Question: 1. Compute the future value of: a. An initial $2,000 compounded annually for 10 years at 8% b. An initial $2,000 compounded annually for 10

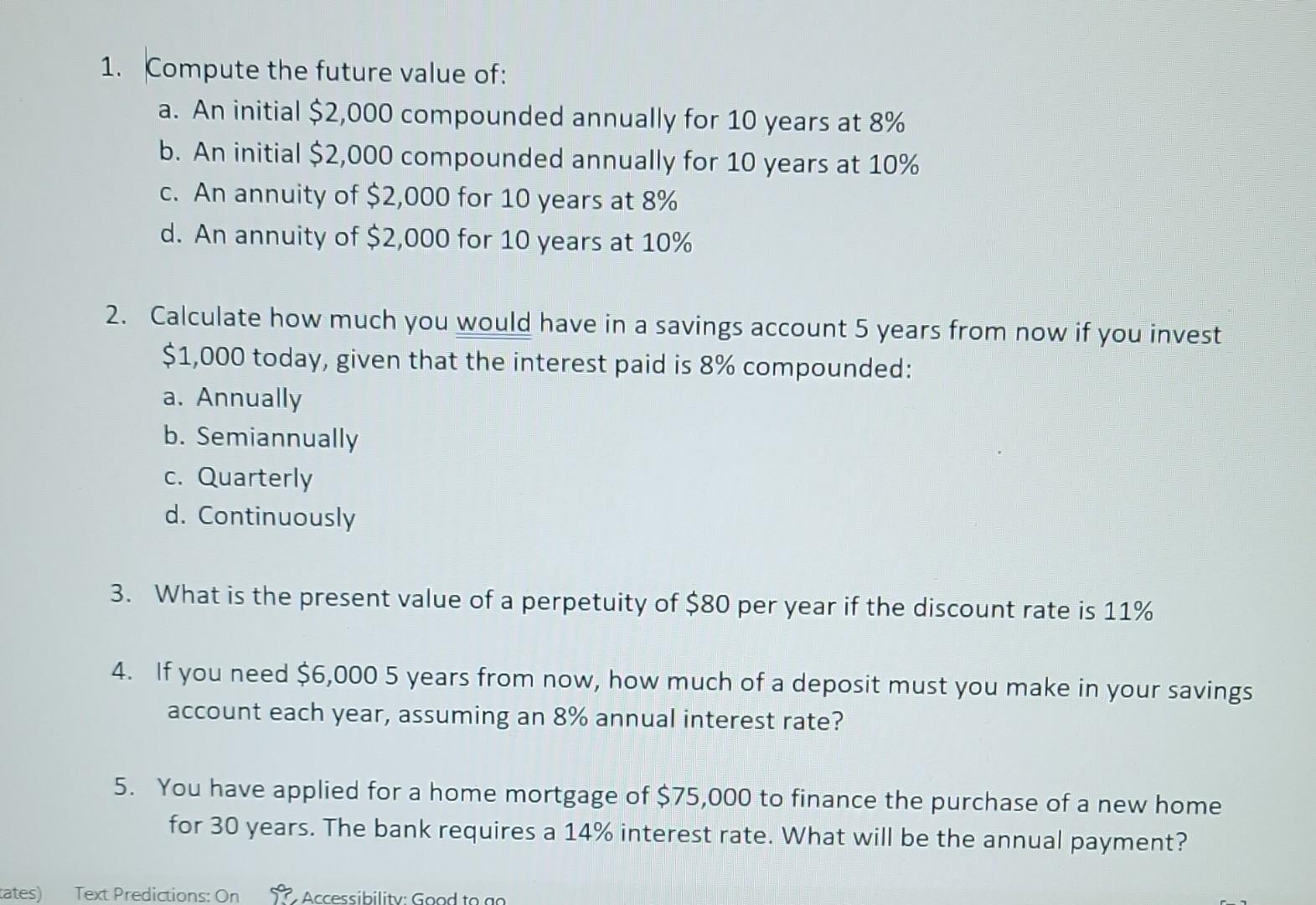

1. Compute the future value of: a. An initial $2,000 compounded annually for 10 years at 8% b. An initial $2,000 compounded annually for 10 years at 10% c. An annuity of $2,000 for 10 years at 8% d. An annuity of $2,000 for 10 years at 10% 2. Calculate how much you would have in a savings account 5 years from now if you invest $1,000 today, given that the interest paid is 8% compounded: a. Annually b. Semiannually c. Quarterly d. Continuously 3. What is the present value of a perpetuity of $80 per year if the discount rate is 11% 4. If you need $6,0005 years from now, how much of a deposit must you make in your savings account each year, assuming an 8% annual interest rate? 5. You have applied for a home mortgage of $75,000 to finance the purchase of a new home for 30 years. The bank requires a 14% interest rate. What will be the annual payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts