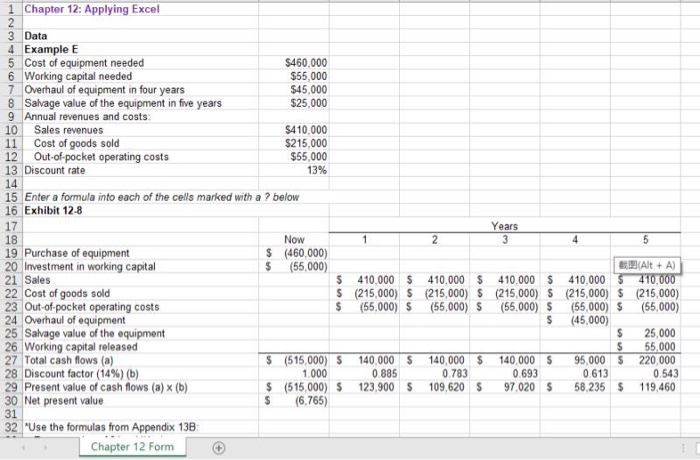

Question: 1 Chapter 12: Applying Excel 3 Data 4 Example E 5 Cost of equipment needed 6 Working capital needed 7 Overhaul of equipment in four

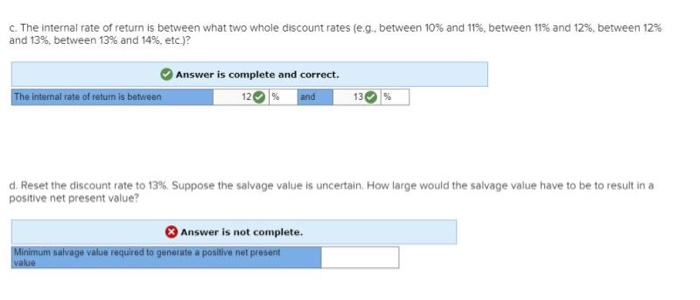

1 Chapter 12: Applying Excel 3 Data 4 Example E 5 Cost of equipment needed 6 Working capital needed 7 Overhaul of equipment in four years 8 Salvage value of the equipment in five years 9 Annual revenues and costs 10 Sales revenues 11 Cost of goods sold 12 Out-of-pocket operating costs 13 Discount rate $460.000 $55,000 $45,000 $25,000 $410,000 $215,000 $55,000 13% 14 15 Enter a formula into each of the cells marked with a ? below 16 Exhibit 12-8 17 Years Now $ (460,000) $ (55,000) $ $ $ 410,000 $ (215,000) $ (55,000) S 410.000 $ (215,000) $ (55,000) S 410,000 $ (215,000) $ (55,000) S $ 410,000 $ (215,000) $ (55,000) $ 45,000) (Alt + A) 410,000 (215,000) (55,000) 19 Purchase of equipment 20 Investment in working capital 21 Sales 22 Cost of goods sold 23 Out-of-pocket operating costs 24 Overhaul of equipment 25 Salvage value of the equipment 26 Working capital released 27 Total cash flows (a) 28 Discount factor (14%) (b) 29 Present value of cash flows (a) 30 Net present value $ $ $ $ (515,000) $ 1.000 $ (515.000) S $ (6,765) 140,000 0.885 123.900 140,000 0.783 109,620 140,000 0.693 97.020 95,000 $ 0.613 58,235 $ 25,000 55,000 220,000 0.543 119,460 (b) $ S $ 32 "Use the formulas from Appendix 138 Chapter 12 Form C. The internal rate of return is between what two whole discount rates (eg., between 10% and 11%, between 11% and 12%, between 12% and 13%, between 13% and 14%, etc.)? Answer is complete and correct. 12 % and The internal rate of return is between 13 % d. Reset the discount rate to 13%. Suppose the salvage value is uncertain How large would the salvage value have to be to result in a positive net present value? X Answer is not complete. Minimum salvage value required to generate a positive net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts