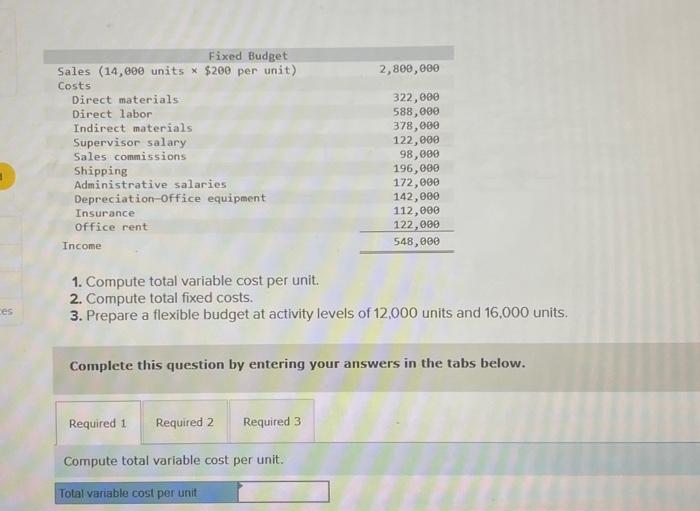

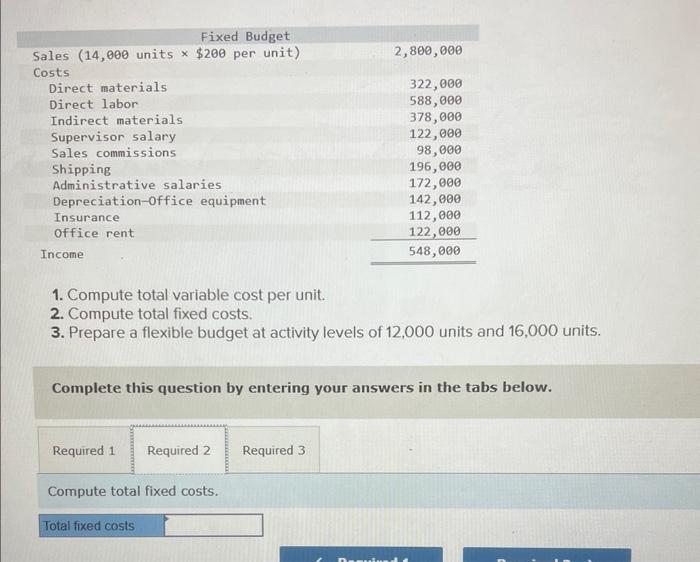

Question: 1. Compute total variable cost per unit. 2. Compute total fixed costs. 3. Prepare a flexible budget at activity levels of 12,000 units and 16,000

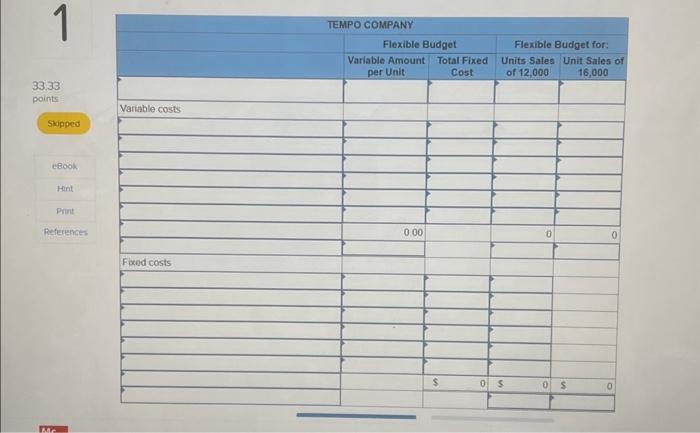

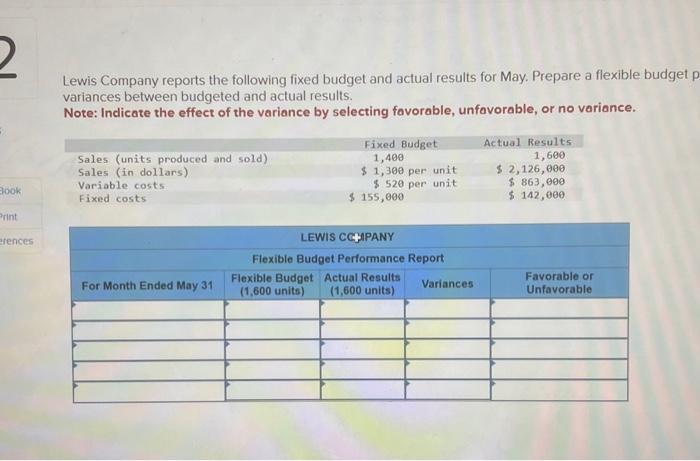

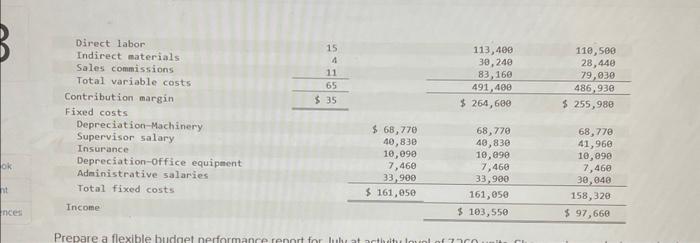

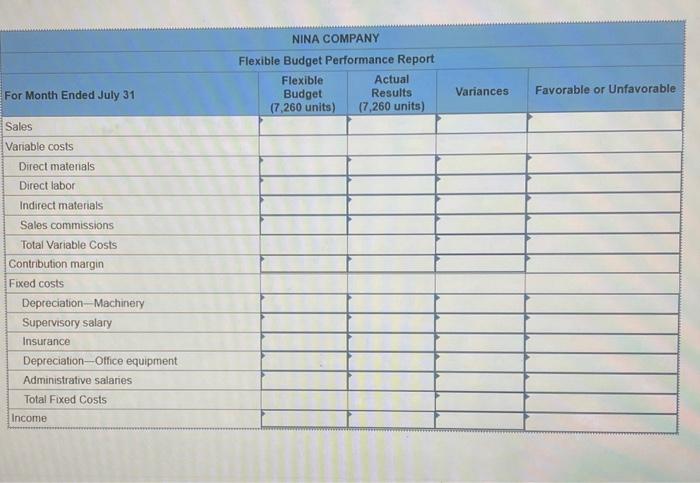

1. Compute total variable cost per unit. 2. Compute total fixed costs. 3. Prepare a flexible budget at activity levels of 12,000 units and 16,000 units. Complete this question by entering your answers in the tabs below. Compute total fixed costs. 1. Compute total variable cost per unit. 2. Compute total fixed costs. 3. Prepare a flexible budget at activity levels of 12,000 units and 16,000 units. Complete this question by entering your answers in the tabs below. Compute total variable cost per unit. \begin{tabular}{|c|c|c|c|c|} \hline Direct labor & 15 & & 113,409 & 110,500 \\ \hline Indirect materials & 4 & & 30,249 & 28,44 \\ \hline Sales commissions & 11 & & 83,16 & 79,030 \\ \hline Total variable costs & 65 & & 491,460 & 486,936 \\ \hline Contribution margin & $35 & & $264,600 & $255,980 \\ \hline \multicolumn{5}{|l|}{\begin{tabular}{l} Fixed costs \\ Depreciation Machinery \end{tabular}} \\ \hline Depreciation-Machinery & & $68,770 & 68,770 & 68,770 \\ \hline Supervisor salary. & & 40,830 & 46,830 & 41,966 \\ \hline Insurance & & 10,090 & 10,090 & 10,090 \\ \hline Depreciation-office equipment & & 7,460 & 7,460 & 7,460 \\ \hline Adainistrative salaries & & 33,900 & 33,900 & 30,048 \\ \hline Total fixed costs & & $161,050 & 161,050 & 158,328 \\ \hline Income & & & $103,550 & $97,660 \\ \hline \end{tabular} Lewis Company reports the following fixed budget and actual results for May. Prepare a flexible budget variances between budgeted and actual results. Note: Inclicate the effect of the variance by selecting favorable, unfavorable, or no variance. NINA COMPANY Flexible Budget Performance Report For Month Ended July 31 Sales Variable costs Direct matenals Direct labor Indirect materials Sales commissions Total Variable Costs Contribution margin Fixed costs Depreciation-Machinery Supervisory salary Insurance Depreciation-Office equipment Administrative salaries Total Fixed Costs Income \begin{tabular}{|c|c|c|c|c|} \begin{tabular}{c} Flexible \\ Budget \\ (7,260 units ) \end{tabular} & \begin{tabular}{c} Actual \\ Results \\ (7,260 units ) \end{tabular} & Variances & Favorable or Unfavorable \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts