Question: 1) Complete the assumptions (blue box) based on the data about Jake's business. Identify and list all variable costs separately and all fixed costs separately

1) Complete the assumptions (blue box) based on the data about Jake's business. Identify and list all variable costs separately and all fixed costs separately before finding the total for each type of cost.

2) Complete the Product Analysis (yellow boxes) assuming Jake ONLY sells either Product #1 (Launch-its) OR Product #2 (Treat -times).

Check figures: Breakeven Point Product #1 = 250 units; Breakeven Point Product #2= 125 units

3) Complete the CM Income Statement for the month of June (green box). HINT: On product line income statements such as this, the fixed costs are only listed in the total column. Make sure you also show the totals for all other line items. Finally, calculate the overall (total) CM% for the company.

Check figure: Operating income = $900 Overall CM% = 48%

4) Calculate the overall contribution margin (Total CM) per unit (in orange box).

Check figure: Overall CM per unit = $8.00

5) Use the Overall CM/unit to calculate the TOTAL number of units needed to breakeven (TOTAL column in the first gray box). THEN, calculate the number of EACH type of product needed to breakeven. Finally, calculate the sales revenue associated with this volume for EACH product, and then the sales revenue to breakeven in total.

Check figures: Breakeven Point Product #1 = 125; Breakeven Point Product #2= 63

6) Use the Overall CM per unit to calculate the total number of units needed to achieve Jake's target profit (TOTAL column in the second gray box). THEN, calculate the number of EACH type of product needed to achieve the target profit. Finally, calculate sales revenue associated with this volume for EACH product, and then the sales revenue in total.

Check figures: Units to achieve target profit Product #1 =792; Units to achieve target profit Product #2= 396

7) Calculate the margin of safety (MOS) using June sales as the expected sales (purple box). Calculate the MOS in terms of sales revenue and as a percentage. Also calculate the current operating leverage factor (round to the nearest 2 decimal places) and use it to determine the expected percentage change in operating income stemming from an expected change in sales volume.

Check figures: MOS%= 38%; Operating leverage factor= 2.67

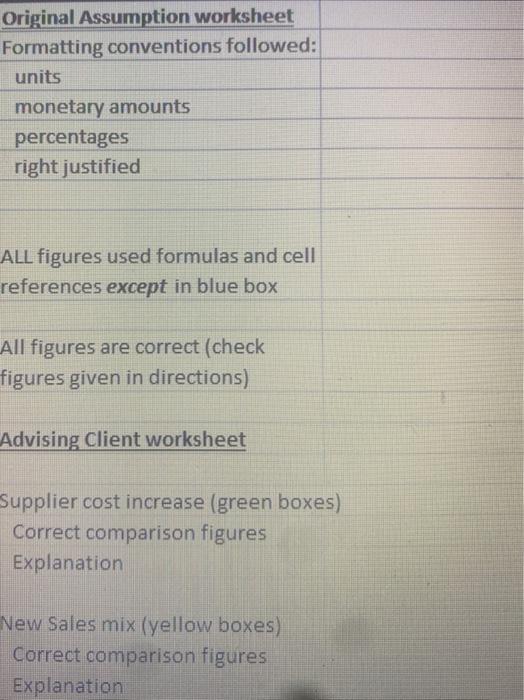

8) Change the name of "Starting file" worksheet to "Original Assumptions".

9) Make sure you have cleaned up your worksheet using the formatting conventions listed above.

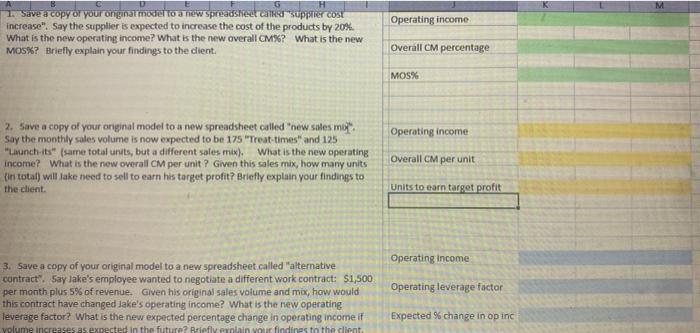

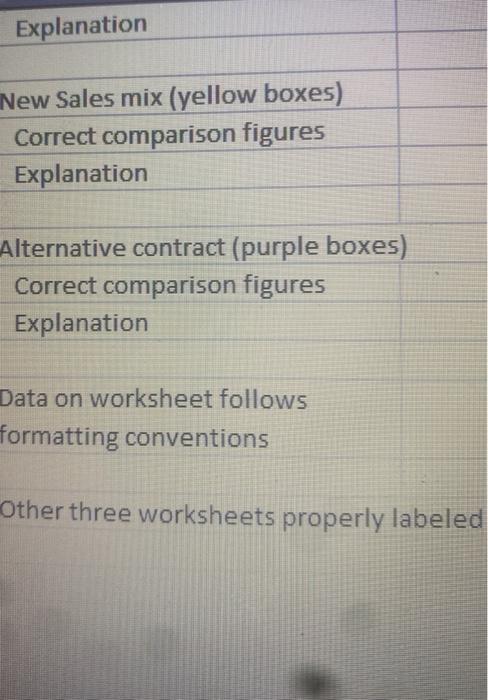

10) Go to the "Advising client" worksheet and follow the directions found there.

11) Check to make sure you have done everything in the checklist. Submit your file via dropbox.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock