Question: 1. Cash conversion cycle is an efficiency ratio which measures the number of days for which a company's cash is tied up in inventories and

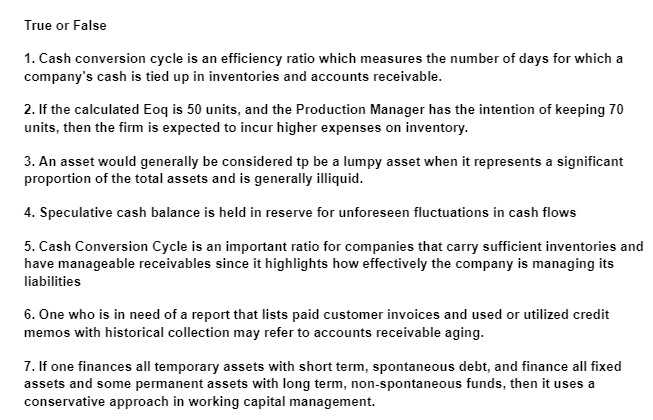

1. Cash conversion cycle is an efficiency ratio which measures the number of days for which a company's cash is tied up in inventories and accounts receivable. 2. If the calculated Eoq is 50 units, and the Production Manager has the intention of keeping 70 units, then the firm is expected to incur higher expenses on inventory. 3. An asset would generally be considered tp be a lumpy asset when it represents a significant proportion of the total assets and is generally illiquid. 4. Speculative cash balance is held in reserve for unforeseen fluctuations in cash flows 5. Cash Conversion Cycle is an important ratio for companies that carry sufficient inventories an have manageable receivables since it highlights how effectively the company is managing its liabilities 6. One who is in need of a report that lists paid customer invoices and used or utilized credit memos with historical collection may refer to accounts receivable aging. 7. If one finances all temporary assets with short term, spontaneous debt, and finance all fixed assets and some permanent assets with long term, non-spontaneous funds, then it uses a conservative approach in working capital management

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts