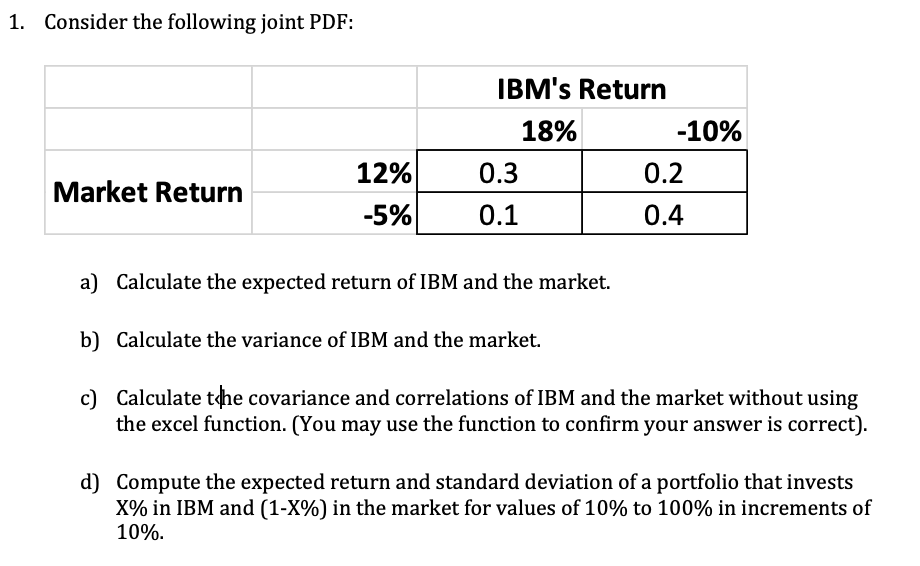

Question: 1. Consider the following joint PDF: IBM's Return 18% -10% 0.3 0.2 0.1 0.4 Market Return 12% -5% a) Calculate the expected return of IBM

1. Consider the following joint PDF: IBM's Return 18% -10% 0.3 0.2 0.1 0.4 Market Return 12% -5% a) Calculate the expected return of IBM and the market. b) Calculate the variance of IBM and the market. c) Calculate the covariance and correlations of IBM and the market without using the excel function. (You may use the function to confirm your answer is correct). d) Compute the expected return and standard deviation of a portfolio that invests X% in IBM and (1-X%) in the market for values of 10% to 100% in increments of 10%. 1. Consider the following joint PDF: IBM's Return 18% -10% 0.3 0.2 0.1 0.4 Market Return 12% -5% a) Calculate the expected return of IBM and the market. b) Calculate the variance of IBM and the market. c) Calculate the covariance and correlations of IBM and the market without using the excel function. (You may use the function to confirm your answer is correct). d) Compute the expected return and standard deviation of a portfolio that invests X% in IBM and (1-X%) in the market for values of 10% to 100% in increments of 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts