Question: 1. Compute the activity rate for each activity pool. 2. Overhead is assigned to the two products as follows: Rims: Posts: 3. Determine the total

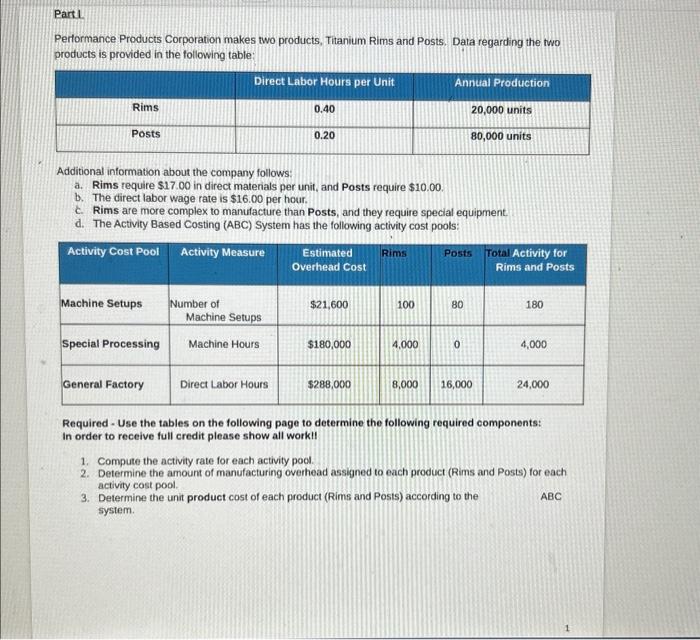

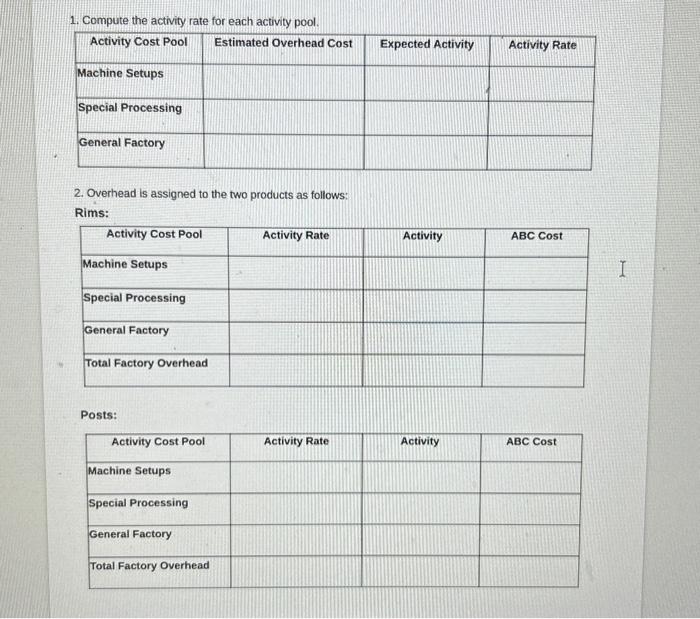

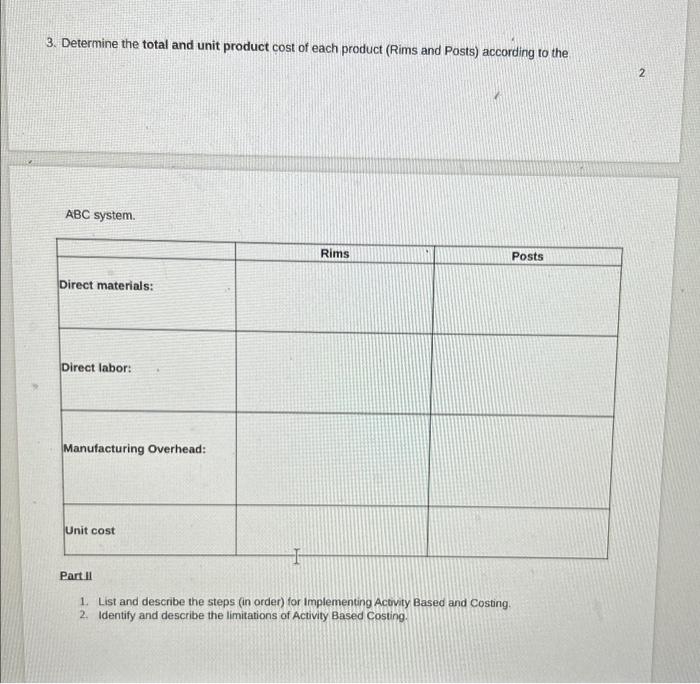

1. Compute the activity rate for each activity pool. 2. Overhead is assigned to the two products as follows: Rims: Posts: 3. Determine the total and unit product cost of each product (Rims and Posts) according to the ABC system. PartII 1. List and describe the steps (in order) for Implementing Activity Based and Costing. 2. Identify and describe the limitations of Activity Based Costing. Performance Products Corporation makes two products, Titanium Rims and Posts. Data regarding the two products is provided in the following table: Additional information about the company follows: a. Rims require $17.00 in direct materials per unit, and Posts require $10.00. b. The direct labor wage rate is $16.00 per hour. c. Rims are more complex to manufacture than Posts, and they require special equipment. d. The Activity Based Costing (ABC) System has the following activity cost pools: Required - Use the tables on the following page to determine the following required components: In order to receive full credit please show all workll 1. Compute the activity rate for each activity pool. 2. Determine the amount of manufacturing overhead assigned to each product (Rims and Posts) for each activity cost pool. 3. Determine the unit product cost of each product (Rims and Posts) according to the ABC system

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts