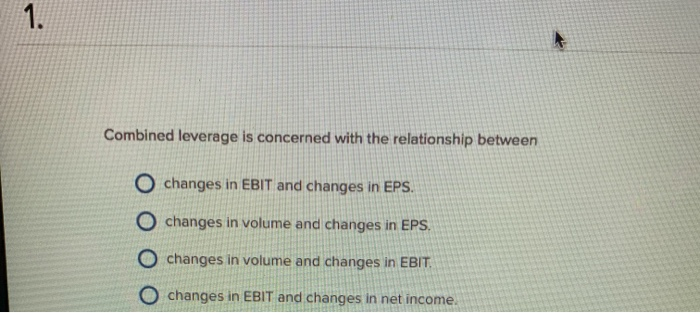

Question: 1. Combined leverage is concerned with the relationship between O changes in EBIT and changes in EPS. O changes in volume and changes in EPS

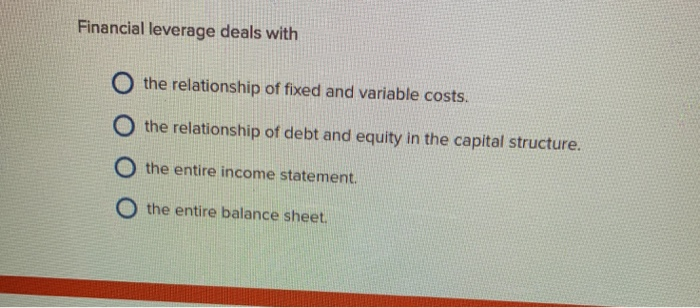

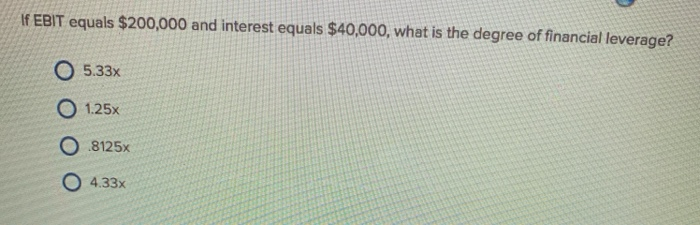

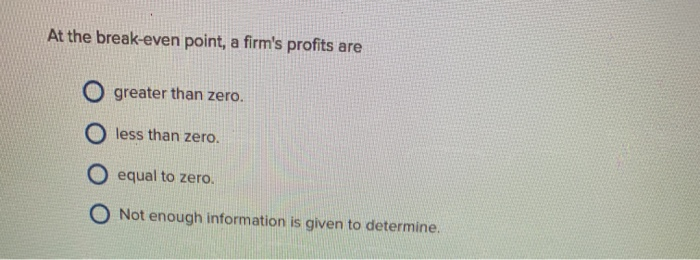

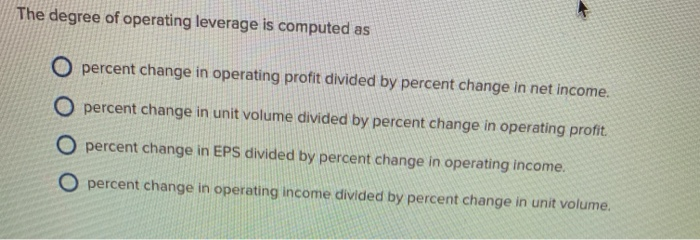

1. Combined leverage is concerned with the relationship between O changes in EBIT and changes in EPS. O changes in volume and changes in EPS O changes in volume and changes in EBIT O changes in EBIT and changes in net income. Financial leverage deals with O the relationship of fixed and variable costs. O the relationship of debt and equity in the capital structure O the entire income statement. the entire balance sheet If EBIT equals $200,000 and interest equals $40,000, what is the degree of financial leverage? O 5.33x O 1.25x O 8125x 4.33x At the break-even point, a firm's profits are greater than zero. less than zero. O equal to zero. O Not enough information is given to determine. The degree of operating leverage is computed as O percent change in operating profit divided by percent change in net income. percent change in unit volume divided by percent change in operating profit O percent change in EPS divided by percent change in operating income. percent change in operating income divided by percent change in unit volume

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts