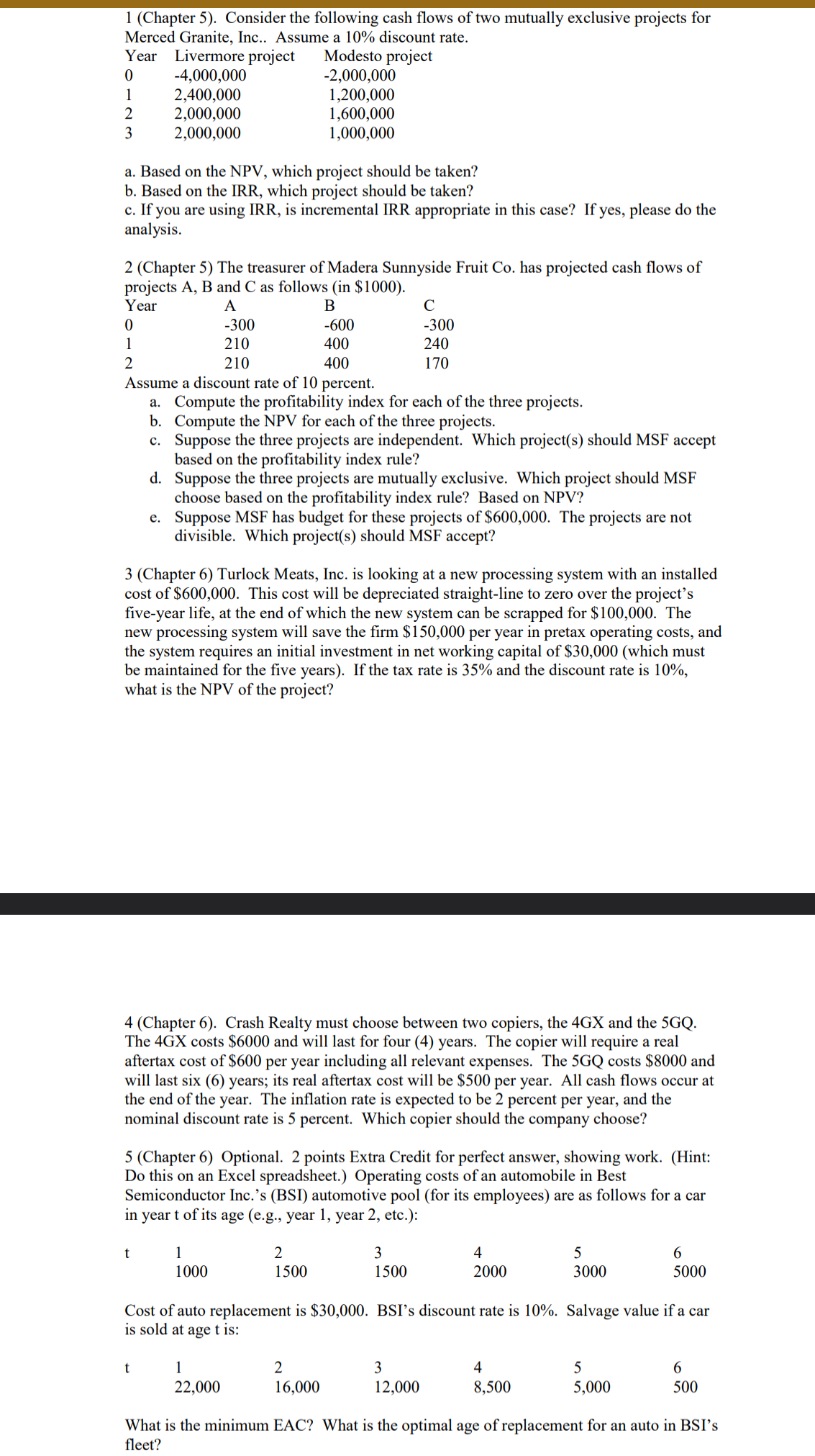

Question: 1 ( Chapter 5 ) . Consider the following cash flows of two mutually exclusive projects for Merced Granite, Inc.. Assume a 1 0 %

Chapter Consider the following cash flows of two mutually exclusive projects for

Merced Granite, Inc.. Assume a discount rate.

Year Livermore project Modesto project

a Based on the NPV which project should be taken?

b Based on the IRR, which project should be taken?

c If you are using IRR, is incremental IRR appropriate in this case? If yes, please do the

analysis.

Chapter The treasurer of Madera Sunnyside Fruit Co has projected cash flows of

projects A B and C as follows in $

Assume a discount rate of percent.

a Compute the profitability index for each of the three projects.

b Compute the NPV for each of the three projects.

c Suppose the three projects are independent. Which projects should MSF accept

based on the profitability index rule?

d Suppose the three projects are mutually exclusive. Which project should MSF

choose based on the profitability index rule? Based on NPV

e Suppose MSF has budget for these projects of $ The projects are not

divisible. Which projects should MSF accept?

Chapter Turlock Meats, Inc. is looking at a new processing system with an installed

cost of $ This cost will be depreciated straightline to zero over the project's

fiveyear life, at the end of which the new system can be scrapped for $ The

new processing system will save the firm $ per year in pretax operating costs, and

the system requires an initial investment in net working capital of $which must

be maintained for the five years If the tax rate is and the discount rate is

what is the NPV of the project?

Chapter Crash Realty must choose between two copiers, the GX and the GQ

The GX costs $ and will last for four years. The copier will require a real

aftertax cost of $ per year including all relevant expenses. The GQ costs $ and

will last six years; its real aftertax cost will be $ per year. All cash flows occur at

the end of the year. The inflation rate is expected to be percent per year, and the

nominal discount rate is percent. Which copier should the company choose?

Chapter Optional. points Extra Credit for perfect answer, showing work. Hint:

Do this on an Excel spreadsheet. Operating costs of an automobile in Best

Semiconductor Inc.s BSI automotive pool for its employees are as follows for a car

in year t of its age eg year year etc.:

t

Cost of auto replacement is $ BSI's discount rate is Salvage value if a car

is sold at age is:

What is the minimum EAC? What is the optimal age of replacement for an auto in BSI's

fleet?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock