Question: 1) (Chapter 5 - 4 Points) If you wish to accumulate $1,000,000 in 30 years, how much must you deposit today in an account that

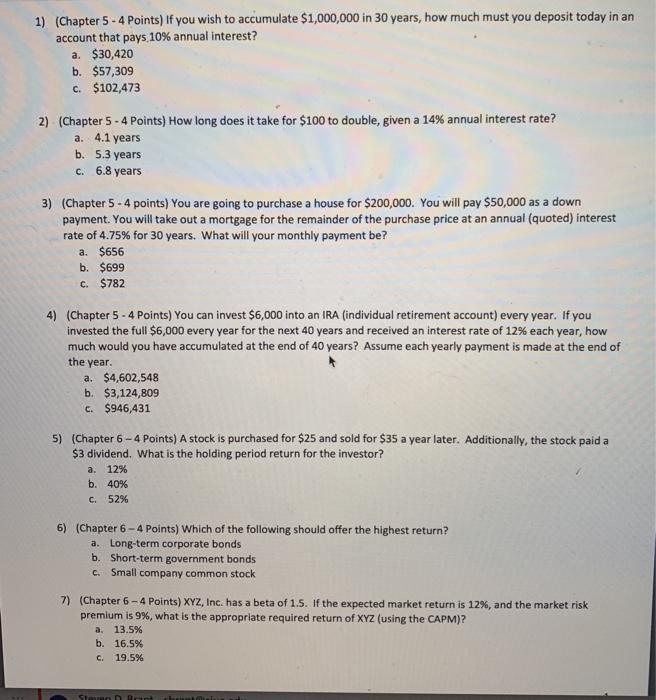

1) (Chapter 5 - 4 Points) If you wish to accumulate $1,000,000 in 30 years, how much must you deposit today in an account that pays 10% annual interest? a. $30,420 b. $57,309 C. $102,473 2) (Chapter 5 - 4 Points) How long does it take for $100 to double, given a 14% annual interest rate? a. 4.1 years b. 5.3 years c. 6.8 years 3) (Chapter 5 - 4 points) You are going to purchase a house for $200,000. You will pay $50,000 as a down payment. You will take out a mortgage for the remainder of the purchase price at an annual (quoted) interest rate of 4.75% for 30 years. What will your monthly payment be? a. $656 b. $699 c. $782 4) (Chapter 5 - 4 Points) You can invest $6,000 into an IRA (individual retirement account) every year. If you invested the full $6,000 every year for the next 40 years and received an interest rate of 12% each year, how much would you have accumulated at the end of 40 years? Assume each yearly payment is made at the end of the year. a. $4,602,548 b. $3,124,809 C. $946,431 5) (Chapter 6 - 4 Points) A stock is purchased for $25 and sold for $35 a year later. Additionally, the stock paid a $3 dividend. What is the holding period return for the investor? a. 12% b. 40% C.52% 6) (Chapter 6-4 points) Which of the following should offer the highest return? a. Long-term corporate bonds b. Short-term government bonds c. Small company common stock 7) (Chapter 6 - 4 Points) XYZ, Inc. has a beta of 1.5. If the expected market return is 12%, and the market risk premium is 9%, what is the appropriate required return of XYZ (using the CAPM)? 13.5% b. 16.5% C. 19.5% a. Stone

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts