Question: 1) Consider a no-interest loan with current rating BB, maturity of 3 years and amount to be repaid at maturity of $100 million. The recovery

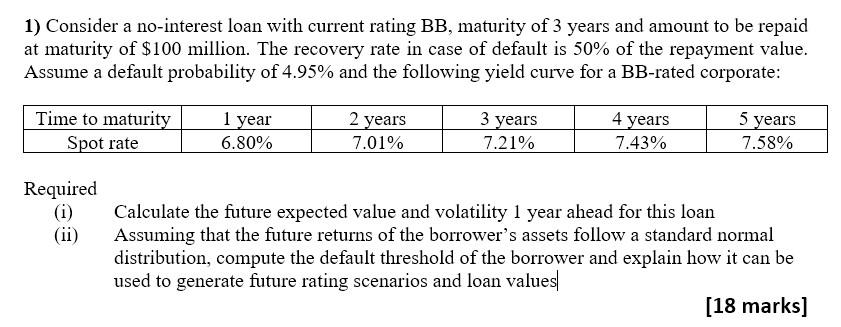

1) Consider a no-interest loan with current rating BB, maturity of 3 years and amount to be repaid at maturity of $100 million. The recovery rate in case of default is 50% of the repayment value. Assume a default probability of 4.95% and the following yield curve for a BB-rated corporate: 1 year Time to maturity Spot rate 2 years 7.01% 4 years 3 years 7.21% 5 years 7.58% 6.80% 7.43% Required (1) (ii) Calculate the future expected value and volatility 1 year ahead for this loan Assuming that the future returns of the borrower's assets follow a standard normal distribution, compute the default threshold of the borrower and explain how it can be used to generate future rating scenarios and loan values (18 marks) 1) Consider a no-interest loan with current rating BB, maturity of 3 years and amount to be repaid at maturity of $100 million. The recovery rate in case of default is 50% of the repayment value. Assume a default probability of 4.95% and the following yield curve for a BB-rated corporate: 1 year Time to maturity Spot rate 2 years 7.01% 4 years 3 years 7.21% 5 years 7.58% 6.80% 7.43% Required (1) (ii) Calculate the future expected value and volatility 1 year ahead for this loan Assuming that the future returns of the borrower's assets follow a standard normal distribution, compute the default threshold of the borrower and explain how it can be used to generate future rating scenarios and loan values (18 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts