Question: 1. Consider a bond that pays interest such that it = 0.14 with an associated risk premium x = 0.06 and calculate the probability

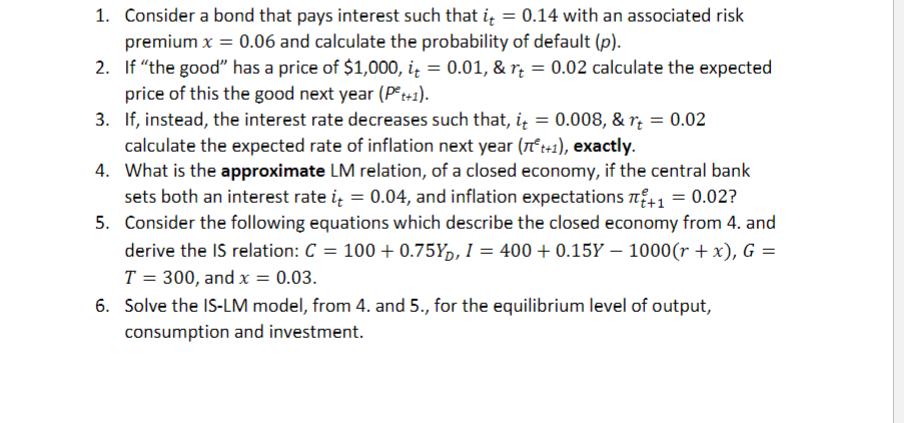

1. Consider a bond that pays interest such that it = 0.14 with an associated risk premium x = 0.06 and calculate the probability of default (p). 2. If "the good" has a price of $1,000, it = 0.01, & r = 0.02 calculate the expected price of this the good next year (Pt+1). 3. If, instead, the interest rate decreases such that, it = 0.008, & r = 0.02 calculate the expected rate of inflation next year (+1), exactly. 4. What is the approximate LM relation, of a closed economy, if the central bank sets both an interest rate it = 0.04, and inflation expectations +1 = 0.02? Consider the following equations which describe the closed economy from 4. and derive the IS relation: C = 100+ 0.75Y, I = 400 +0.15Y - 1000(r + x), G = T = 300, and x = 0.03. 5. 6. Solve the IS-LM model, from 4. and 5., for the equilibrium level of output, consumption and investment.

Step by Step Solution

3.43 Rating (169 Votes )

There are 3 Steps involved in it

1 To calculate the probability of default p for the bond we need the risk premium x The risk premium is the excess return required by investors to hold a risky asset compared to a riskfree asset Given ... View full answer

Get step-by-step solutions from verified subject matter experts