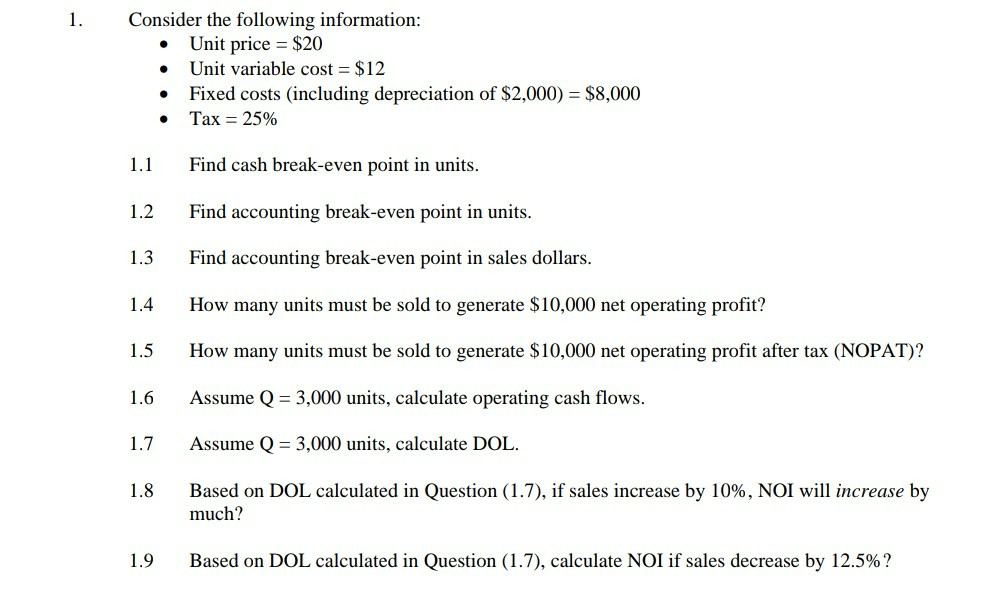

Question: 1 Consider the following information: .Unit price $20 Unit variable cost = $12 Fixed costs (including depreciation of $2,000) $8,000 . Tax-25% 1.1 Find cash

1 Consider the following information: .Unit price $20 Unit variable cost = $12 Fixed costs (including depreciation of $2,000) $8,000 . Tax-25% 1.1 Find cash break-even point in units. 1.2 Find accounting break-even point in units 1.3 Find accounting break-even point in sales dollars 1.4 How many units must be sold to generate $10,000 net operating profit? 1.5 How many units must be sold to generate $10,000 net operating profit after tax (NOPAT)? 1.6 Assume Q 3,000 units, calculate operating cash flows. 1.7 Assume Q 3,000 units, calculate DOL 1.8 Based on DOL calculated in Question (1.7), if sales increase by 10%, NOI will increase by much? Based on DOL calculated in Question ( 1.7), calculate NOI if sales decrease by 12.5%? 1.9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts