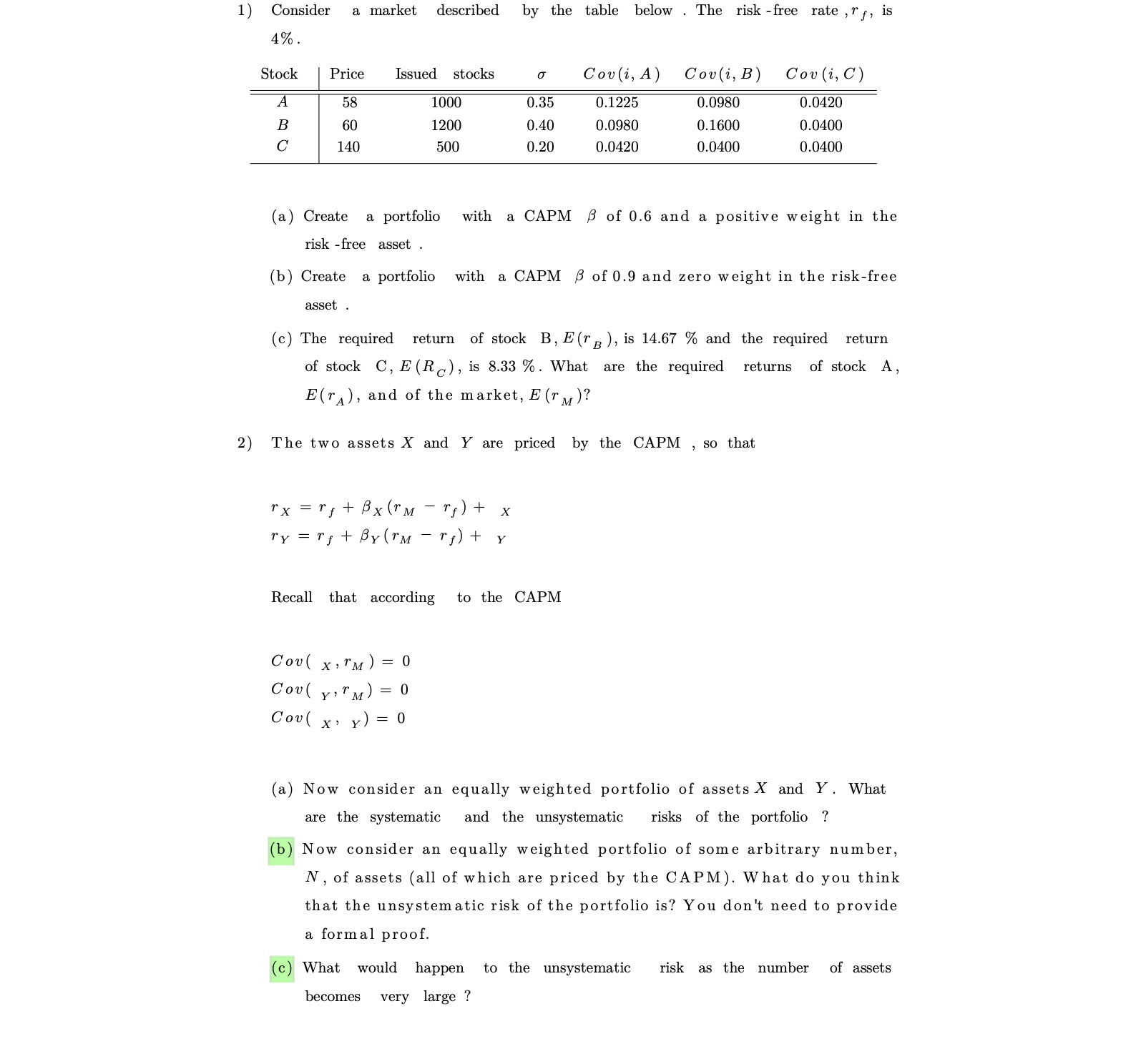

Question: 1) Consider a market described by the table below . The risk -free rate , ry, is 4% Stock | Price Issued stocks Cov(i, A)

1) Consider a market described by the table below . The risk -free rate , ry, is 4% Stock | Price Issued stocks Cov(i, A) Cov(i, B) Cov (i, C) A 58 LOOC 0.35 0.1225 0.0980 0.0420 60 1200 0.40 0.0980 0.1600 0.0400 140 500 0.20 0.0420 0.0400 0.0400 (a) Create a portfolio with a CAPM 3 of 0.6 and a positive weight in the risk -free asset . (b ) Create a portfolio with a CAPM B of 0.9 and zero weight in the risk-free asset . (c) The required return of stock B, E(B ), is 14.67 % and the required return of stock C, E(Rc), is 8.33 %. What are the required returns of stock A, E( TA), and of the market, E (r M)? 2) The two assets X and Y are priced by the CAPM , so that rx =rf + Bx (r M - rf ) + x ry = rf + By(rM - rf) + x Recall that according to the CAPM Cov( x, TM ) = 0 Cov( y, TM) = Cov( x , Y) = 0 (a) Now consider an equally weighted portfolio of assets X and Y . What are the systematic and the unsystematic risks of the portfolio ? (b) Now consider an equally weighted portfolio of some arbitrary number, N, of assets (all of which are priced by the CAPM). What do you think that the unsystematic risk of the portfolio is? You don't need to provide a formal proof. (c) What would happen to the unsystematic risk as the number of assets becomes very large

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts