Question: 1. Capital project cvaluation ( 20 points) A. List at least two common methods for capital project evaluation, and explain how each method is done,

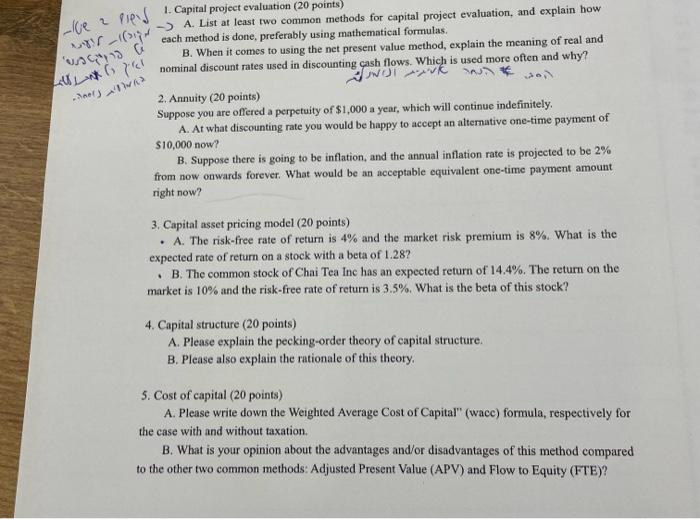

1. Capital project cvaluation ( 20 points) A. List at least two common methods for capital project evaluation, and explain how each method is done, preferably using mathematical formulas. B. When it comes to using the net present value method, explain the meaning of real and nominal discount rates used in discounting cash flows. Which is used more often and why? 2. Annuity ( 20 points) Suppose you are offered a perpetuity of $1,000 a year, which will continue indefinitely. A. At what discounting rate you would be happy to accept an altemative one-time payment of $10,000 now? B. Suppose there is going to be inflation, and the annual inflation rate is projected to be 2% from now onwards forever. What would be an acceptable equivalent one-time payment amount right now? 3. Capital asset pricing model ( 20 points) - A. The risk-free rate of return is 4% and the market risk premium is 8%. What is the expected rate of return on a stock with a beta of 1.28 ? - B. The common stock of Chai Tea Inc has an expected return of 14.4%. The return on the market is 10% and the risk-free rate of return is 3.5%. What is the beta of this stock? 4. Capital structure ( 20 points) A. Please explain the pecking-order theory of capital structure. B. Please also explain the rationale of this theory. 5. Cost of capital ( 20 points) A. Please write down the Weighted Average Cost of Capital" (wacc) formula, respectively for the case with and without taxation. B. What is your opinion about the advantages and/or disadvantages of this method compared to the other two common methods: Adjusted Present Value (APV) and Flow to Equity (FTE)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts