Question: 1. Consider the decision problem of a representative household optimally choosing a sequence of consumption {ct} and asset holdings {at+1} over an infinite horizon, taking

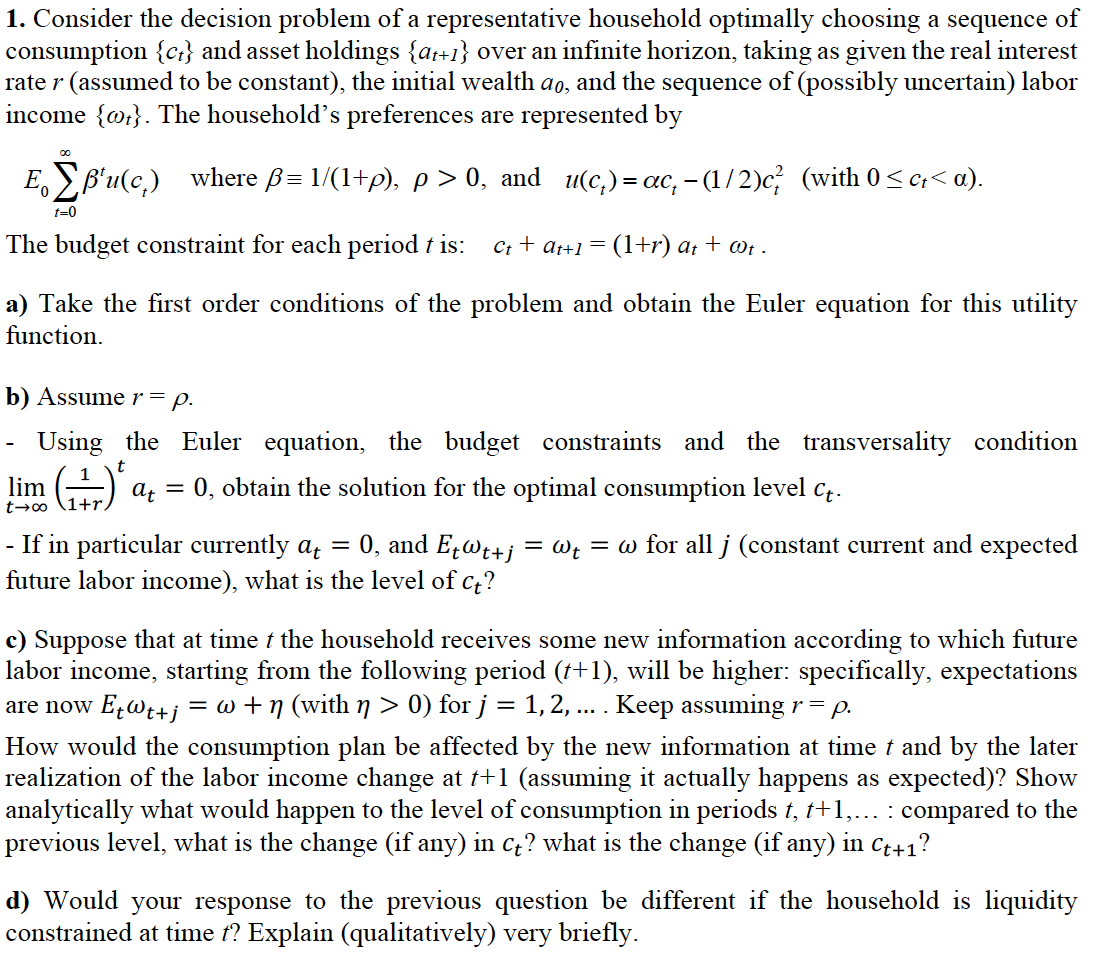

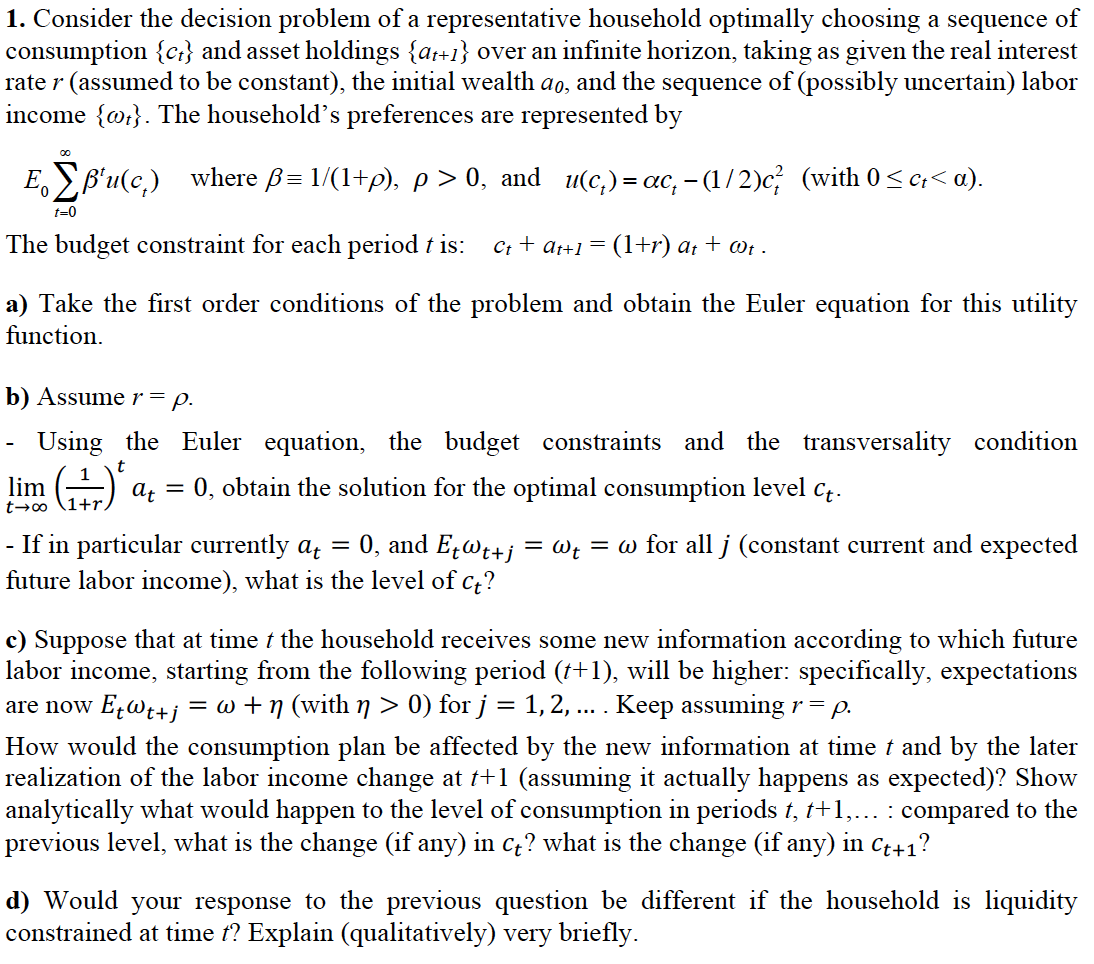

1. Consider the decision problem of a representative household optimally choosing a sequence of

consumption {ct} and asset holdings {at+1} over an infinite horizon, taking as given the real interest

rate r (assumed to be constant), the initial wealth a0, and the sequence of (possibly uncertain) labor

income {?t}. The household's preferences are represented by

where b 1/(1+r), ? > 0, and (with 0 ? ct

The budget constraint for each period t is: ct + at+1 = (1+r) at + ?t .

a) Take the first order conditions of the problem and obtain the Euler equation for this utility

function.

b) Assume r = r.

- Using the Euler equation, the budget constraints and the transversality condition

lim

!?#

' $

$%&(

!

?! = 0, obtain the solution for the optimal consumption level ?!.

- If in particular currently ?! = 0, and ?!?!%' = ?! = ? for all ? (constant current and expected

future labor income), what is the level of ?!?

c) Suppose that at time t the household receives some new information according to which future

labor income, starting from the following period (t+1), will be higher: specifically, expectations

are now ?!?!%' = ? + ? (with ? > 0) for ? = 1, 2,... . Keep assuming r = r.

How would the consumption plan be affected by the new information at time t and by the later

realization of the labor income change at t+1 (assuming it actually happens as expected)? Show

analytically what would happen to the level of consumption in periods t, t+1,... : compared to the

previous level, what is the change (if any) in ?!? what is the change (if any) in ?!%$?

d) Would your response to the previous question be different if the household is liquidity

constrained at time t? Explain (qualitatively) very briefly.

1. Consider the decision problem of a representative household optimally choosing a sequence of consumption {Cr} and asset holdings {am 1} over an innite horizon, taking as given the real interest rate r (assumed to be constant), the initial wealth a9, and the sequence of (possibly uncertain) labor income {cm}. The household's preferences are represented by EUZJB'MCJ where [32 1/(1+p), p > 0, and u(c,)= ac, (1/2)c,2 (with 0 g ct 0) forj = 1, 2, . Keep assuming r = p. How would the consumption plan be affected by the new information at time t and by the later realization of the labor income change at t+1 (assuming it actually happens as expected)? Show analytically what would happen to the level of consumption in periods t, H1, . .. : compared to the previous level, what is the change (if any) in Ct? what is the change (if any) in CH1? (1) Would your response to the previous question be different if the household is liquidity constrained at time 1'? Explain (qualitatively) very briey

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts