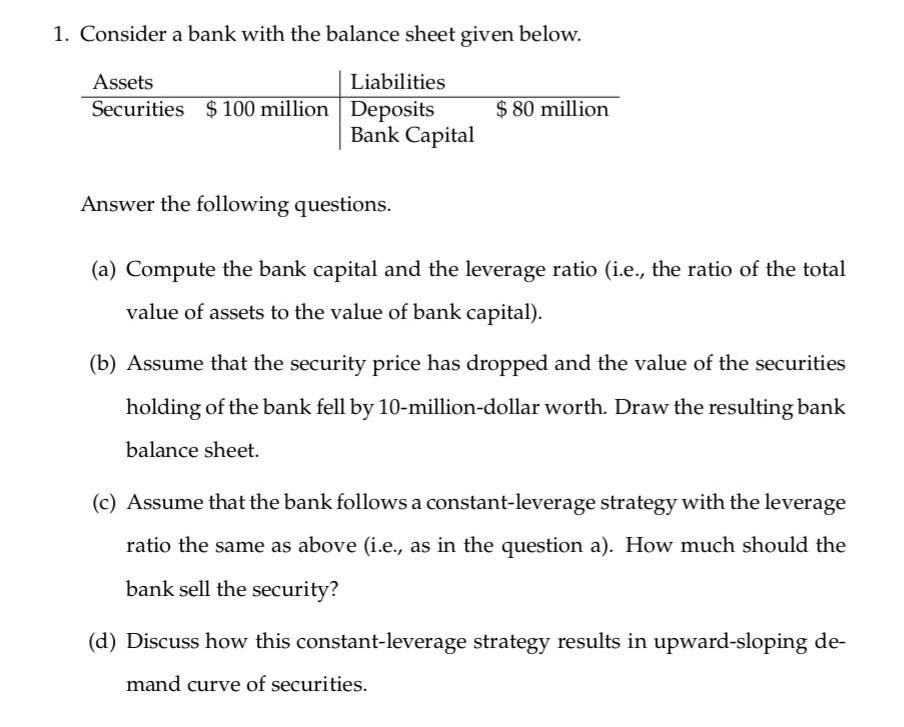

Question: 1. Consider a bank with the balance sheet given below. Assets Securities $ 100 million | Liabilities Deposits Bank Capital $ 80 million Answer the

1. Consider a bank with the balance sheet given below. Assets Securities $ 100 million | Liabilities Deposits Bank Capital $ 80 million Answer the following questions. (a) Compute the bank capital and the leverage ratio (i.e., the ratio of the total value of assets to the value of bank capital). (b) Assume that the security price has dropped and the value of the securities holding of the bank fell by 10-million-dollar worth. Draw the resulting bank balance sheet. (c) Assume that the bank follows a constant-leverage strategy with the leverage ratio the same as above (i.e., as in the question a). How much should the bank sell the security? (d) Discuss how this constant-leverage strategy results in upward-sloping de- mand curve of securities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts