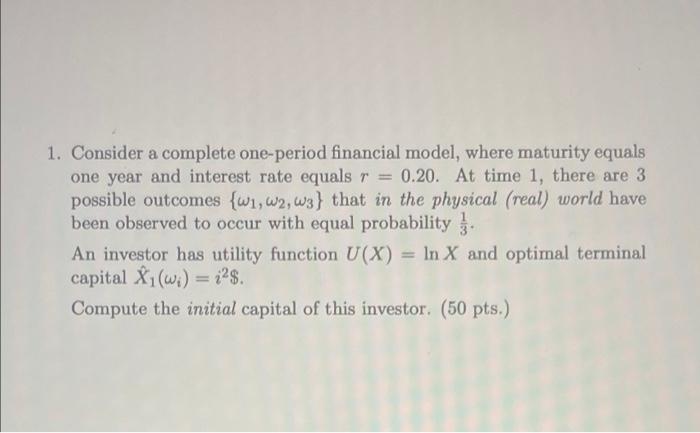

Question: 1. Consider a complete one-period financial model, where maturity equals one year and interest rate equals r = 0.20. At time 1, there are 3

1. Consider a complete one-period financial model, where maturity equals one year and interest rate equals r = 0.20. At time 1, there are 3 possible outcomes {w1, W2, W3} that in the physical (real) world have been observed to occur with equal probability. An investor has utility function U(X) = In X and optimal terminal capital fi(w.) = 12$. Compute the initial capital of this investor. (50 pts.) 1. Consider a complete one-period financial model, where maturity equals one year and interest rate equals r = 0.20. At time 1, there are 3 possible outcomes {w1, W2, W3} that in the physical (real) world have been observed to occur with equal probability. An investor has utility function U(X) = In X and optimal terminal capital fi(w.) = 12$. Compute the initial capital of this investor. (50 pts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts