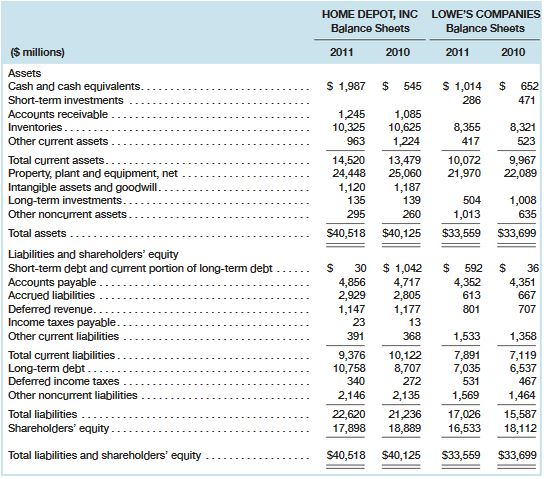

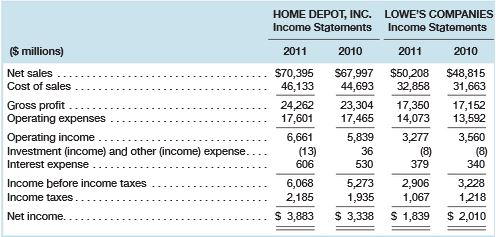

Question: 1. Compute return on equity (ROE), return on assets (ROA), and return on financial leverage (ROFL) for each company in 2011. 2. Disaggregate the ROAs

1. Compute return on equity (ROE), return on assets (ROA), and return on financial leverage (ROFL) for each company in 2011.

2. Disaggregate the ROAs computed into profit margin (PM) and asset turnover (AT) components. Which of these factors drives ROA for each company?

3. Compute the gross profit margin (GPM) and operating expense-to-sales ratios for each company. How do these companies profitability measures compare?

4. Compute the accounts receivable turnover (ART), inventory turnover (INVT), and property, plant and equipment turnover (PPET) for each company. How do these companies turnover measures compare?

5. Compare and evaluate these competitors performance in 2011.

1. Compute return on equity (ROE), return on assets (ROA), and return on financial leverage (ROFL) for each company in 2011. 2. Disaggregate the ROAs computed into profit margin (PM) and asset turnover (AT) components. Which of these factors drives ROA for each company? 3. Compute the gross profit margin (GPM) and operating expense-to-sales ratios for each company. How do these companie profitability measures compare? 4. Compute the accounts receivable turnover (ART), inventory turnover (INVT), and property, plant and equipment turnover (PPET) for each company. How do these companies turnover measures compare? 5. Compare and evaluate these competitors performance in 2011

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts