Question: 1. Chapter 11 1. Project L requires an initial outlay at t = 0 of $65,000, its expected cash inflows are $12,000 per year for

1.

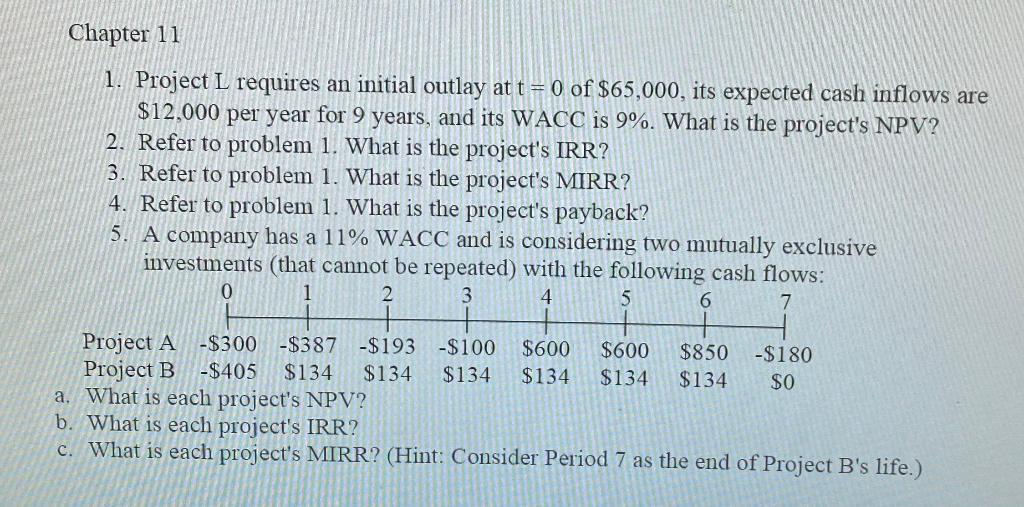

Chapter 11 1. Project L requires an initial outlay at t = 0 of $65,000, its expected cash inflows are $12,000 per year for 9 years, and its WACC is 9%. What is the project's NPV? 2. Refer to problem 1. What is the project's IRR? 3. Refer to problem 1. What is the project's MIRR? 4. Refer to problem 1. What is the project's payback? 5. A company has a 11% WACC and is considering two mutually exclusive investments (that cannot be repeated) with the following cash flows: 1 2 3 4 5 7 0 6 Project A -$300 -$387 -$193 -$100 $600 $600 $850 -$180 Project B $405 $134 $134 $134 $134 $134 $134 $0 a. What is each project's NPV? b. What is each project's IRR? c. What is each project's MIRR? (Hint: Consider Period 7 as the end of Project B's life.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts