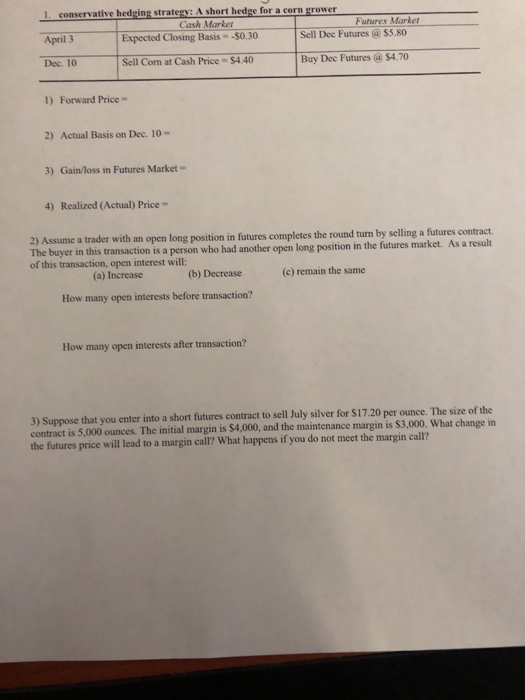

Question: 1. conservative hedging strategy: A short hedge for a corn grower Cash Market Fures Market April 3 Expected Closing Basis --50.30 Sell Dec Futures @

1. conservative hedging strategy: A short hedge for a corn grower Cash Market Fures Market April 3 Expected Closing Basis --50.30 Sell Dec Futures @ $5.80 Dec. 10 Sell Com at Cash Price = $4.40 Buy Dee Futures @ $4.70 1) Forward Price 2) Actual Basis on Dec. 10 - 3) Gain loss in Futures Market 4) Realized (Actual) Price 2) Assume a trader with an open long position in futures completes the round turn by selling a futures contract The buyer in this transaction is a person who had another open long position in the futures market. As a result of this transaction, open interest will: (a) Increase (b) Decrease (c) remain the same How many open interests before transaction? How many open interests after transaction? 3) Suppose that you enter into a short futures contract to sell July silver for $17.20 per ounce. The size of the contract is 5,000 ounces. The initial margin is $4,000, and the maintenance margin is $3,000. What change in the futures price will lead to a margin call? What happens if you do not meet the margin call

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts