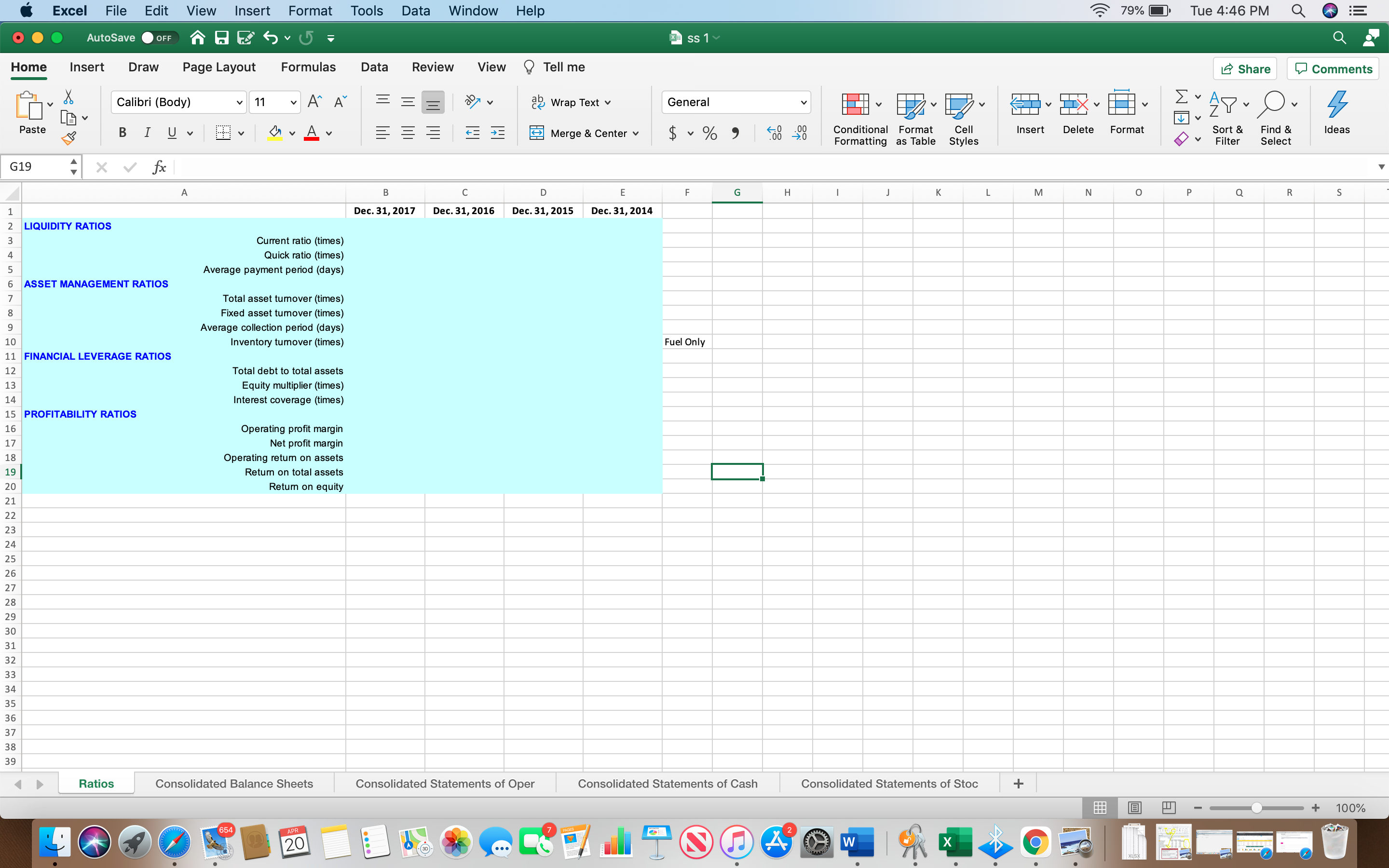

Question: 1) Compute the financial ratios by applying the formulas. (Note that there are two inventories to consider for the company: Fuel and expendable parts. The

1) Compute the financial ratios by applying the formulas. (Note that there are two inventories to consider for the company: Fuel and expendable parts. The ratios required ONLY take fuel into account.) Note: you must use theEXCEL functionsin computation instead of inputting the numbers.

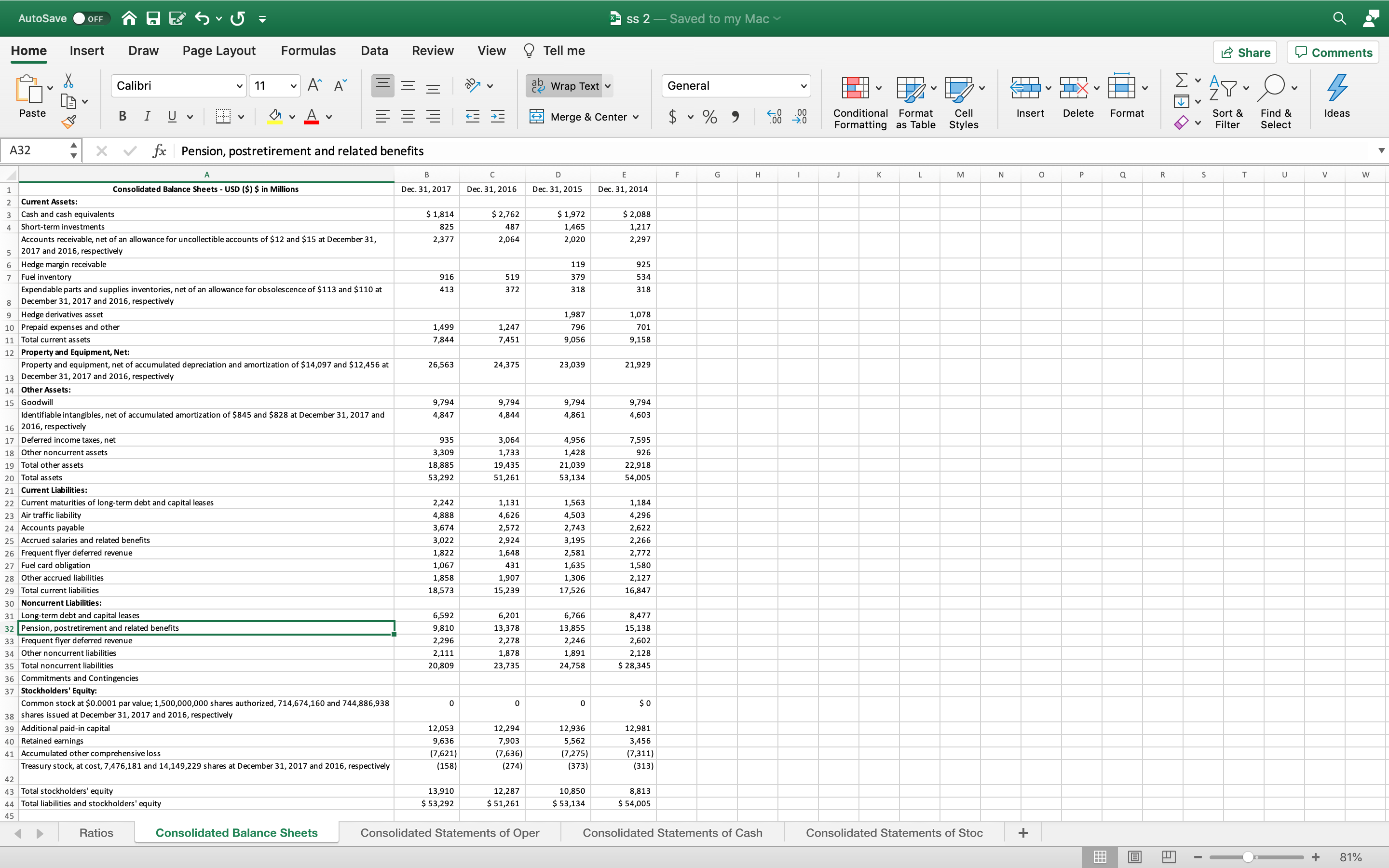

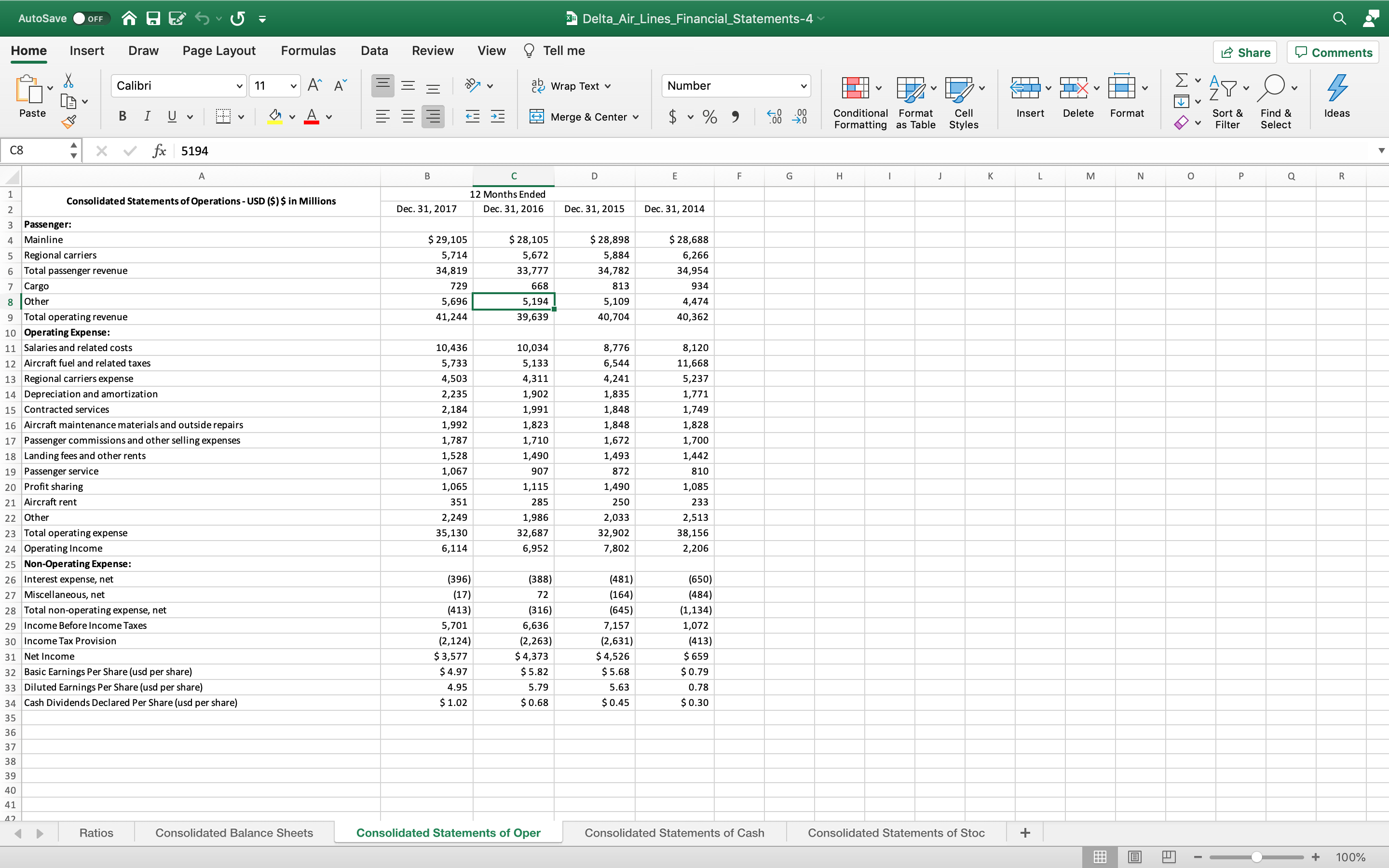

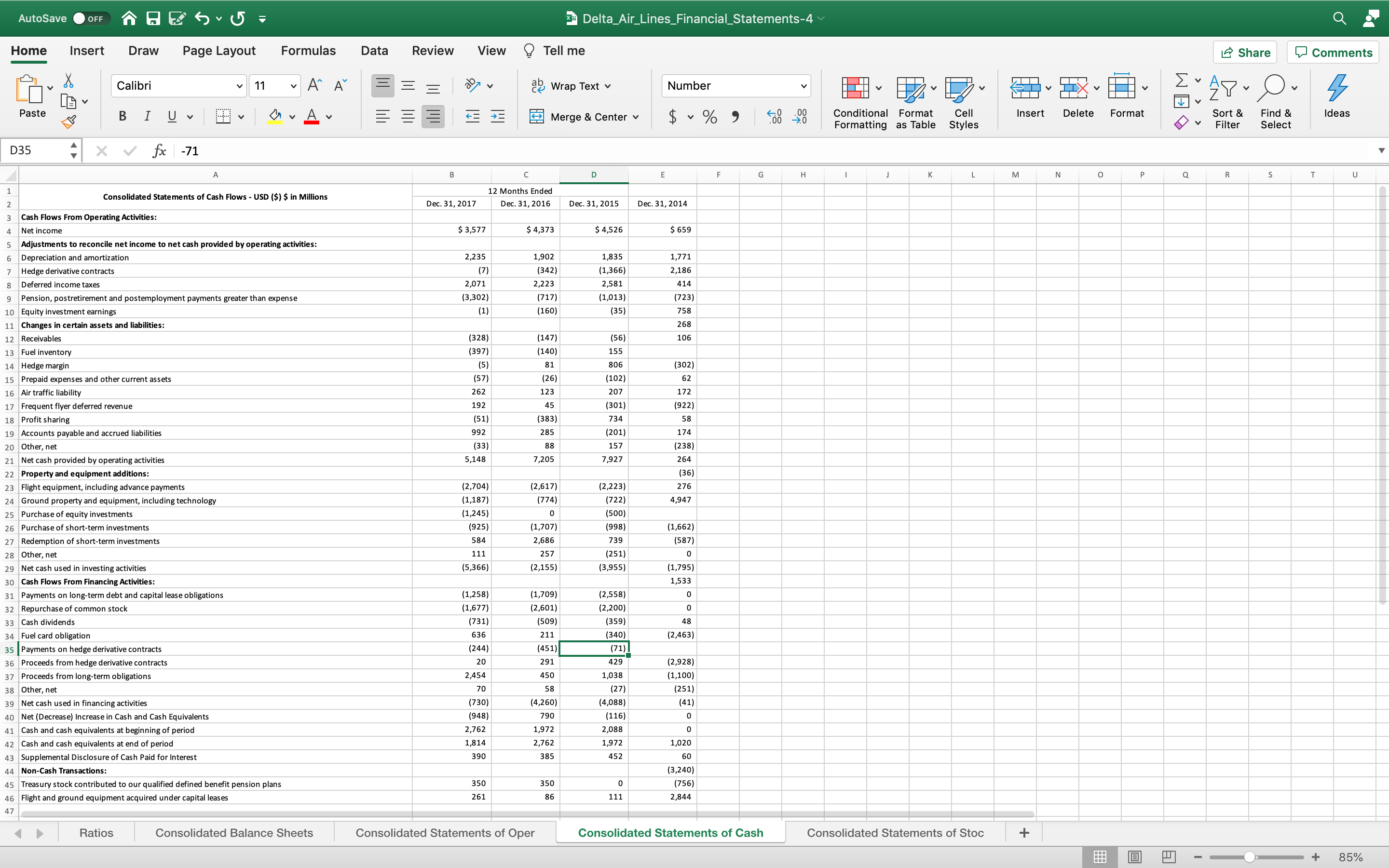

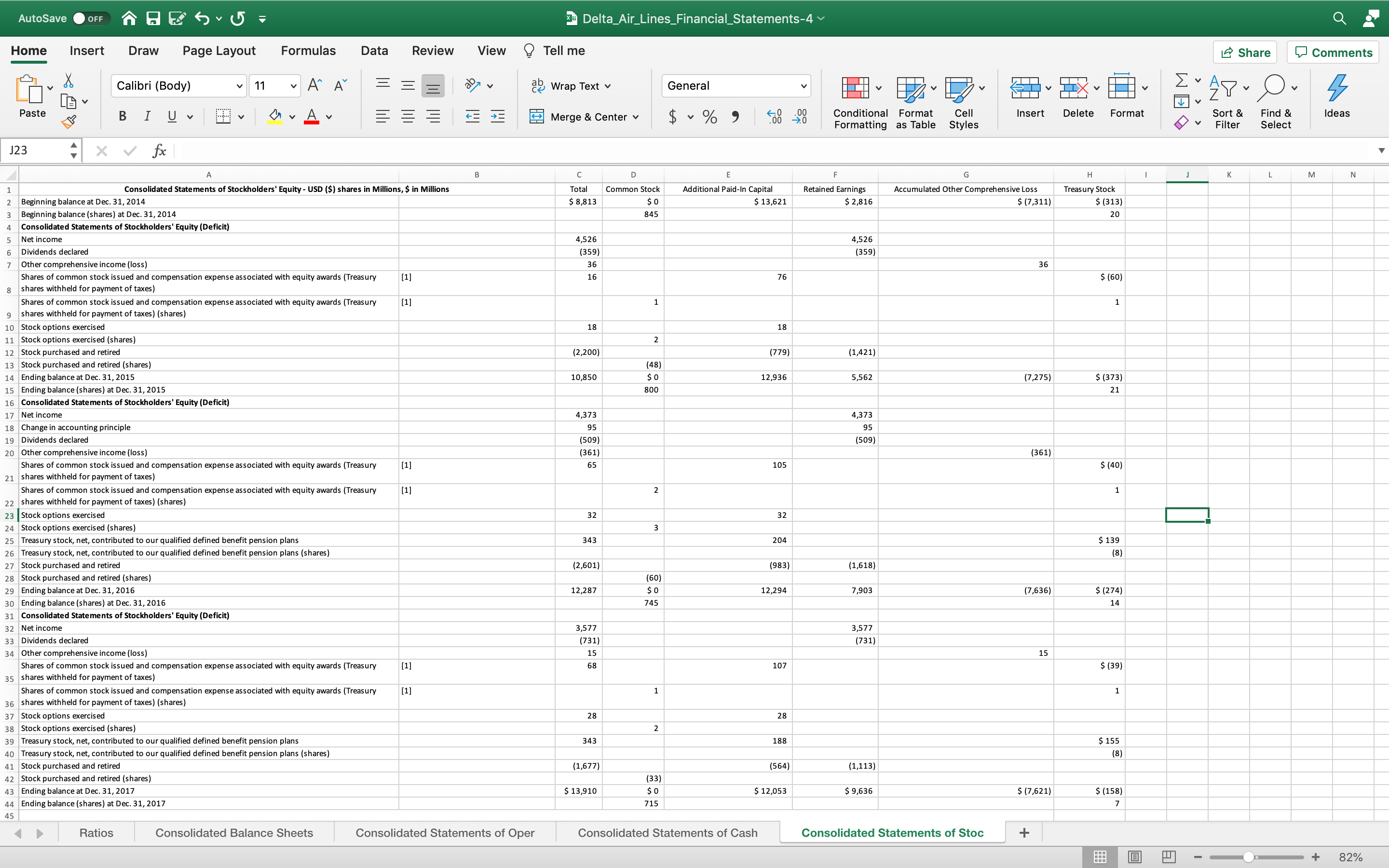

AutoSave OFF ss 2 - Saved to my Mac Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Calibri 11 AA ab Wrap Text General Ex AP- O. Paste BIUV MvAv Merge & Center v $ ~ % " $08 08 Conditional Format Cell Insert Delete Format Sort & Find & Ideas Formatting as Table Styles Filter Select A32 X V fx Pension, postretirement and related benefits D G M N Q R V Consolidated Balance Sheets - USD ($) $ in Millions w Dec. 31, 2017 Dec. 31, 2016 Dec. 31, 2015 Dec. 31, 2014 Current Assets: Cash and cash equivalents $ 1,814 $ 2,762 $ 1,972 $ 2,088 Short-term investments 825 487 1,465 1,217 Accounts receivable, net of an allowance for uncollectible accounts of $12 and $15 at December 31, 2,377 2,064 2,020 2,297 5 2017 and 2016, respectively 6 Hedge margin receivable 119 925 7 Fuel inventory 916 519 379 534 Expendable parts and supplies inventories, net of an allowance for obsolescence of $113 and $110 at 413 372 318 318 December 31, 2017 and 2016, respectively Hedge derivatives asset 1,987 1,078 10 Prepaid expenses and other 1,499 1,247 796 701 11 Total current assets 7,844 7,451 9,056 9,158 12 Property and Equipment, Net: Property and equipment, net of accumulated depreciation and amortization of $14,097 and $12,456 at 26,563 24,375 23,039 21,929 13 December 31, 2017 and 2016, respectively 14 Other Assets: 15 Goodwill 9, 794 9,794 9,794 9,794 Identifiable intangibles, net of accumulated amortization of $845 and $828 at December 31, 2017 and 4.847 4,844 4,861 4,603 16 2016, respectively 17 Deferred income taxes, net 935 3,064 4,956 7,595 18 Other noncurrent assets 3,309 1,733 1,428 926 19 Total other assets 18,885 19,435 21,039 22,918 20 Total assets 53,292 51,261 53,134 54,005 21 Current Liabilities: 22 Current maturities of long-term debt and capital leases 2,242 1,131 1,563 1,184 23 Air traffic liability 4,888 4,626 4,503 4,296 24 Accounts payabl 3,674 2,572 2,743 2,622 25 Accrued salaries and related benefits 3,022 2,924 3,195 2,266 26 Frequent flyer deferred revenue 1,822 ,648 2,581 2,772 27 Fuel card obligation 1,067 431 1,635 1,580 28 Other accrued liabilities 1,858 1,907 1,306 2,127 29 Total current liabilities 8,573 15,239 7,526 16,847 30 Noncurrent Liabilities 31 Long-term debt and capital leases 6,592 6,201 6,766 8,477 32 Pension, postretirement and related benefits 9,810 3,378 13,855 15,138 3 Frequent flyer deferred revenue 2,296 2,278 2,246 2,602 34 Other noncurrent liabilities 2,111 1,878 1,891 2,128 35 Total noncurrent liabilities 20,809 23,735 24,758 $ 28,345 36 Commitments and Contingencies 37 Stockholders' Equity: Common stock at $0.0001 par value; 1,500,000,000 shares authorized, 714,674,160 and 744,886,938 $0 38 shares issued at December 31, 2017 and 2016, respectively 39 Additional paid-in capita 12,053 12,294 12,936 12,981 40 Retained earnings 9 , 636 7,903 5,562 3,456 41 Accumulated other comprehensive loss (7,621) (7,636) 7,275) (7,311) Treasury stock, at cost, 7,476,181 and 14,149,229 shares at December 31, 2017 and 2016, respectively (158) (274) (373) (313 42 43 Total stockholders' equity 13,910 12,287 10,850 8,813 44 Total liabilities and stockholders' equity $ 53,292 $ 51,261 $ 53,134 $54,005 45 Ratios Consolidated Balance Sheets Consolidated Statements of Oper Consolidated Statements of Cash Consolidated Statements of Stoc + + 81%Excel File Edit View Insert Format Tools Data Window Help 79% Tue 4:46 PM Q DE AutoSave OFF ss 1 Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Calibri (Body) v 11 A A =1 ap Wrap Text v General EV AY- O. Ideas Paste BIU E DVAv Merge & Center v $ ~ % " Conditional Format Cell Insert Delete Format DV Sort & Find & Formatting as Table Styles Filter Select G19 4 X V fx A B C F G H K L M N P Q R S Dec. 31, 2017 Dec. 31, 2016 Dec. 31, 2015 Dec. 31, 2014 LIQUIDITY RATIOS Current ratio (times) UIDWN Quick ratio (times) Average payment period (days) ASSET MANAGEMENT RATIOS Total asset turnover (times) 1 00 Fixed asset turnover (times) Average collection period (days) 10 Inventory turnover (times) Fuel Only 11 FINANCIAL LEVERAGE RATIOS 12 Total debt to total assets 13 Equity multiplier (times) 14 Interest coverage (times) 15 PROFITABILITY RATIOS 16 Operating profit margin 17 Net profit margin 18 Operating retum on assets 19 Return on total assets 20 Return on equity 21 22 23 24 26 35 36 37 38 39 Ratios Consolidated Balance Sheets Consolidated Statements of Oper Consolidated Statements of Cash Consolidated Statements of Stoc + - + 100% APR 20 .30 ... WAutoSave O OFF Delta_Air_Lines_Financial_Statements-4 Q Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Calibri v 11 AA =E ap Wrap Text Number Ex AP- O. V v Paste BIU BY DV Av EE Merge & Center v $ ~ % " Conditional Format Cell Insert Delete Format Sort & Find & Ideas Formatting as Table Styles Filter Select C8 4 X fx 5194 B F G H K L M N 0 P Q R Consolidated Statements of Operations - USD ($) $ in Millions 12 Months Ended Dec. 31, 2017 Dec. 31, 2016 Dec. 31, 2015 Dec. 31, 2014 Passenger: 4 Mainline $29,105 $ 28,105 $ 28,898 $ 28,688 5 Regional carriers 5, 714 5,672 5,884 ,266 6 Total passenger revenue 34,819 3,777 4,782 34,954 7 729 668 81 934 8 Other 5,696 5,194 5,109 , 474 9 Total operating revenue 41,244 39,639 40,704 40,362 10 Operating Expense 11 Salaries and related costs 10,436 10,034 8,77 8,120 12 Aircraft fuel and related taxes 5 ,733 5 , 133 6,544 11,668 13 Regional carriers expense 4,503 4,311 4,241 5,237 14 Depreciation and amortization 2,235 1,902 1,83 1,77 15 Contracted services 2,184 1,991 1,848 ,749 16 Aircraft maintenance materials and outside repairs 1,992 1,823 1,848 1,828 17 Passenger commissions and other selling expenses 1,787 1,710 1,67 1,70 18 Landing fees and other rents 1,528 1,490 1,493 1,442 19 Passenger service 1,067 907 372 810 20 Profit sharing 1,065 1,115 1,490 1,085 21 Aircraft rent 351 285 250 233 22 Other 2,249 1,986 2,033 2,513 23 Total operating expense 35,130 32,68 32,90 38,15 24 Operating Income 5,114 6,952 7,80 2,206 Non-Operating Expense: 26 Interest expense, ne (396) (388) (481) (650) 27 Miscellaneous, net (17) 72 164 (484) 28 Total non-operating expense, net (413) (316) (645 1,134 29 Income Before Income Taxes 5 ,701 6,636 7,157 ., 072 30 Income Tax Provision (2,124) (2,263 (2,631) (413) 31 Net Income $ 3,577 $ 4,373 $ 4,526 $ 659 32 Basic Earnings Per Share (usd per share) $ 4.97 $ 5.82 $ 5.68 $0.79 33 Diluted Earnings Per Share (usd per share) 4.95 5.79 5.63 0 ,78 34 Cash Dividends Declared Per Share (usd per share) $ 1.02 $ 0.68 $ 0.45 $ 0.30 35 36 37 38 39 40 41 Ratios Consolidated Balance Sheets Consolidated Statements of Oper Consolidated Statements of Cash Consolidated Statements of Stoc + + 100%AutoSave OFF Delta_Air_Lines_Financial_Statements-4 Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Calibri v 11 AA =E ap Wrap Text v Number EX AP- O. Paste BIU BY Merge & Center v $ ~ % " Conditional Format Cell Insert Delete Format Sort & Find & Ideas Formatting as Table Styles Filter Select D35 4 X V fx -71 B D F G H M N Q R T U Consolidated Statements of Cash Flows - USD ($) $ in Millions 12 Months Ended Dec. 31, 2017 Dec. 31, 2016 Dec. 31, 2015 Dec. 31, 2014 Cash Flows From Operating Activities: Net income $ 3,577 $ 4,373 $ 4,526 $ 659 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 2,235 1,902 1,835 1,771 7 Hedge derivative contracts (7 (342) (1,366) 2,186 Deferred income taxes 2,071 ,223 2,581 414 Pension, postretirement and postemployment payments greater than expense (3,302) (717) (1,013) 723) 10 Equity investment earnings (1) (160) (35) 758 11 Changes in certain assets and liabilities: 268 12 Receivables (328) (147) (56) 106 13 Fuel inventory (397) (140) 155 14 Hedge margin (5 ) 81 806 (302) 15 Prepaid expenses and other current assets (57 ) ( 26 ) (102) 62 16 Air traffic liability 262 123 207 172 17 Frequent flyer deferred revenue 192 45 (301) (922) 18 Profit sharing (51 ) (383) 734 58 19 Accounts payable and accrued liabilities 992 285 (201) 174 20 Other, net (33 ) 88 157 (238) 21 Net cash provided by operating activities 5,148 7,205 7,927 264 22 Property and equipment additions: (36) 23 Flight equipment, including advance payments (2,704) (2,617) (2,223) 276 24 Ground property and equipment, including technology 1,187 (774) (722) 4,947 25 Purchase of equity investments (1,245) (500) 26 Purchase of short-term investments (925) (1,707) (998) (1,662) 27 Redemption of short-term investments 584 2,686 739 (587) 28 Other, net 111 257 (251) 29 Net cash used in investing activities (5,366) .,155 (3,955) (1,795) Cash Flows From Financing Activities: 1,533 1 Payments on long-term debt and capital lease obligations (1,258) (1,709) (2,558) 2 Repurchase of common stock (1,677) 2,601 2,200) 0 33 Cash dividends (731 (50 (359) 48 34 Fuel card obligation 636 211 340) (2,463) 35 Payments on hedge derivative contracts 244) 451) (71) 36 Proceeds from hedge derivative contracts 20 291 429 (2,928) 37 Proceeds from long-term obligations 2,454 450 1,038 (1,100 38 Other, net 70 58 ( 27 ) 251) 39 Net cash used in financing activities (730) 4,260) (4,088) (41) 40 Net (Decrease) Increase in Cash and Cash Equivalents (948 ) 790 (116) 41 Cash and cash equivalents at beginning of period 2,762 1,972 2,088 42 Cash and cash equivalents at end of period 1,814 2,762 1,972 .020 43 Supplemental Disclosure of Cash Paid for Interest 390 385 452 60 44 Non-Cash Transactions: (3,240) 45 Treasury stock contributed to our qualified defined benefit pension plans 350 350 (756) 46 Flight and ground equipment acquired under capital leases 261 86 111 2,844 47 Ratios Consolidated Balance Sheets Consolidated Statements of Oper Consolidated Statements of Cash Consolidated Statements of Stoc + + 85%AutoSave O OFF Delta_Air_Lines_Financial_Statements-4 ~ Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Calibri (Body) v 11 AA al Wrap Text v General Ex AP- O. Paste BIUV DV Av E Merge & Center v $ ~ % " Conditional Format Cell Insert Delete Format Sort & Find & Ideas Formatting as Table Styles Filter Select J23 fx B D G H M N Consolidated Statements of Stockholders' Equity - USD ($) shares in Millions, $ in Millions Total Common Stock Additional Paid-In Capital Retained Earnings Accumulated Other Comprehensive Loss Treasury Stock Beginning balance at Dec. 31, 2014 $ 8,813 $0 $ 13,621 $ 2,816 $ (7,311) $ (313) Beginning balance (shares) at Dec. 31, 2014 845 20 Consolidated Statements of Stockholders' Equity (Deficit) 5 Net income 4,526 4,526 6 Dividends declared (359 ) (359) 7 Other comprehensive income (loss) 36 36 Shares of common stock issued and compensation expense associated with equity awards (Treasury [1] 16 76 $ (60) 8 shares withheld for payment of taxes Shares of common stock issued and compensation expense associated with equity awards (Treasury [1] 9 shares withheld for payment of taxes) (shares) 10 Stock options exercised 18 18 11 Stock options exercised (shares) 2 12 Stock purchased and retired (2,200) (779) (1,421) 13 Stock purchased and retired (shares) (48) 14 Ending balance at Dec. 31, 2015 10,850 $0 12,936 5 , 562 (7,275) $ (373 ) 15 Ending balance (shares) at Dec. 31, 2015 800 21 16 Consolidated Statements of Stockholders' Equity (Deficit) 17 Net income 4,373 4,373 18 Change in accounting principle 95 95 19 Dividends declared (509) (509) 20 Other comprehensive income (loss) (361) (361) Shares of common stock issued and compensation expense associated with equity awards (Treasury [1] 65 105 $ (40) 21 shares withheld for payment of taxes) Shares of common stock issued and compensation expense associated with equity awards (Treasury 2 22 shares withheld for payment of taxes) (shares) 23 Stock options exercised 32 32 24 Stock options exercised (shares) 25 Treasury stock, net, contributed to our qualified defined benefit pension plans 343 204 $ 139 26 Treasury stock, net, contributed to our qualified defined benefit pension plans (shares) (8 ) 27 Stock purchased and retired (2,601) (983) (1,618) 28 Stock purchased and retired (shares) (60 29 Ending balance at Dec. 31, 2016 12,287 12,294 7,903 (7,636) $ (274) 30 Ending balance (shares) at Dec. 31, 2016 745 14 31 Consolidated Statements of Stockholders' Equity (Deficit) 32 Net income 3,577 3,577 Dividends declared ( 731 ) (731 ) 34 Other comprehensive income (loss) 15 15 Shares of common stock issued and compensation expense associated with equity awards (Treasury [1] 68 107 $ (39) 35 shares withheld for payment of taxes) Shares of common stock issued and compensation expense associated with equity awards (Treasury [1] 36 shares withheld for payment of taxes) (shares) 37 Stock options exercised 28 28 38 Stock options exercised (shares) 2 39 Treasury stock, net, contributed to our qualified defined benefit pension plans 343 188 $ 155 40 Treasury stock, net, contributed to our qualified defined benefit pension plans (shares) (8) 41 Stock purchased and retired (1,677) (564) (1,113) 42 Stock purchased and retired (shares) (33) 43 Ending balance at Dec. 31, 2017 $ 13,910 $ 12,053 $ 9,636 $ (7,621) $ (158) 44 Ending balance (shares) at Dec. 31, 2017 715 45 D Ratios Consolidated Balance Sheets Consolidated Statements of Oper Consolidated Statements of Cash Consolidated Statements of Stoc + + 82%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts