Question: 1. Compute the payback (using free cash flow) period for investors in firm. 3. (25 points) Problem - FCF and NPV Your company is considering

1. Compute the payback (using free cash flow) period for investors in firm.

1. Compute the payback (using free cash flow) period for investors in firm.

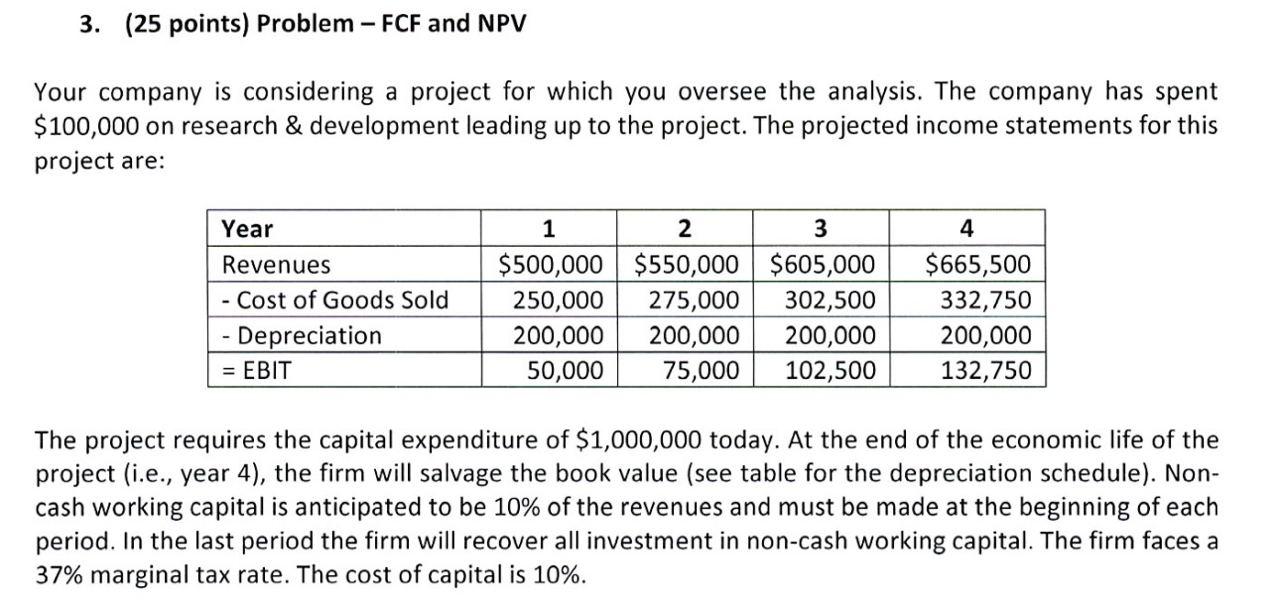

3. (25 points) Problem - FCF and NPV Your company is considering a project for which you oversee the analysis. The company has spent $100,000 on research & development leading up to the project. The projected income statements for this project are: Year Revenues - Cost of Goods Sold - Depreciation = EBIT 1 2 3 $500,000 $550,000 $605,000 250,000 275,000 302,500 200,000 200,000 200,000 50,000 75,000 102,500 4 $665,500 332,750 200,000 132,750 The project requires the capital expenditure of $1,000,000 today. At the end of the economic life of the project (i.e., year 4), the firm will salvage the book value (see table for the depreciation schedule). Non- cash working capital is anticipated to be 10% of the revenues and must be made at the beginning of each period. In the last period the firm will recover all investment in non-cash working capital. The firm faces a 37% marginal tax rate. The cost of capital is 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts