Question: 1 cin Amos Bhd. is specialized in making a variety of high quality cookies in Malaysia. One of their business strategy is to make

\

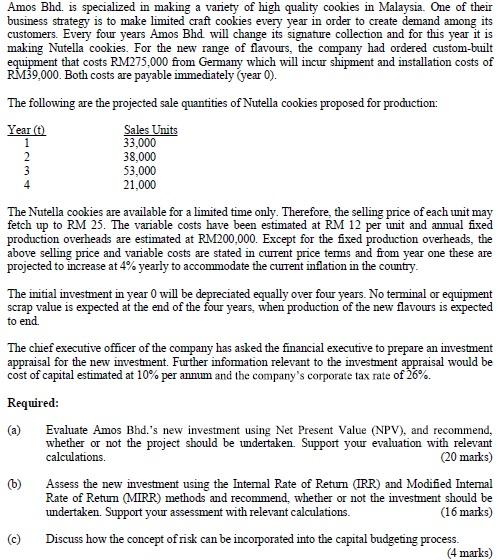

1 cin Amos Bhd. is specialized in making a variety of high quality cookies in Malaysia. One of their business strategy is to make limited craft cookies every year in order to create demand among its customers. Every fow years Amos Bhd will change its signature collection and for this year it is making Nutella cookies. For the new range of flavours, the company had ordered custom-built equipment that costs RM275,000 from Germany which will incur shipment and installation costs of RM39.000. Both costs are payable immediately (year 0). The following are the projected sale quantities of Nutella cookies proposed for production: Year (t) Sales Units 33,000 2 38,000 3 53,000 4 21,000 The Nutella cookies are available for a limited time only. Therefore, the selling price of each unit may fetch up to RM 25. The variable costs have been estimated at RM 12 per unit and annual fixed production overheads are estimated at RM200,000. Except for the fixed production overheads, the above selling price and variable costs are stated in current price terms and from year one these are projected to increase at 4% yearly to accommodate the current inflation in the country. The initial investment in year 0 will be depreciated equally over four years. No terminal or equipment scrap value is expected at the end of the four years, when production of the new flavours is expected to end The chief executive officer of the company has asked the financial executive to prepare an investment appraisal for the new investment. Further infomation relevant to the investment appraisal would be cost of capital estimated at 10% per anmm and the company's corporate tax rate of 26%. Required: (a) Evaluate Amos Bhd.'s new investment using Net Present Value (NPV), and recommend, whether or not the project should be undertaken. Support your evaluation with relevant calculations (20 marks) (6) Assess the new investment using the Intemal Rate of Retum (IRR) and Modified Intemal Rate of Retum (MIRR) methods and recommend, whether or not the investment should be undertaken. Support your assessment with relevant calculations. (16 marks) (c) Discuss how the concept of risk can be incorporated into the capital budgeting process (4 marks) 1 cin Amos Bhd. is specialized in making a variety of high quality cookies in Malaysia. One of their business strategy is to make limited craft cookies every year in order to create demand among its customers. Every fow years Amos Bhd will change its signature collection and for this year it is making Nutella cookies. For the new range of flavours, the company had ordered custom-built equipment that costs RM275,000 from Germany which will incur shipment and installation costs of RM39.000. Both costs are payable immediately (year 0). The following are the projected sale quantities of Nutella cookies proposed for production: Year (t) Sales Units 33,000 2 38,000 3 53,000 4 21,000 The Nutella cookies are available for a limited time only. Therefore, the selling price of each unit may fetch up to RM 25. The variable costs have been estimated at RM 12 per unit and annual fixed production overheads are estimated at RM200,000. Except for the fixed production overheads, the above selling price and variable costs are stated in current price terms and from year one these are projected to increase at 4% yearly to accommodate the current inflation in the country. The initial investment in year 0 will be depreciated equally over four years. No terminal or equipment scrap value is expected at the end of the four years, when production of the new flavours is expected to end The chief executive officer of the company has asked the financial executive to prepare an investment appraisal for the new investment. Further infomation relevant to the investment appraisal would be cost of capital estimated at 10% per anmm and the company's corporate tax rate of 26%. Required: (a) Evaluate Amos Bhd.'s new investment using Net Present Value (NPV), and recommend, whether or not the project should be undertaken. Support your evaluation with relevant calculations (20 marks) (6) Assess the new investment using the Intemal Rate of Retum (IRR) and Modified Intemal Rate of Retum (MIRR) methods and recommend, whether or not the investment should be undertaken. Support your assessment with relevant calculations. (16 marks) (c) Discuss how the concept of risk can be incorporated into the capital budgeting process (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts