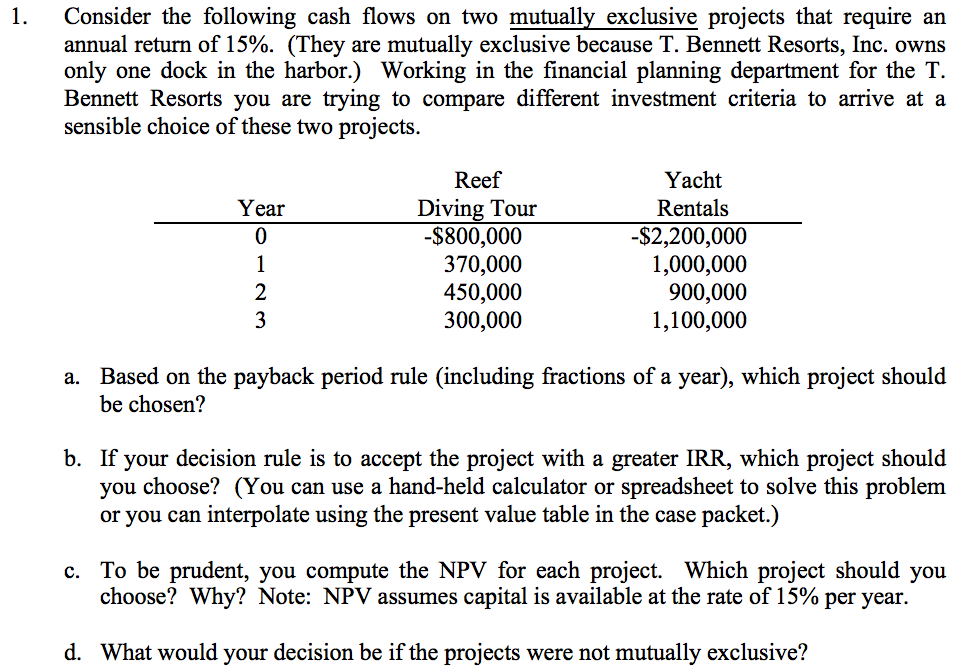

Question: 1. Consider the following cash flows on two mutually exclusive projects that require an annual return of 15%. (They are mutually exclusive because T. Bennett

1. Consider the following cash flows on two mutually exclusive projects that require an annual return of 15%. (They are mutually exclusive because T. Bennett Resorts, Inc. owns only one dock in the harbor.) Working in the financial planning department for the T. Bennett Resorts you are trying to compare different investment criteria to arrive at a sensible choice of these two projects Yacht Rentals Reef Diving Tour -$800,000 370,000 450,000 300,000 Year 0 -$2,200,000 1,000,000 900,000 1,100,000 2 a. Based on the payback period rule (including fractions of a year), which project should be chosen? b. If your decision rule is to accept the project with a greater IRR, which project should you choose? (You can use a hand-held calculator or spreadsheet to solve this problem or you can interpolate using the present value table in the case packet.) c. To be prudent, you compute the NPV for each project. Which project should you choose? Why? Note: NPV assumes capital is available at the rate of 15% per year d. What would your decision be if the projects were not mutually exclusive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts