Question: 1. CAPM and Multifactor Models (18 points) Consider the following Fama-French (FF) three factor model: ID - r = ap + Bp (TM-) + BsMBISMB+BHmlHmL

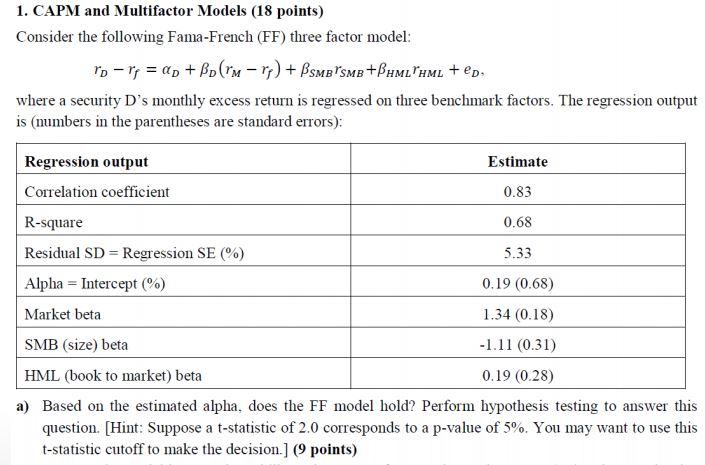

1. CAPM and Multifactor Models (18 points) Consider the following Fama-French (FF) three factor model: ID - r = ap + Bp (TM-) + BsMBISMB+BHmlHmL +ep where a security D's monthly excess return is regressed on three benchmark factors. The regression output is (numbers in the parentheses are standard errors): Estimate Regression output Correlation coefficient 0.83 R-square 0.68 5.33 Residual SD = Regression SE () Alpha = Intercept (%) 0.19 (0.68) 1.34 (0.18) Market beta SMB (size) beta -1.11 (0.31) 0.19 (0.28) HML (book to market) beta a) Based on the estimated alpha, does the FF model hold? Perform hypothesis testing to answer this question. (Hint: Suppose a t-statistic of 2.0 corresponds to a p-value of 5%. You may want to use this t-statistic cutoff to make the decision.] (9 points) 1. CAPM and Multifactor Models (18 points) Consider the following Fama-French (FF) three factor model: ID - r = ap + Bp (TM-) + BsMBISMB+BHmlHmL +ep where a security D's monthly excess return is regressed on three benchmark factors. The regression output is (numbers in the parentheses are standard errors): Estimate Regression output Correlation coefficient 0.83 R-square 0.68 5.33 Residual SD = Regression SE () Alpha = Intercept (%) 0.19 (0.68) 1.34 (0.18) Market beta SMB (size) beta -1.11 (0.31) 0.19 (0.28) HML (book to market) beta a) Based on the estimated alpha, does the FF model hold? Perform hypothesis testing to answer this question. (Hint: Suppose a t-statistic of 2.0 corresponds to a p-value of 5%. You may want to use this t-statistic cutoff to make the decision.] (9 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts