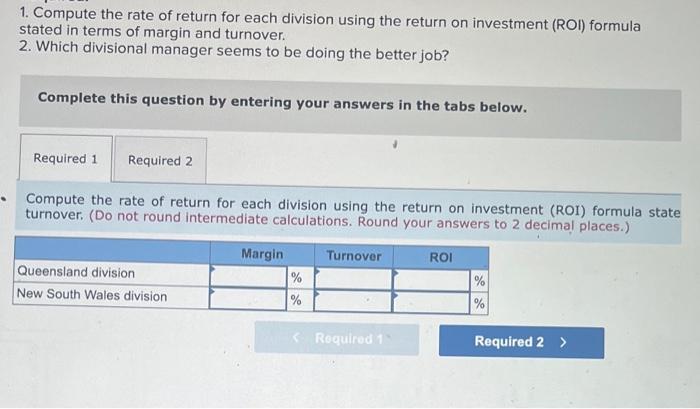

Question: 1. Compute the rate of return for each division using the return on investment (ROI) formula stated in terms of margin and turnover. 2. Which

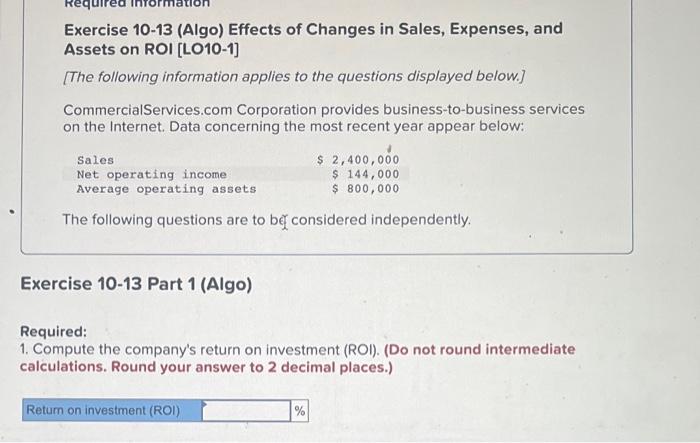

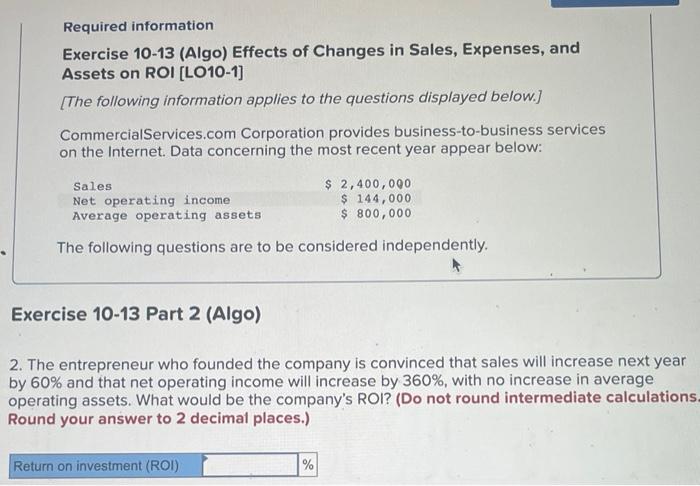

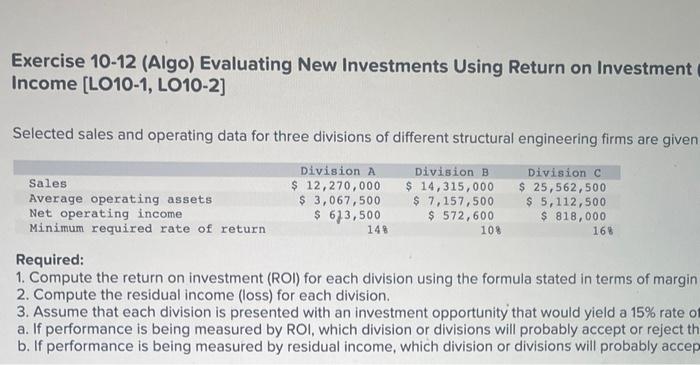

1. Compute the rate of return for each division using the return on investment (ROI) formula stated in terms of margin and turnover. 2. Which divisional manager seems to be doing the better job? Complete this question by entering your answers in the tabs below. Compute the rate of return for each division using the return on investment (ROI) formula state turnover. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Exercise 10-13 (Algo) Effects of Changes in Sales, Expenses, and Assets on ROI [LO10-1] [The following information applies to the questions displayed below.] CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below: The following questions are to b[ considered independently. Exercise 10-13 Part 1 (Algo) Required: 1. Compute the company's return on investment (ROI). (Do not round intermediate calculations. Round your answer to 2 decimal places.) Required information Exercise 10-13 (Algo) Effects of Changes in Sales, Expenses, and Assets on ROI [LO10-1] [The following information applies to the questions displayed below.] CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below: The following questions are to be considered independently. Exercise 10-13 Part 2 (Algo) 2. The entrepreneur who founded the company is convinced that sales will increase next year by 60% and that net operating income will increase by 360%, with no increase in average operating assets. What would be the company's ROI? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Exercise 10-12 (Algo) Evaluating New Investments Using Return on Investment Income [LO10-1, LO10-2] Selected sales and operating data for three divisions of different structural engineering firms are given Required: 1. Compute the return on investment (ROI) for each division using the formula stated in terms of margin 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yield a 15% rate o a. If performance is being measured by ROI, which division or divisions will probably accept or reject th b. If performance is being measured by residual income, which division or divisions will probably accep 1. Compute the rate of return for each division using the return on investment (ROI) formula stated in terms of margin and turnover. 2. Which divisional manager seems to be doing the better job? Complete this question by entering your answers in the tabs below. Compute the rate of return for each division using the return on investment (ROI) formula state turnover. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Exercise 10-13 (Algo) Effects of Changes in Sales, Expenses, and Assets on ROI [LO10-1] [The following information applies to the questions displayed below.] CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below: The following questions are to b[ considered independently. Exercise 10-13 Part 1 (Algo) Required: 1. Compute the company's return on investment (ROI). (Do not round intermediate calculations. Round your answer to 2 decimal places.) Required information Exercise 10-13 (Algo) Effects of Changes in Sales, Expenses, and Assets on ROI [LO10-1] [The following information applies to the questions displayed below.] CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below: The following questions are to be considered independently. Exercise 10-13 Part 2 (Algo) 2. The entrepreneur who founded the company is convinced that sales will increase next year by 60% and that net operating income will increase by 360%, with no increase in average operating assets. What would be the company's ROI? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Exercise 10-12 (Algo) Evaluating New Investments Using Return on Investment Income [LO10-1, LO10-2] Selected sales and operating data for three divisions of different structural engineering firms are given Required: 1. Compute the return on investment (ROI) for each division using the formula stated in terms of margin 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yield a 15% rate o a. If performance is being measured by ROI, which division or divisions will probably accept or reject th b. If performance is being measured by residual income, which division or divisions will probably accep

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts