Question: 1. Compute the equivalent units for direct materials and conversion costs. 2. Compute the cost per equivalent unit. 3. Assign the costs to units completed

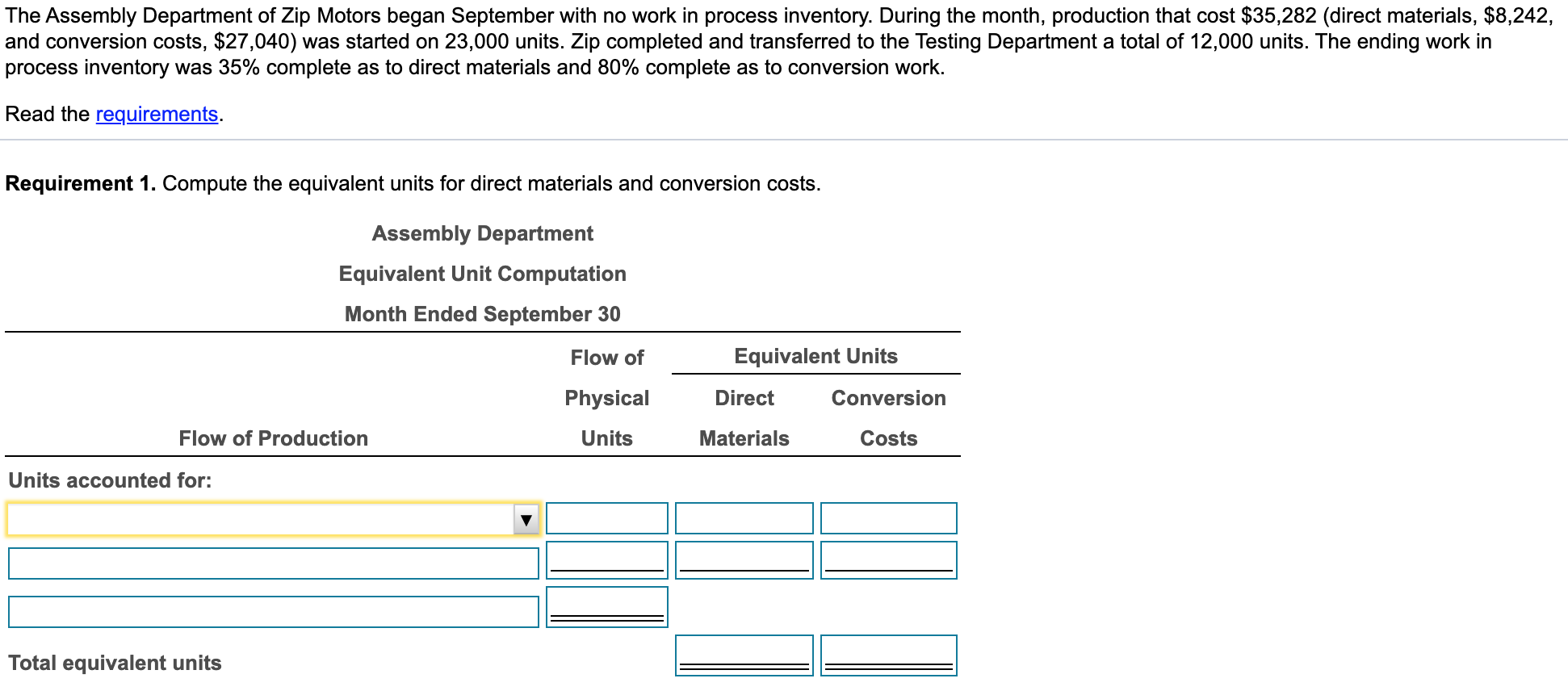

1. Compute the equivalent units for direct materials and conversion costs. 2. Compute the cost per equivalent unit. 3. Assign the costs to units completed and transferred out and ending work in process inventory. 4. Record the journal entry for the costs transferred out of the Assembly Department to the Testing Department. 5. Post all of the transactions in the "Work in Process InventoryAssembly" T-account. What is the ending balance? The Assembly Department of Zip Motors began September with no work in process inventory. During the month, production that cost $35,282 (direct materials, $8,242, and conversion costs, $27,040) was started on 23,000 units. Zip completed and transferred to the Testing Department a total of 12,000 units. The ending work in process inventory was 35% complete as to direct materials and 80% complete as to conversion work. Read the requirements. Requirement 1. Compute the equivalent units for direct materials and conversion costs. Assembly Department Equivalent Unit Computation Month Ended September 30 Equivalent Units Flow of Physical Direct Conversion Flow of Production Units Materials Costs Units accounted for: Total equivalent units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts