Question: 1. Charitable Contributions Pub. 542 -https:/l www.irs.gov/ipub/irs-pdf/p542.pdf Income, Deductions, and Special Provisions section then Charitable Contributions Zazzle Inc. is considering making the following contributions: inventory

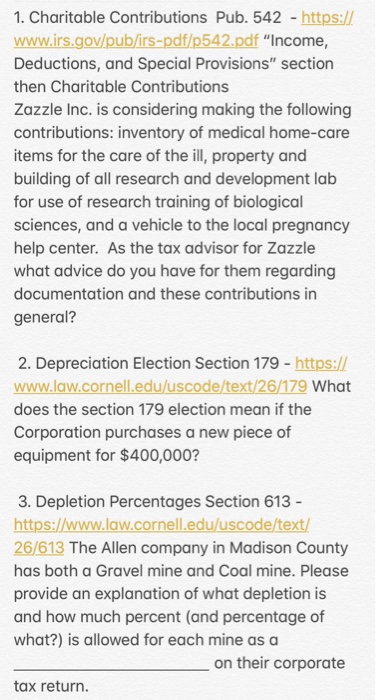

1. Charitable Contributions Pub. 542 -https:/l www.irs.gov/ipub/irs-pdf/p542.pdf "Income, Deductions, and Special Provisions" section then Charitable Contributions Zazzle Inc. is considering making the following contributions: inventory of medical home-care items for the care of the ill, property and building of all research and development lab for use of research training of biological sciences, and a vehicle to the local pregnancy help center. As the tax advisor for Zazzle what advice do you have for them regarding documentation and these contributions in general? 2. Depreciation Election Section 179 -https:// www.law.cornell.edu/uscode/text/26/179 What does the section 179 election mean if the Corporation purchases a new piece of equipment for $400,000? 3. Depletion Percentages Section 613 https://www.law.cornell.edu/uscode/text/ 26/613 The Allen company in Madison County has both a Gravel mine and Coal mine. Please provide an explanation of what depletion is and how much percent (and percentage of what?) is allowed for each mine as a on their corporate tax return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts