Question: 1. Consider equity (E) and bond (B) mutual funds with the following properties: SD Fund Risk premium E 5.75% B 2.60% 15.15% 8.85% The correlation

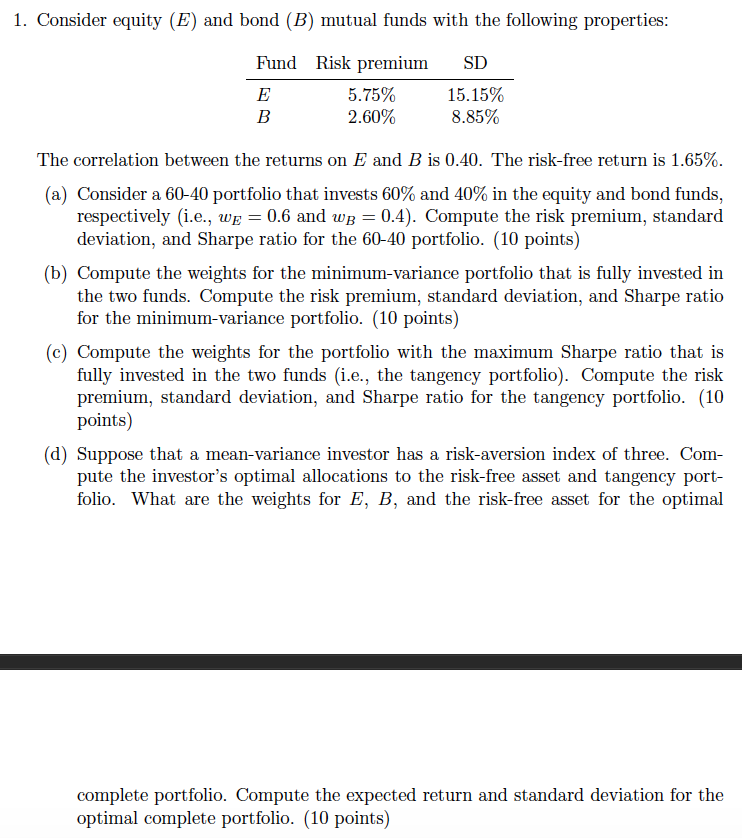

1. Consider equity (E) and bond (B) mutual funds with the following properties: SD Fund Risk premium E 5.75% B 2.60% 15.15% 8.85% The correlation between the returns on E and B is 0.40. The risk-free return is 1.65%. (a) Consider a 60-40 portfolio that invests 60% and 40% in the equity and bond funds, respectively (i.e., we = 0.6 and wb = 0.4). Compute the risk premium, standard deviation, and Sharpe ratio for the 60-40 portfolio. (10 points) (b) Compute the weights for the minimum-variance portfolio that is fully invested in the two funds. Compute the risk premium, standard deviation, and Sharpe ratio for the minimum-variance portfolio. (10 points) (c) Compute the weights for the portfolio with the maximum Sharpe ratio that is fully invested in the two funds (i.e., the tangency portfolio). Compute the risk premium, standard deviation, and Sharpe ratio for the tangency portfolio. (10 points) (d) Suppose that a mean-variance investor has a risk-aversion index of three. Com- pute the investor's optimal allocations to the risk-free asset and tangency port- folio. What are the weights for E, B, and the risk-free asset for the optimal complete portfolio. Compute the expected return and standard deviation for the optimal complete portfolio. (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts