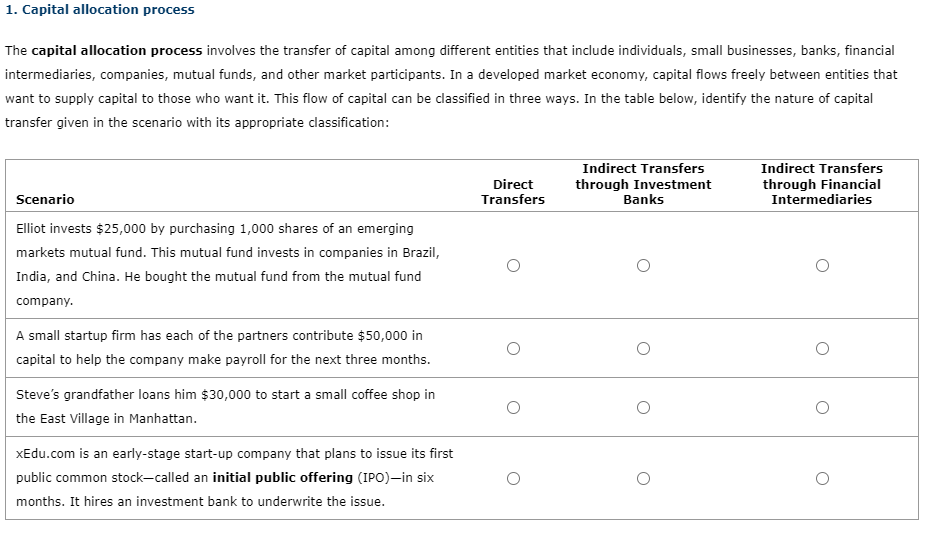

1. Capital allocation process The capital allocation process involves the transfer of capital among different entities that include individuals, small businesses, banks, financial intermediaries, companies, mutual funds, and other market participants. In a developed market economy, capital flows freely between entities that want to supply capital to those who want it. This flow of capital can be classified in three ways. In the table below, identify the nature of capital transfer given in the scenario with its appropriate classification: Scenario Elliot invests $25,000 by purchasing 1,000 shares of an emerging markets mutual fund. This mutual fund invests in companies in Brazil, India, and China. He bought the mutual fund from the mutual fund company. A small startup firm has each of the partners contribute $50,000 in capital to help the company make payroll for the next three months. Steve's grandfather loans him $30,000 to start a small coffee shop in the East Village in Manhattan. xEdu.com is an early-stage start-up company that plans to issue its first public common stock-called an initial public offering (IPO)-in six months. It hires an investment bank to underwrite the issue. Direct Transfers Indirect Transfers through Investment Banks Indirect Transfers through Financial Intermediaries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts