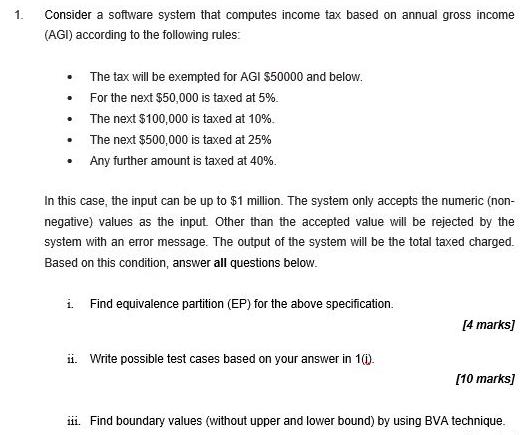

Question: 1. Consider a software system that computes income tax based on annual gross income (AGI) according to the following rules: . . . .

1. Consider a software system that computes income tax based on annual gross income (AGI) according to the following rules: . . . . The tax will be exempted for AGI $50000 and below. For the next $50,000 is taxed at 5%. The next $100,000 is taxed at 10%. The next $500,000 is taxed at 25% Any further amount is taxed at 40%. In this case, the input can be up to $1 million. The system only accepts the numeric (non- negative) values as the input. Other than the accepted value will be rejected by the system with an error message. The output of the system will be the total taxed charged. Based on this condition, answer all questions below. i. Find equivalence partition (EP) for the above specification. ii. Write possible test cases based on your answer in 1(1). [4 marks] [10 marks] 111. Find boundary values (without upper and lower bound) by using BVA technique.

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

i Equivalence Partitioning EP Based on the given specification we can identify the following partiti... View full answer

Get step-by-step solutions from verified subject matter experts