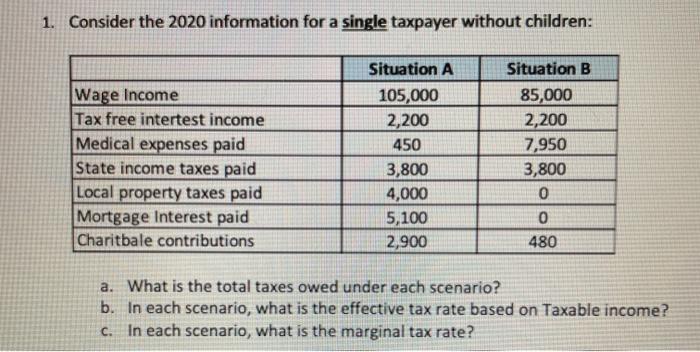

Question: 1. Consider the 2020 information for a single taxpayer without children: Wage Income Tax free intertest income Medical expenses paid State income taxes paid Local

1. Consider the 2020 information for a single taxpayer without children: Wage Income Tax free intertest income Medical expenses paid State income taxes paid Local property taxes paid Mortgage Interest paid Charitbale contributions Situation A 105,000 2,200 450 3,800 4,000 5,100 2,900 Situation B 85,000 2,200 7,950 3,800 0 0 480 a. What is the total taxes owed under each scenario? b. In each scenario, what is the effective tax rate based on Taxable income? In each scenario, what is the marginal tax rate? C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts