Question: 1 Case Objective Your objective is to price a cliquette struck on Palantir stock. This exercise should familiarise you with the use of binomial trees,

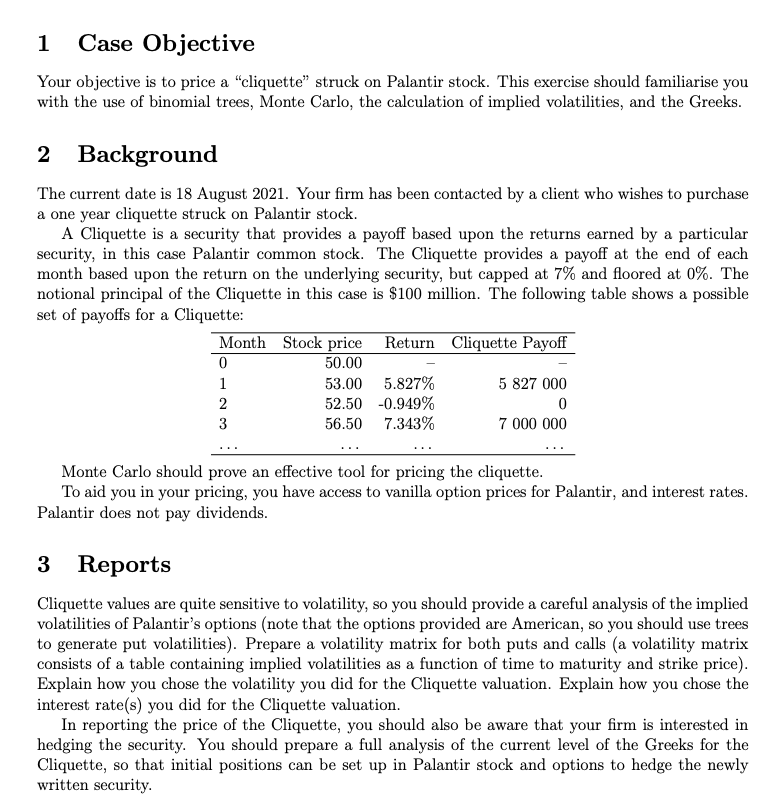

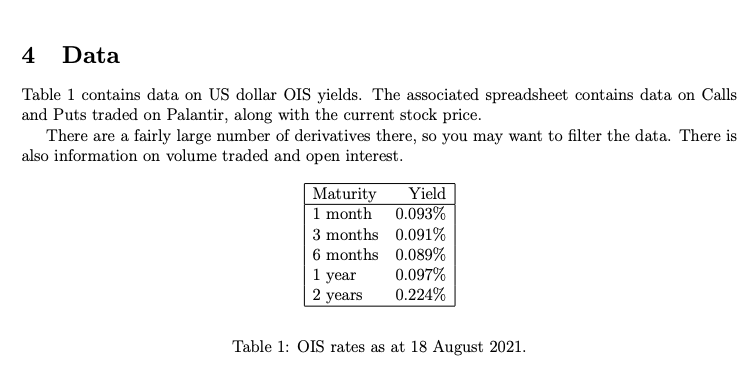

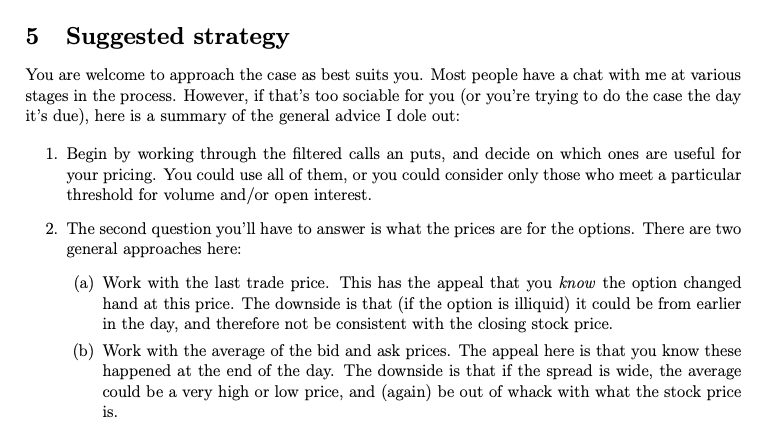

1 Case Objective Your objective is to price a "cliquette struck on Palantir stock. This exercise should familiarise you with the use of binomial trees, Monte Carlo, the calculation of implied volatilities, and the Greeks. 2 Background The current date is 18 August 2021. Your firm has been contacted by a client who wishes to purchase a one year cliquette struck on Palantir stock. A Cliquette is a security that provides a payoff based upon the returns earned by a particular security, in this case Palantir common stock. The Cliquette provides a payoff at the end of each month based upon the return on the underlying security, but capped at 7% and floored at 0%. The notional principal of the Cliquette in this case is $100 million. The following table shows a possible set of payoffs for a Cliquette: Month Stock price Return Cliquette Payoff 0 50.00 1 53.00 5.827% 5 827 000 2 52.50 -0.949% 0 3 56.50 7.343% 7 000 000 Monte Carlo should prove an effective tool for pricing the cliquette. To aid you in your pricing, you have access to vanilla option prices for Palantir, and interest rates. Palantir does not pay dividends. 3 Reports Cliquette values are quite sensitive to volatility, so you should provide a careful analysis of the implied volatilities of Palantir's options (note that the options provided are American, so you should use trees to generate put volatilities). Prepare a volatility matrix for both puts and calls (a volatility matrix consists of a table containing implied volatilities as a function of time to maturity and strike price). Explain how you chose the volatility you did for the Cliquette valuation. Explain how you chose the interest rate(s) you did for the Cliquette valuation. In reporting the price of the Cliquette, you should also be aware that your firm is interested in hedging the security. You should prepare a full analysis of the current level of the Greeks for the Cliquette, so that initial positions can be set up in Palantir stock and options to hedge the newly written security. 4 Data Table 1 contains data on US dollar OIS yields. The associated spreadsheet contains data on Calls and Puts traded on Palantir, along with the current stock price. There are a fairly large number of derivatives there, so you may want to filter the data. There is also information on volume traded and open interest. Maturity Yield 1 month 0.093% 3 months 0.091% 6 months 0.089% 1 year 0.097% 2 years 0.224% Table 1: OIS rates as at 18 August 2021. 5 Suggested strategy You are welcome to approach the case as best suits you. Most people have a chat with me at various stages in the process. However, if that's too sociable for you (or you're trying to do the case the day it's due), here is a summary of the general advice I dole out: 1. Begin by working through the filtered calls an puts, and decide on which ones are useful for your pricing. You could use all of them, or you could consider only those who meet a particular threshold for volume and/or open interest. 2. The second question you'll have to answer is what the prices are for the options. There are two general approaches here: (a) Work with the last trade price. This has the appeal that you know the option changed hand at this price. The downside is that (if the option is illiquid) it could be from earlier in the day, and therefore not be consistent with the closing stock price. (b) Work with the average of the bid and ask prices. The appeal here is that you know these happened at the end of the day. The downside is that if the spread is wide, the average could be a very high or low price, and (again) be out of whack with what the stock price is. 1 Case Objective Your objective is to price a "cliquette struck on Palantir stock. This exercise should familiarise you with the use of binomial trees, Monte Carlo, the calculation of implied volatilities, and the Greeks. 2 Background The current date is 18 August 2021. Your firm has been contacted by a client who wishes to purchase a one year cliquette struck on Palantir stock. A Cliquette is a security that provides a payoff based upon the returns earned by a particular security, in this case Palantir common stock. The Cliquette provides a payoff at the end of each month based upon the return on the underlying security, but capped at 7% and floored at 0%. The notional principal of the Cliquette in this case is $100 million. The following table shows a possible set of payoffs for a Cliquette: Month Stock price Return Cliquette Payoff 0 50.00 1 53.00 5.827% 5 827 000 2 52.50 -0.949% 0 3 56.50 7.343% 7 000 000 Monte Carlo should prove an effective tool for pricing the cliquette. To aid you in your pricing, you have access to vanilla option prices for Palantir, and interest rates. Palantir does not pay dividends. 3 Reports Cliquette values are quite sensitive to volatility, so you should provide a careful analysis of the implied volatilities of Palantir's options (note that the options provided are American, so you should use trees to generate put volatilities). Prepare a volatility matrix for both puts and calls (a volatility matrix consists of a table containing implied volatilities as a function of time to maturity and strike price). Explain how you chose the volatility you did for the Cliquette valuation. Explain how you chose the interest rate(s) you did for the Cliquette valuation. In reporting the price of the Cliquette, you should also be aware that your firm is interested in hedging the security. You should prepare a full analysis of the current level of the Greeks for the Cliquette, so that initial positions can be set up in Palantir stock and options to hedge the newly written security. 4 Data Table 1 contains data on US dollar OIS yields. The associated spreadsheet contains data on Calls and Puts traded on Palantir, along with the current stock price. There are a fairly large number of derivatives there, so you may want to filter the data. There is also information on volume traded and open interest. Maturity Yield 1 month 0.093% 3 months 0.091% 6 months 0.089% 1 year 0.097% 2 years 0.224% Table 1: OIS rates as at 18 August 2021. 5 Suggested strategy You are welcome to approach the case as best suits you. Most people have a chat with me at various stages in the process. However, if that's too sociable for you (or you're trying to do the case the day it's due), here is a summary of the general advice I dole out: 1. Begin by working through the filtered calls an puts, and decide on which ones are useful for your pricing. You could use all of them, or you could consider only those who meet a particular threshold for volume and/or open interest. 2. The second question you'll have to answer is what the prices are for the options. There are two general approaches here: (a) Work with the last trade price. This has the appeal that you know the option changed hand at this price. The downside is that (if the option is illiquid) it could be from earlier in the day, and therefore not be consistent with the closing stock price. (b) Work with the average of the bid and ask prices. The appeal here is that you know these happened at the end of the day. The downside is that if the spread is wide, the average could be a very high or low price, and (again) be out of whack with what the stock price is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts