Question: 1. Consider the following money-in-utility model. The utility function is given by u(c, m) B (In c + ln mt) t=0 and the budget

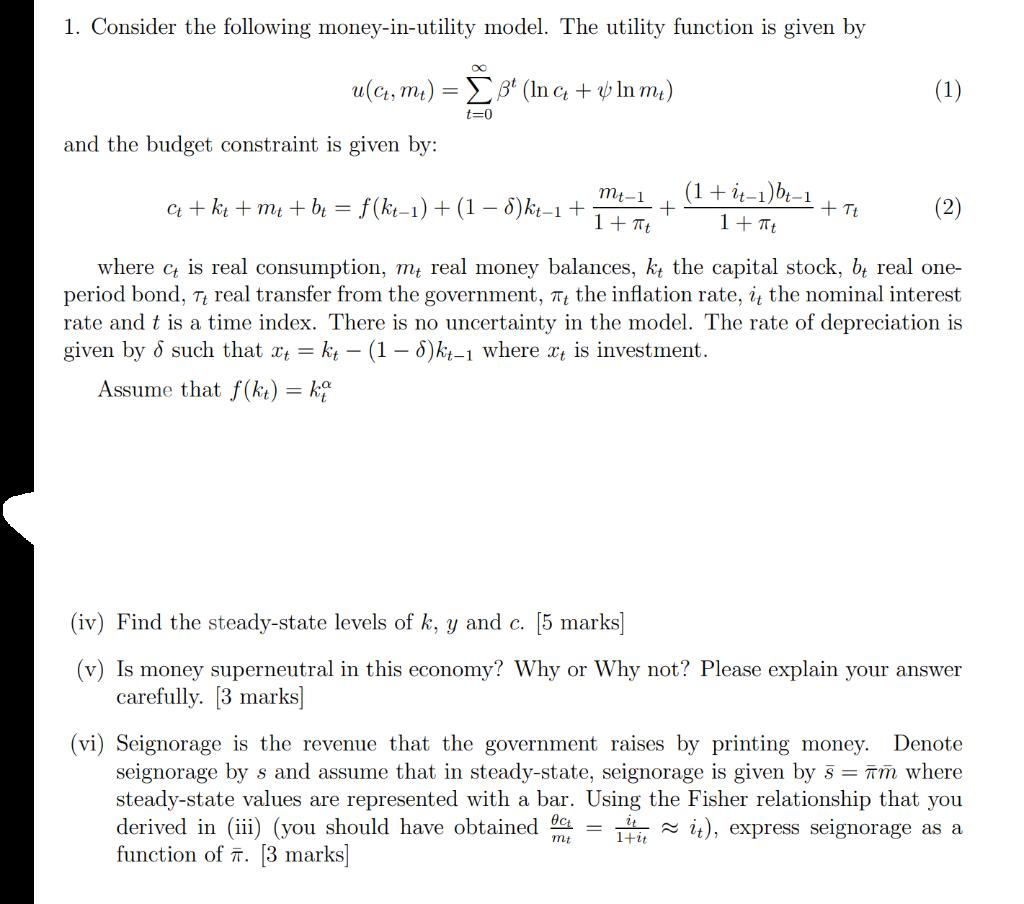

1. Consider the following money-in-utility model. The utility function is given by u(c, m) B (In c + ln mt) t=0 and the budget constraint is given by: = at + kt +mt + bt = f(kt-1) + (18)kt-1 + mt-1 1+t + (1 + it-1) bt-1 1 + Tt mt + Tt (1) (2) where ct is real consumption, mt real money balances, kt the capital stock, b, real one- period bond, Tt real transfer from the government, the inflation rate, it the nominal interest rate and t is a time index. There is no uncertainty in the model. The rate of depreciation is given by d such that xt = kt - (1-6)kt-1 where x is investment. Assume that f(kt) = kt (iv) Find the steady-state levels of k, y and c. [5 marks] (v) Is money superneutral in this economy? Why or Why not? Please explain your answer carefully. [3 marks] (vi) Seignorage is the revenue that the government raises by printing money. Denote seignorage by s and assume that in steady-state, seignorage is given by 5 - m where steady-state values are represented with a bar. Using the Fisher relationship that you derived in (iii) (you should have obtained it), express seignorage as a function of 7. [3 marks]

Step by Step Solution

There are 3 Steps involved in it

iv To find the steadystate levels of capital k output y and consumption c we need to solve for the values that satisfy the steadystate conditions In t... View full answer

Get step-by-step solutions from verified subject matter experts