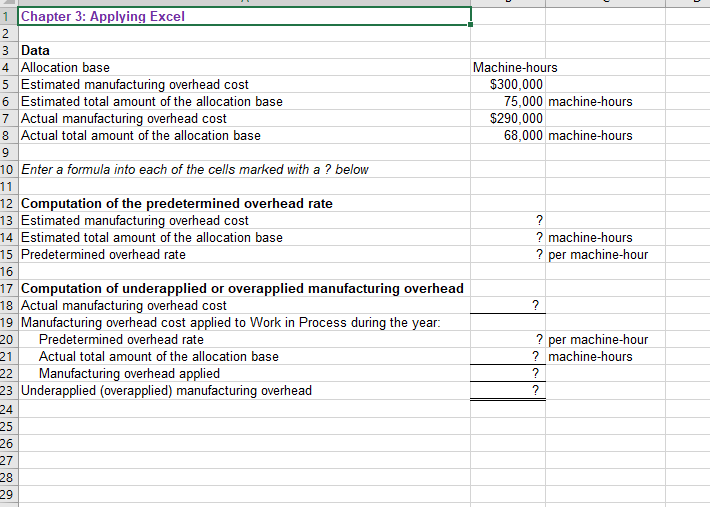

Question: 1 Chapter 3: Applying Excel 2 3 Data 4 Allocation base 5 Estimated manufacturing overhead cost 6 Estimated total amount of the allocation base 7

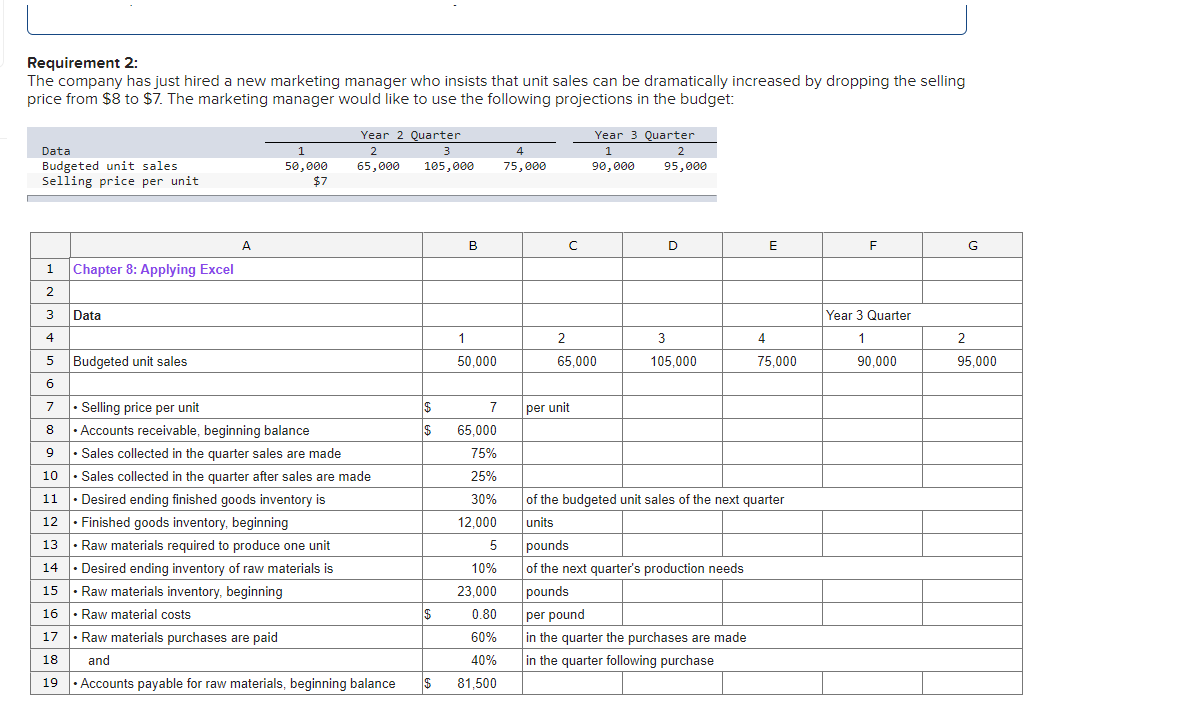

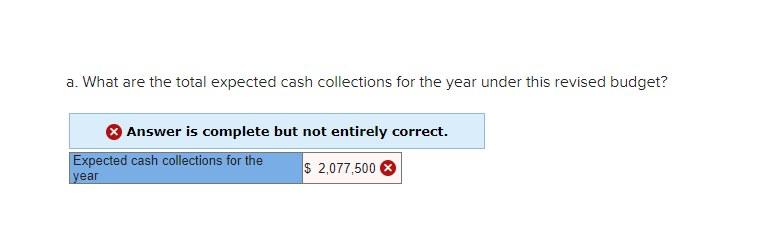

1 Chapter 3: Applying Excel 2 3 Data 4 Allocation base 5 Estimated manufacturing overhead cost 6 Estimated total amount of the allocation base 7 Actual manufacturing overhead cost 8 Actual total amount of the allocation base 9 10 Enter a formula into each of the cells marked with a ? below Machine-hours $300,000 75,000 machine-hours $290,000 68,000 machine-hours 11 ? machine-hours ? per machine-hour ? 20 12 Computation of the predetermined overhead rate 13 Estimated manufacturing overhead cost 14 Estimated total amount of the allocation base 15 Predetermined overhead rate 16 17 Computation of underapplied or overapplied manufacturing overhead 18 Actual manufacturing overhead cost 19 Manufacturing overhead cost applied to Work in Process during the year: Predetermined overhead rate 21 Actual total amount of the allocation base Manufacturing overhead applied 23 Underapplied (overapplied) manufacturing overhead 24 25 26 27 28 29 ? per machine-hour ? machine-hours ? ? 22 Requirement 2: The company has just hired a new marketing manager who insists that unit sales can be dramatically increased by dropping the selling price from $8 to $7. The marketing manager would like to use the following projections in the budget: Data Budgeted unit sales Selling price per unit 1 50,000 $7 Year 2 Quarter 2 3 65,000 105,000 4 75,000 Year 3 Quarter 1 2 90,000 95,000 A B D E F G 1 Chapter 8: Applying Excel 2 3 3 Data Year 3 Quarter 4 2 3 4 1 1 50.000 2 2 95,000 5 Budgeted unit sales 65,000 105,000 75,000 90,000 6 $ per unit $ 7 7 65,000 75% 7. Selling price per unit 8 Accounts receivable, beginning balance 9 Sales collected in the quarter sales are made 10 - Sales collected in the quarter after sales are made 11 Desired ending finished goods inventory is 12 - Finished goods inventory, beginning 13 Raw materials required to produce one unit 14 Desired ending inventory of raw materials is 15 - Raw materials inventory, beginning 16 . Raw material costs 17 Raw materials purchases are paid 18 and 19 Accounts payable for raw materials, beginning balance 25% 30% 12,000 5 5 10% 23,000 0.80 60% of the budgeted unit sales of the next quarter units pounds of the next quarter's production needs pounds per pound in the quarter the purchases are made in the quarter following purchase $ 40% 81,500 $ a. What are the total expected cash collections for the year under this revised budget? Answer is complete but not entirely correct. Expected cash collections for the $ 2,077,500 year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts