Question: 1) Case introduction (around 150-250 words/one page): a quick introduction of the case background and your proposed solutions or conclusions; 2) Case analysis (no words

1) Case introduction (around 150-250 words/one page): a quick introduction

of the case background and your proposed solutions or conclusions;

2) Case analysis (no words limit but no less than 500/2-3 pages): a detailed

analysis and creative answers to each question is strongly suggested. To make

your answers and solutions more convincing, support data, tables, figures and

citing theories/formulas learned from class will add points.

3) Conclusions and suggestions of the case study (around 100-200 words):

Lastly is the summary of solutions and conclusions. You may also suggest

further improvements, or possible alternative approaches in this concluding

section

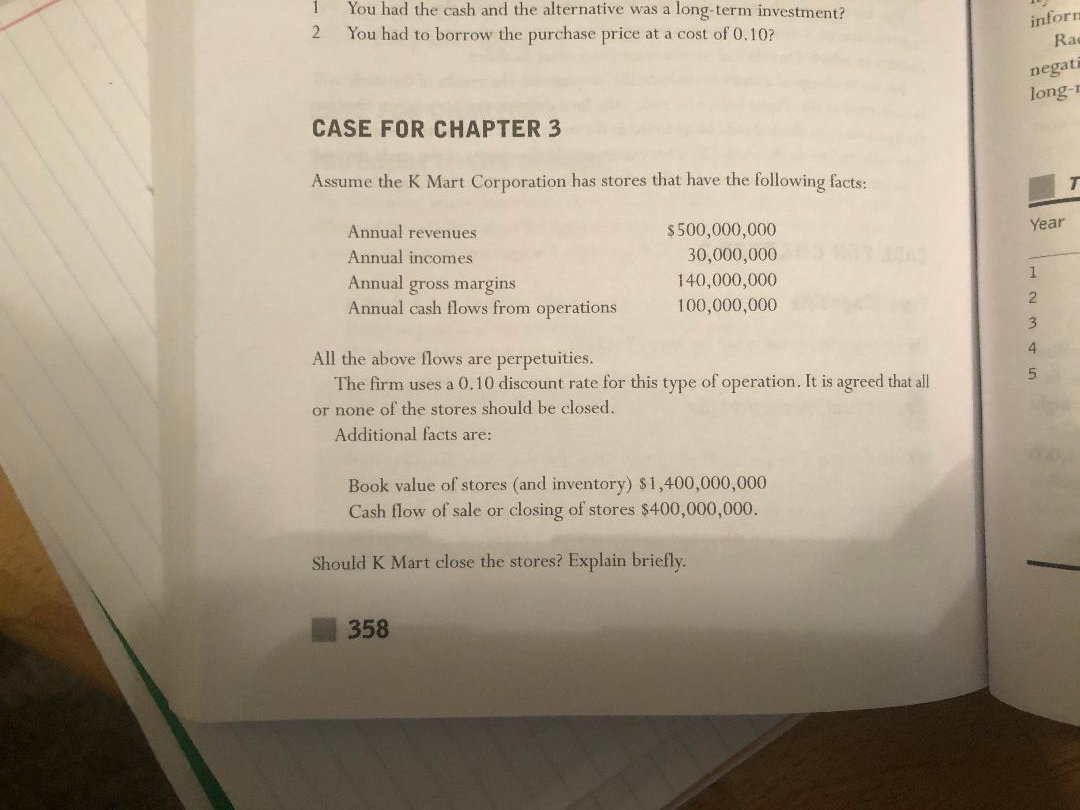

1 2 You had the cash and the alternative was a long-term investment? You had to borrow the purchase price at a cost of 0.10? inforn Rad negati long-1 CASE FOR CHAPTER 3 Assume the K Mart Corporation has stores that have the following facts: Year Annual revenues Annual incomes Annual gross margins Annual cash flows from operations $500,000,000 30,000,000 140,000,000 100,000,000 UN All the above flows are perpetuities. The firm uses a 0.10 discount rate for this type of operation. It is agreed that all or none of the stores should be closed. Additional facts are: Book value of stores and inventory) $1,400,000,000 Cash flow of sale or closing of stores $400,000,000. Should K Mart close the stores? Explain briefly. 358 1 2 You had the cash and the alternative was a long-term investment? You had to borrow the purchase price at a cost of 0.10? inforn Rad negati long-1 CASE FOR CHAPTER 3 Assume the K Mart Corporation has stores that have the following facts: Year Annual revenues Annual incomes Annual gross margins Annual cash flows from operations $500,000,000 30,000,000 140,000,000 100,000,000 UN All the above flows are perpetuities. The firm uses a 0.10 discount rate for this type of operation. It is agreed that all or none of the stores should be closed. Additional facts are: Book value of stores and inventory) $1,400,000,000 Cash flow of sale or closing of stores $400,000,000. Should K Mart close the stores? Explain briefly. 358

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts