Question: 1. compute net cash inflow (incremental contribution margin minus incremental fixed expenses) of sale of device for each year over next 6 years) 2. using

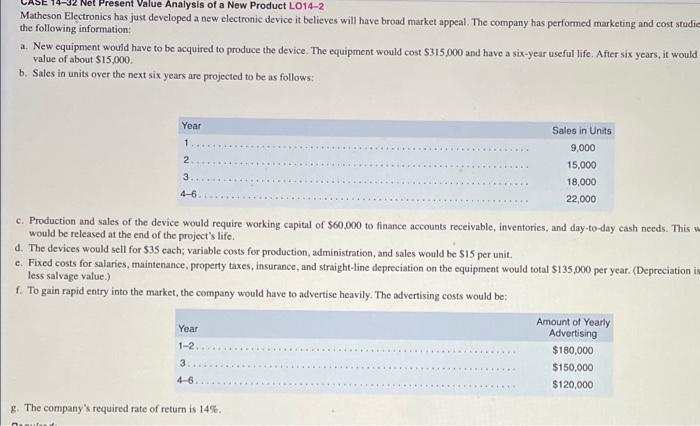

CASE 14-32 Not Present Value Analysis of a New Product LO14-2 Matheson Electronics has just developed a new electronic device it believes will have broad market appeal. The company has performed marketing and cost studie the following information: a. New equipment would have to be acquired to produce the device. The equipment would cost $315,000 and have a six-year useful life. After six years, it would value of about $15,000. b. Sales in units over the next six years are projected to be as follows: c. Production and sales of the device would require working capital of $60,000 to finance accounts receivable, inventories, and day-to-day cash needs. This v would be released at the end of the project's life. d. The devices would sell for $35 each; variable costs for production, administration, and sales would be $15 per unit. e. Fixed costs for salaries, maintenance, property taxes, insurance, and straight-line depreciation on the equipment would total $135,000 per year. (Depreciation less salvage value.) f. To gain rapid entry into the market, the company would have to advertise heavily. The advertising costs would be: g. The company's required rate of retum is 14%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts