Question: 1. Consider the following information: a. You will work for 40 years and, then, retire. b. You will live for an additional 30 years after

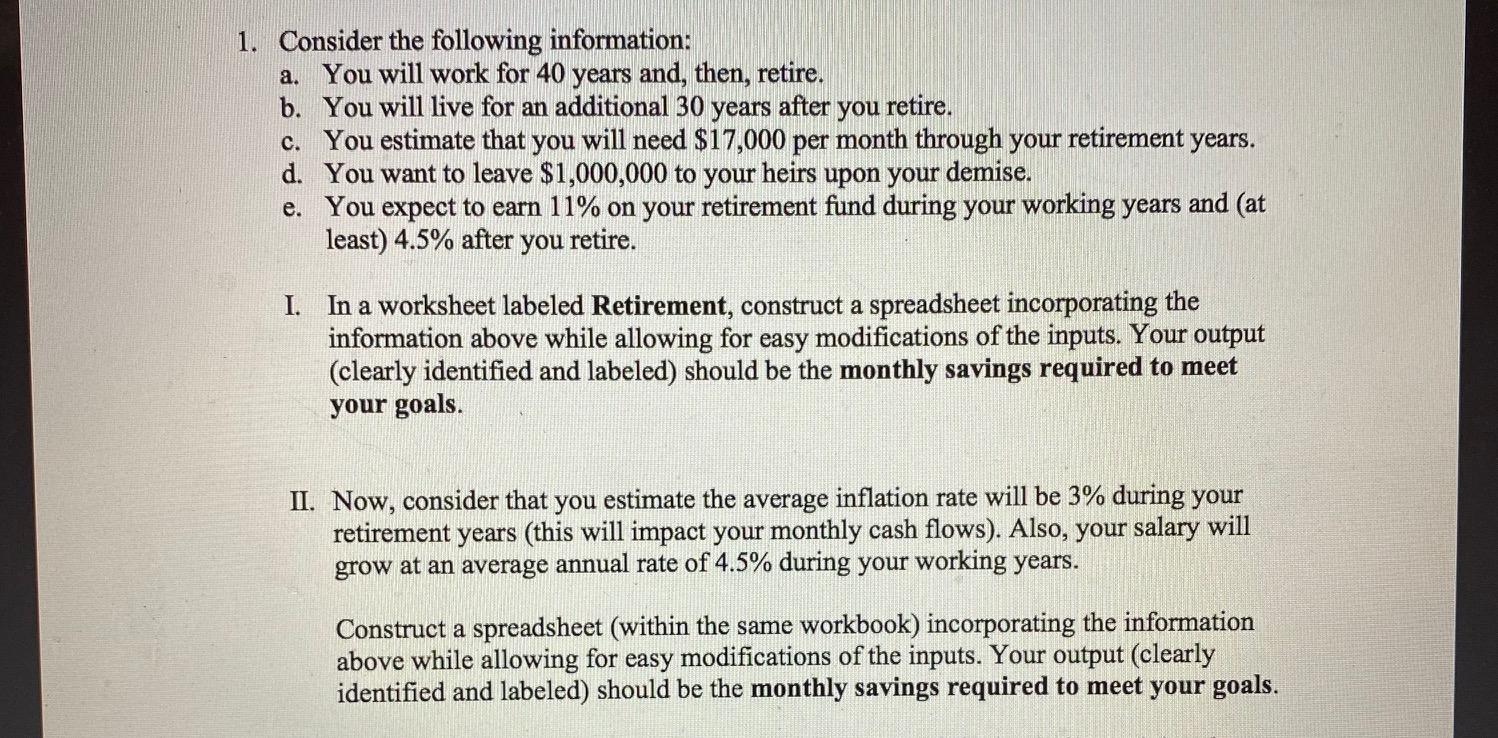

1. Consider the following information: a. You will work for 40 years and, then, retire. b. You will live for an additional 30 years after you retire. c. You estimate that you will need $17,000 per month through your retirement years. d. You want to leave $1,000,000 to your heirs upon your demise. e. You expect to earn 11% on your retirement fund during your working years and (at least) 4.5% after you retire. I. In a worksheet labeled Retirement, construct a spreadsheet incorporating the information above while allowing for easy modifications of the inputs. Your output (clearly identified and labeled) should be the monthly savings required to meet your goals. II. Now, consider that you estimate the average inflation rate will be 3% during your retirement years (this will impact your monthly cash flows). Also, your salary will grow at an average annual rate of 4.5% during your working years. Construct a spreadsheet (within the same workbook) incorporating the information above while allowing for easy modifications of the inputs. Your output (clearly identified and labeled) should be the monthly savings required to meet your goals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts