Question: 1- Classify each item as an asset, liability or owners equity. _____ 1 . Note payable _____ 2. Accounts payable _____ 3. Expense _____ 4.

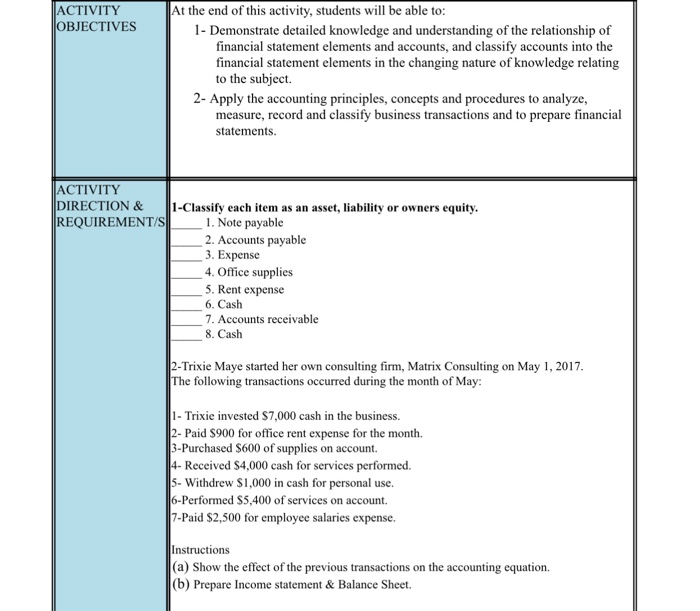

1-Classify each item as an asset, liability or owners equity.

_____ 1. Note payable

_____ 2. Accounts payable

_____ 3. Expense

_____ 4. Office supplies

_____ 5. Rent expense

_____ 6. Cash

_____ 7. Accounts receivable

_____ 8. Cash

2-Trixie Maye started her own consulting firm, Matrix Consulting on May 1, 2017.

The following transactions occurred during the month of May:

1- Trixie invested $7,000 cash in the business.

2- Paid $900 for office rent expense for the month.

3-Purchased $600 of supplies on account.

4- Received $4,000 cash for services performed.

5- Withdrew $1,000 in cash for personal use.

6-Performed $5,400 of services on account.

7-Paid $2,500 for employee salaries expense.

Instructions

ACTIVITY OBJECTIVES At the end of this activity, students will be able to: 1- Demonstrate detailed knowledge and understanding of the relationship of financial statement elements and accounts, and classify accounts into the financial statement elements in the changing nature of knowledge relating to the subject 2- Apply the accounting principles, concepts and procedures to analyze, measure, record and classify business transactions and to prepare financial statements. ACTIVITY DIRECTION & 1-Classify each item as an asset, liability or owners equity. REQUIREMENTS 1. Note payable 2. Accounts payable 3. Expense 4. Office supplies 5. Rent expense 6. Cash 7. Accounts receivable 8. Cash 2-Trixie Maye started her own consulting firm, Matrix Consulting on May 1, 2017. The following transactions occurred during the month of May: 1- Trixie invested $7,000 cash in the business. 2- Paid $900 for office rent expense for the month. 3-Purchased $600 of supplies on account 4- Received $4,000 cash for services performed. s-Withdrew $1,000 in cash for personal use. 6-Performed $5,400 of services on account 7-Paid $2,500 for employee salaries expense. Instructions (a) Show the effect of the previous transactions on the accounting equation. (b) Prepare Income statement & Balance Sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts