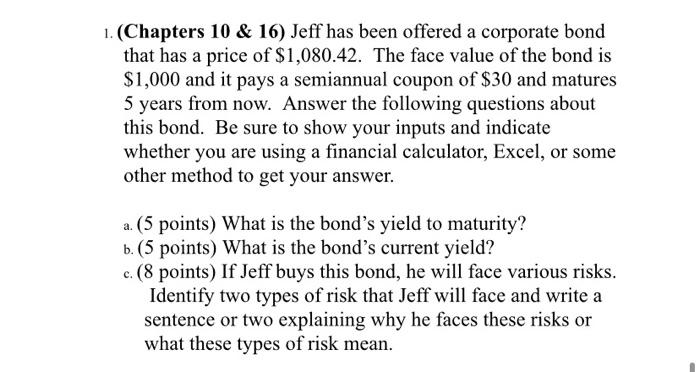

Question: 1. (Chapters 10 & 16) Jeff has been offered a corporate bond that has a price of $1,080.42. The face value of the bond is

1. (Chapters 10 & 16) Jeff has been offered a corporate bond that has a price of $1,080.42. The face value of the bond is $1,000 and it pays a semiannual coupon of $30 and matures 5 years from now. Answer the following questions about this bond. Be sure to show your inputs and indicate whether you are using a financial calculator, Excel, or some other method to get your answer. a. (5 points) What is the bond's yield to maturity? b. (5 points) What is the bond's current yield? c. (8 points) If Jeff buys this bond, he will face various risks. Identify two types of risk that Jeff will face and write a sentence or two explaining why he faces these risks or what these types of risk mean

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts