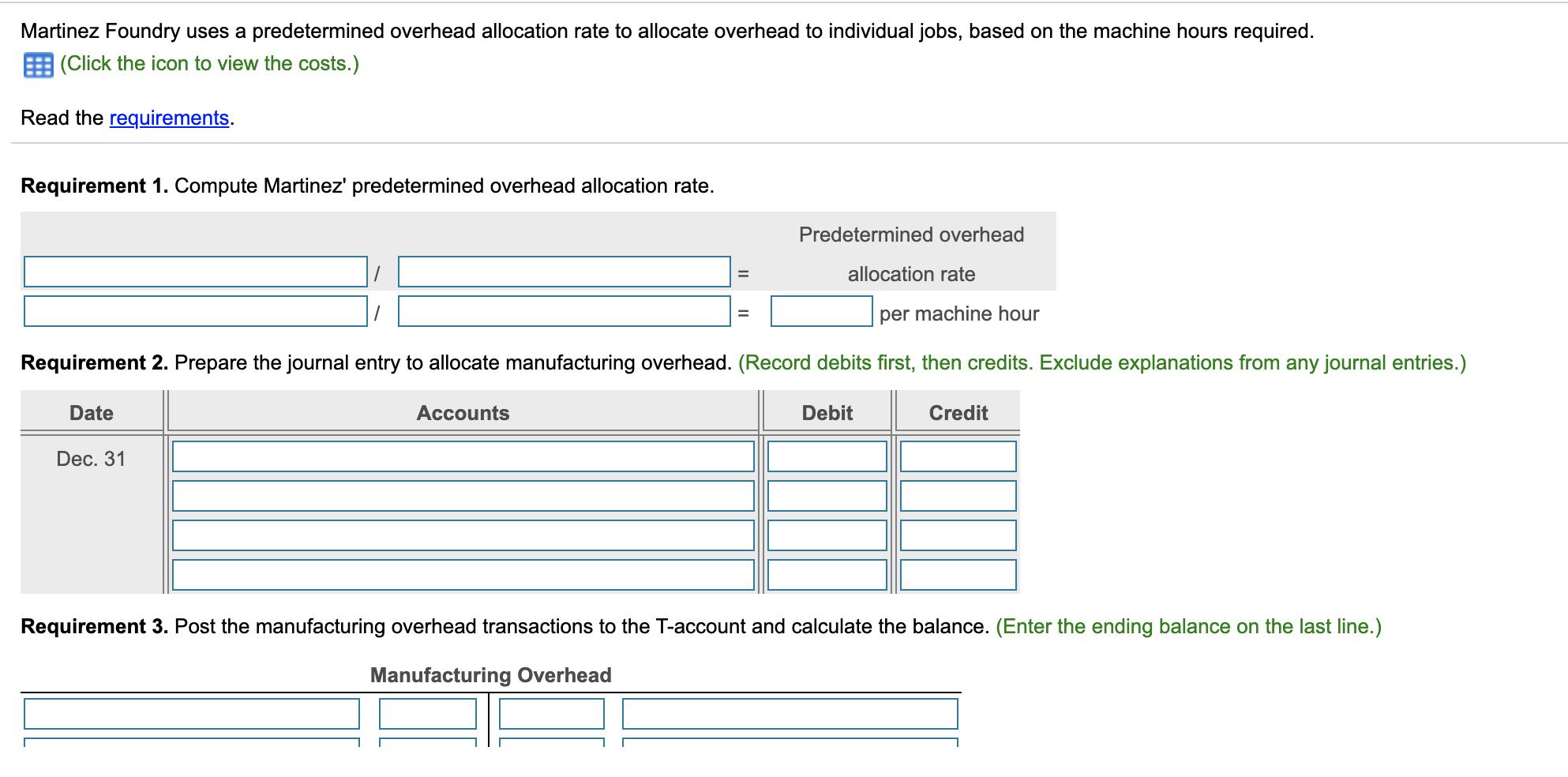

Question: Martinez Foundry uses a predetermined overhead allocation rate to allocate overhead to individual jobs, based on the machine hours required. E (Click the icon

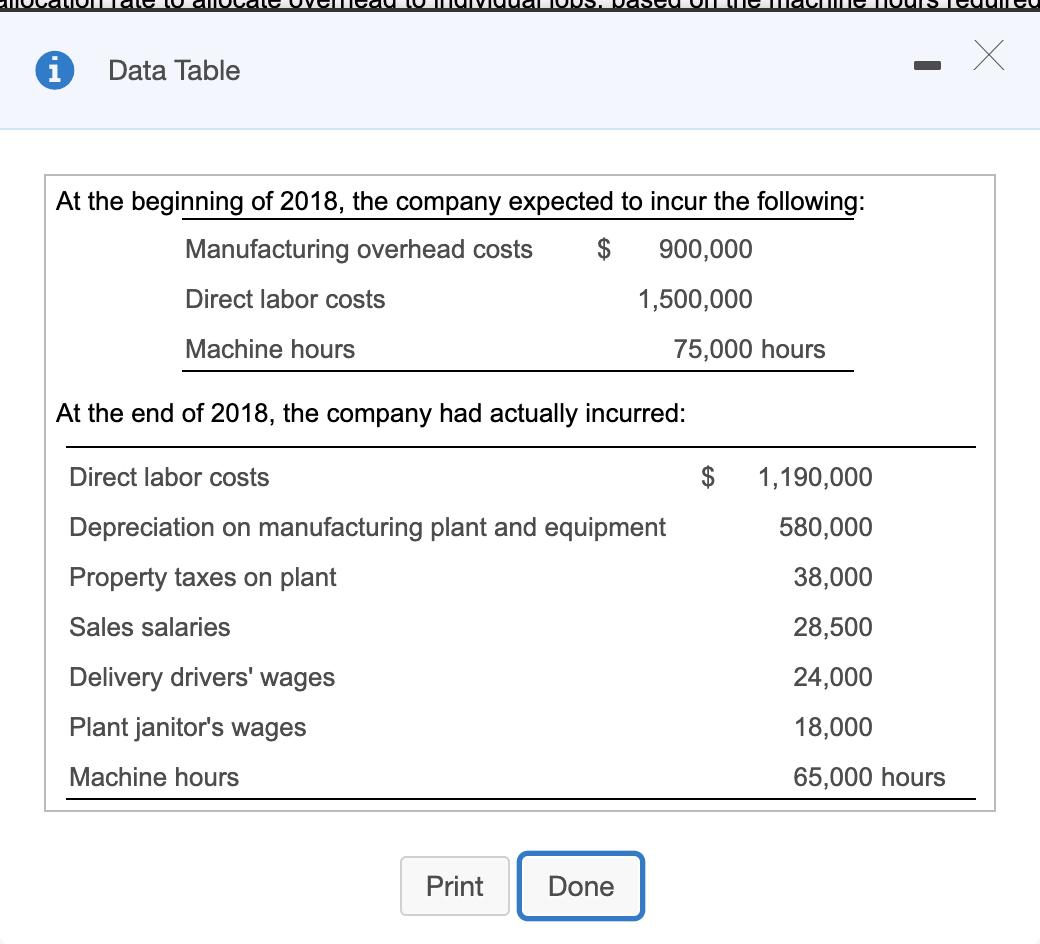

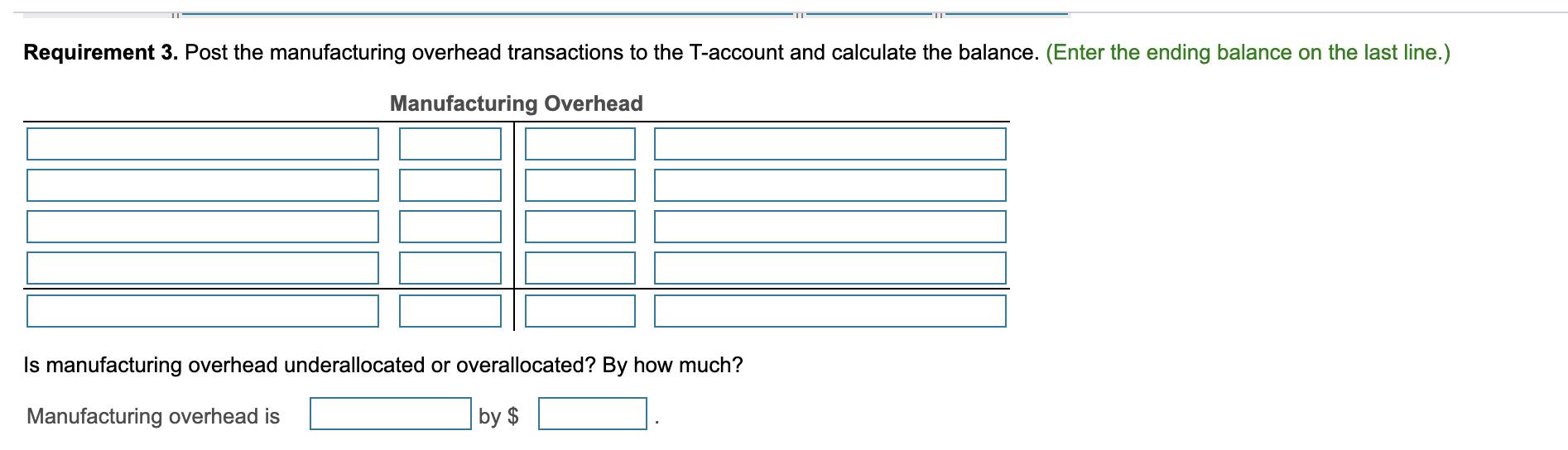

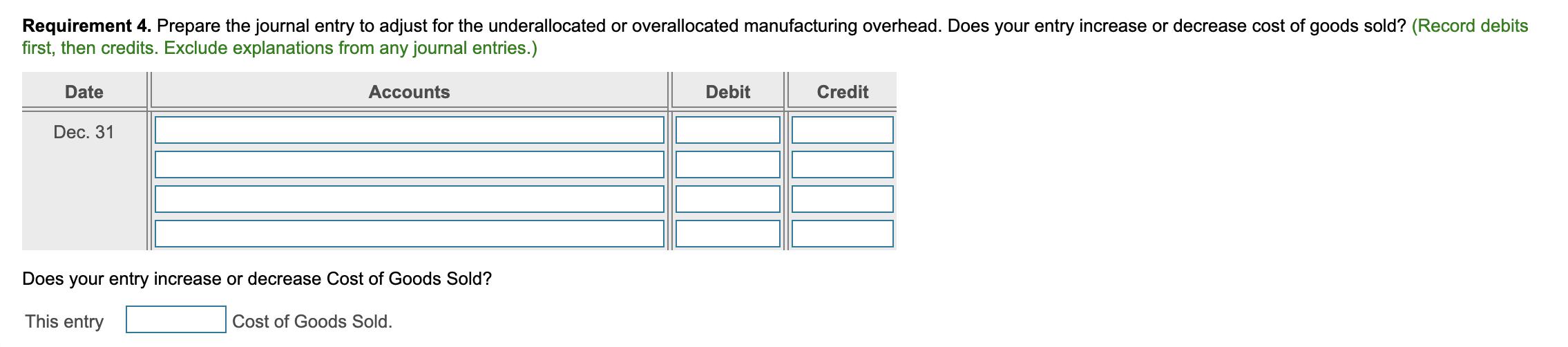

Martinez Foundry uses a predetermined overhead allocation rate to allocate overhead to individual jobs, based on the machine hours required. E (Click the icon to view the costs.) Read the requirements. Requirement 1. Compute Martinez' predetermined overhead allocation rate. Predetermined overhead allocation rate per machine hour %3D Requirement 2. Prepare the journal entry to allocate manufacturing overhead. (Record debits first, then credits. Exclude explanations from any journal entries.) Date Accounts Debit Credit Dec. 31 Requirement 3. Post the manufacturing overhead transactions to the T-account and calculate the balance. (Enter the ending balance on the last line.) Manufacturing Overhead 1. Compute Martinez' predetermined overhead allocation rate. 2. Prepare the journal entry to allocate manufacturing overhead. 3. Post the manufacturing overhead transactions to the Manufacturing Overhead T-account. Is manufacturing overhead underallocated or overallocated? By how much? 4. Prepare the journal entry to adjust for the underallocated or overallocated manufacturing overhead. Does your entry increase or decrease Cost of Goods Sold? Data Table At the beginning of 2018, the company expected to incur the following: Manufacturing overhead costs 900,000 Direct labor costs 1,500,000 Machine hours 75,000 hours At the end of 2018, the company had actually incurred: Direct labor costs 1,190,000 Depreciation on manufacturing plant and equipment 580,000 Property taxes on plant 38,000 Sales salaries 28,500 Delivery drivers' wages 24,000 Plant janitor's wages 18,000 Machine hours 65,000 hours Print Done Requirement 3. Post the manufacturing overhead transactions to the T-account and calculate the balance. (Enter the ending balance on the last line.) Manufacturing Overhead Is manufacturing overhead underallocated or overallocated? By how much? Manufacturing overhead is | by $ Requirement 4. Prepare the journal entry to adjust for the underallocated or overallocated manufacturing overhead. Does your entry increase or decrease cost of goods sold? (Record debits first, then credits. Exclude explanations from any journal entries.) Date Accounts Debit Credit Dec. 31 Does your entry increase or decrease Cost of Goods Sold? This entry Cost of Goods Sold.

Step by Step Solution

3.39 Rating (146 Votes )

There are 3 Steps involved in it

1 Predetermined overhead allocation rate Estimated manufacturing ... View full answer

Get step-by-step solutions from verified subject matter experts