Question: 1. (Ch. 7) Triangular Arbitrage. Assume the following information: St=.62 in AUDUSD S1=1.12 in GBPUSD S1=1.82 in GBPAUD Where GBP is the British pound, AUD

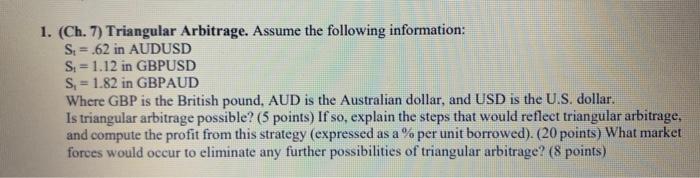

1. (Ch. 7) Triangular Arbitrage. Assume the following information: St=.62 in AUDUSD S1=1.12 in GBPUSD S1=1.82 in GBPAUD Where GBP is the British pound, AUD is the Australian dollar, and USD is the U.S. dollar. Is triangular arbitrage possible? ( 5 points) If so, explain the steps that would reflect triangular arbitrage, and compute the profit from this strategy (expressed as a \% per unit borrowed). (20 points) What market forces would occur to eliminate any further possibilities of triangular arbitrage? ( 8 points)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock