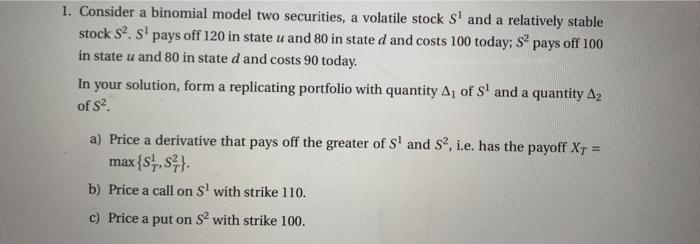

Question: 1. Consider a binomial model two securities, a volatile stock s' and a relatively stable stock S2. s' pays off 120 in state u and

1. Consider a binomial model two securities, a volatile stock s' and a relatively stable stock S2. s' pays off 120 in state u and 80 in stated and costs 100 today; S pays off 100 in state u and 80 in stated and costs 90 today, In your solution, form a replicating portfolio with quantity A, of s' and a quantity A2 of S. a) Price a derivative that pays off the greater of sand S, i.e. has the payoff Xy = max{1,5} b) Price a call on Sl with strike 110. c) Price a put on S4 with strike 100

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock