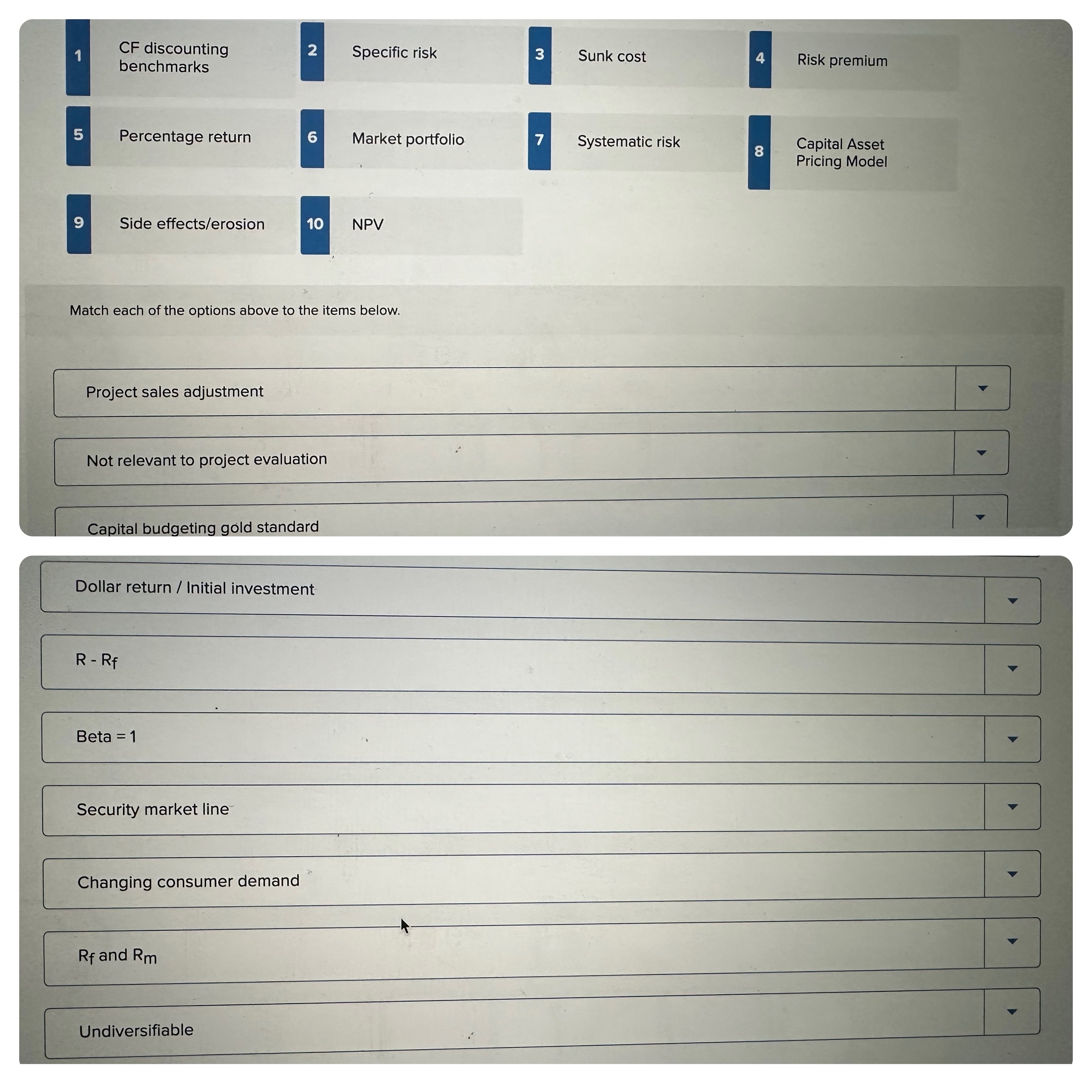

Question: 1 CF discounting benchmarks 2 Specific risk 3 Sunk cost 4 Risk premium 5 Percentage return 6 Market portfolio 7 Systematic risk 8 Capital Asset

CF discounting benchmarks

Specific risk

Sunk cost

Risk premium

Percentage return

Market portfolio

Systematic risk

Capital Asset

Pricing Model

Side effectserosion

NPV

Match each of the options above to the items below.

Project sales adjustment

Not relevant to project evaluation

Capital budgeting gold standard

Dollar return Initial investment

Beta

Security market line

Changing consumer demand

and

Undiversifiable

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock