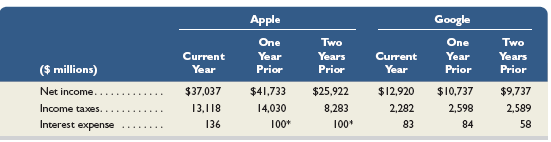

Question: 1. Compute times interest earned for the three years' data shown for each company. 2. Comment on which company appears stronger in its ability to

1. Compute times interest earned for the three years' data shown for each company.

2. Comment on which company appears stronger in its ability to pay interest obligations if income should decline. Assume an industry average of 10.

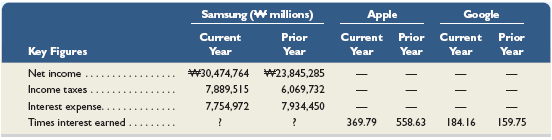

- Compute the times interest earned ratio for the most recent two years for Samsung using the data shown.

- Which company of the three presented provides the best coverage of interest expense? Explain.

Apple Google One Two One Two Current Year Years Current Year Years ($ millions) Year Prior Prior Year Prior Prior Net income. $37,037 $41,733 $25,922 $10,737 $12,920 $9,737 Income taxes 13,1 18 4.030 8,283 2,282 2,598 2,589 Interest expense 136 00* 100 83 84 58 Samsung (W millions) Apple Google Current Prior Current Prior Current Prior Year Key Figures Year Year Year Year Year Net income. 23.845,285 30,474,764 Income taces 7,889,515 6,069,732 Interest expense. 7,754,972 7,934,450 Times interest earned ? 369.79 558.63 184,16 159,75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts