Question: 1 . ( Chapter 1 2 ) Cash flow Assume a corporation has earnings before depreciation and taxes of $ 9 0 , 0 0

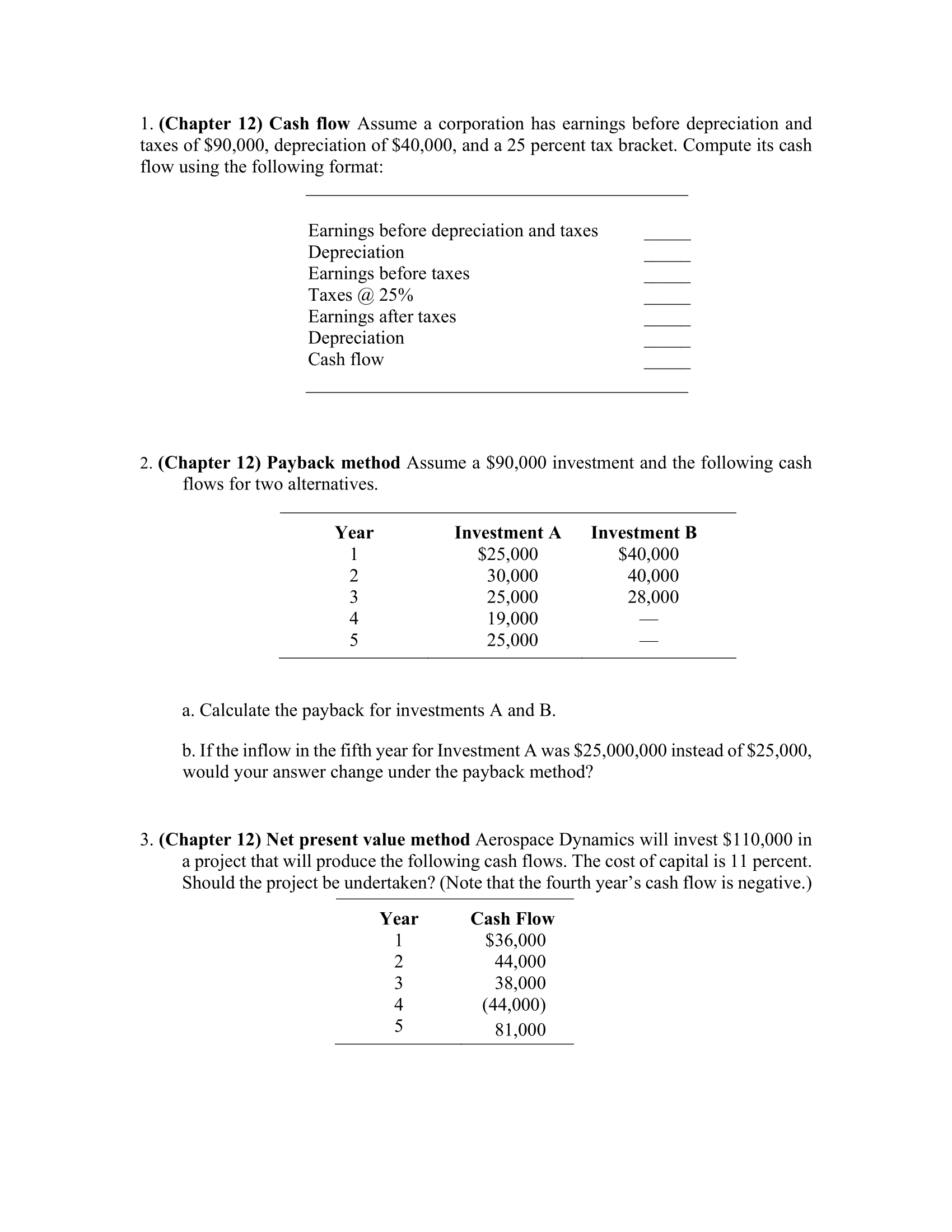

Chapter Cash flow Assume a corporation has earnings before depreciation and taxes of $ depreciation of $ and a percent tax bracket. Compute its cash flow using the following format:

Earnings before depreciation and taxes Depreciation

Earnings before taxes

Taxes @

Earnings after taxes Depreciation

Cash flow

Chapter Payback method Assume a $ investment and the following cash flows for two alternatives.

Year Investment A Investment B

$ $

a Calculate the payback for investments A and B

b If the inflow in the fifth year for Investment A was $ instead of $ would your answer change under the payback method?

Chapter Net present value method Aerospace Dynamics will invest $ in a project that will produce the following cash flows. The cost of capital is percent. Should the project be undertaken? Note that the fourth years cash flow is negative.

Year

Cash Flow

$

Chapter Capital rationing and mutually exclusive investments The Suboptimal Glass Company uses a process of capital rationing in its decision making. The firms cost of capital is percent. It will only invest $ this year. It has determined the internal rate of return for each of the following projects.

Project

Project Size

Internal Rate of Return

A $

B

C

D

E

F

G

Select the projects that the firm should accept.

If Projects A and B are mutually exclusive, how would that affect your overall answer? That is which projects would you accept in spending the $

Chapter Riskaverse Assume you are riskaverse and have the following three choices. Which project will you select? Compute the coefficient of variation for each.

Project

A B C

Expected Value $

Standard Deviation $

Chapter Cash flow Assume a corporation has earnings before depreciation and taxes of $ depreciation of $ and a percent tax bracket. Compute its cash flow using the following format:

Earnings before depreciation and taxes

Depreciation

Earnings before taxes

Taxes @

Earnings after taxes

Depreciation

Cash flow

Chapter Payback method Assume a $ investment and the following cash flows for two alternatives.

a Calculate the payback for investments A and B

b If the inflow in the fifth year for Investment A was $ instead of $ would your answer change under the payback method?

Chapter Net present value method Aerospace Dynamics will invest $ in a project that will produce the following cash flows. The cost of capital is percent. Should the project be undertaken? Note that the fourth year's cash flow is negative.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock