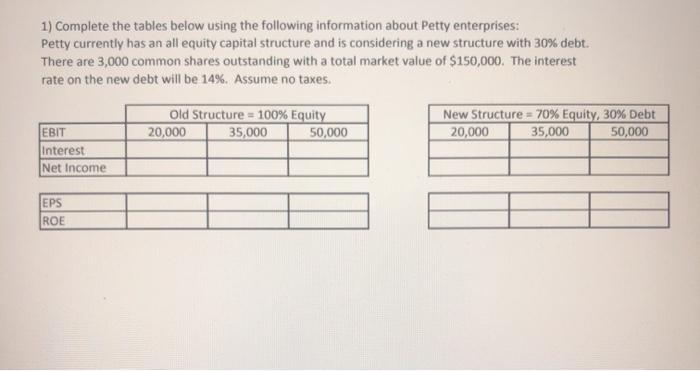

Question: 1) Complete the tables below using the following information about Petty enterprises: Petty currently has an all equity capital structure and is considering a new

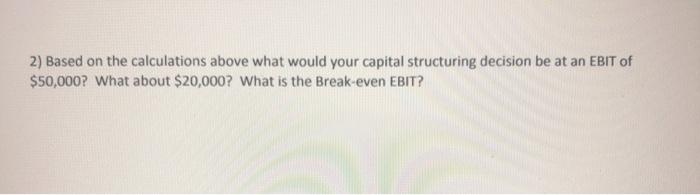

1) Complete the tables below using the following information about Petty enterprises: Petty currently has an all equity capital structure and is considering a new structure with 30% debt. There are 3,000 common shares outstanding with a total market value of $150,000. The interest rate on the new debt will be 14%. Assume no taxes. Old Structure = 100% Equity 20,000 35,000 50,000 New Structure = 70% Equity, 30% Debt 20,000 35,000 50,000 EBIT Interest Net Income EPS ROE 2) Based on the calculations above what would your capital structuring decision be at an EBIT of $50,000? What about $20,000? What is the Break-even EBIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts