Question: 1. Consider the following problem: Suppose that the interest rate in this year is 5% and all investors expect that interest rates for the

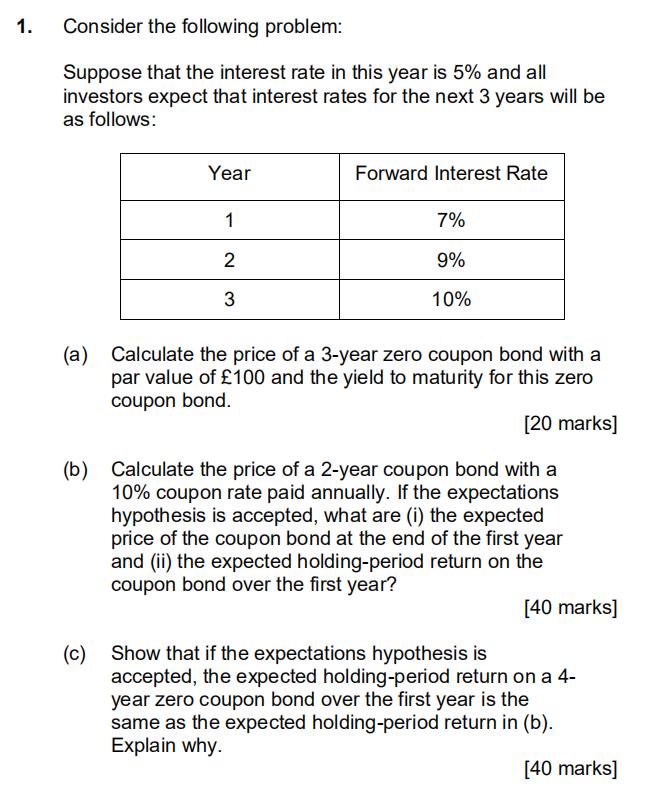

1. Consider the following problem: Suppose that the interest rate in this year is 5% and all investors expect that interest rates for the next 3 years will be as follows: Year 1 2 3 Forward Interest Rate (c) 7% 9% 10% (a) Calculate the price of a 3-year zero coupon bond with a par value of 100 and the yield to maturity for this zero coupon bond. [20 marks] (b) Calculate the price of a 2-year coupon bond with a 10% coupon rate paid annually. If the expectations hypothesis is accepted, what are (i) the expected price of the coupon bond at the end of the first year and (ii) the expected holding-period return on the coupon bond over the first year? [40 marks] Show that if the expectations hypothesis is accepted, the expected holding-period return on a 4- year zero coupon bond over the first year is the same as the expected holding-period return in (b). Explain why. [40 marks]

Step by Step Solution

There are 3 Steps involved in it

Solution a Calculate the price of a 3year zero coupon bond and the yield to maturity The price P of ... View full answer

Get step-by-step solutions from verified subject matter experts