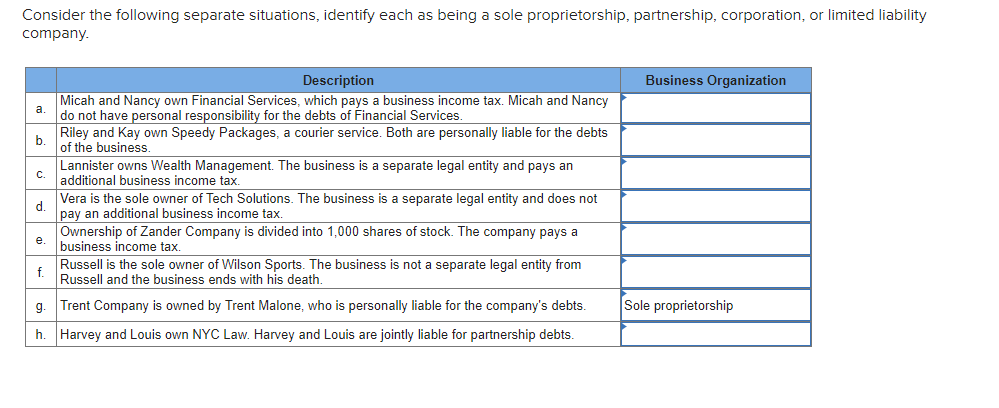

Question: 1. Consider the following separate situations, identify each as being a sole proprietorship, partnership, corporation, or limited liability company. Description Business Organization Micah and Nancy

1.

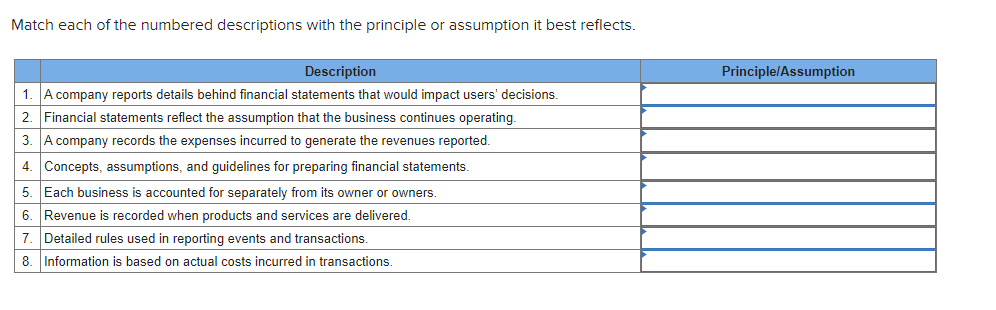

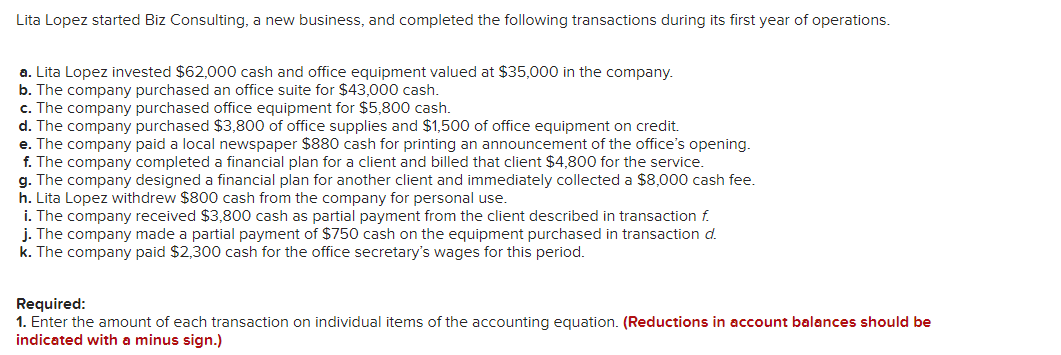

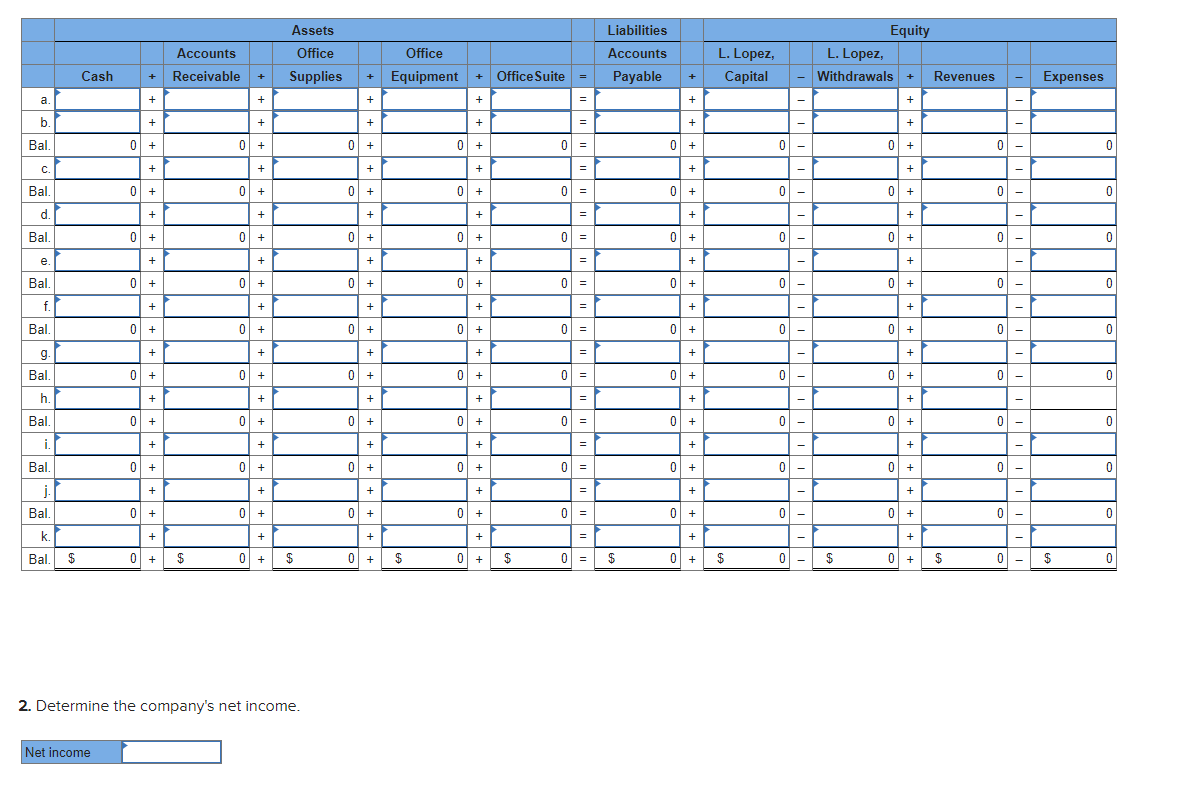

Consider the following separate situations, identify each as being a sole proprietorship, partnership, corporation, or limited liability company. Description Business Organization Micah and Nancy own Financial Services, which pays a business income tax. Micah and Nancy a do not have personal responsibility for the debts of Financial Services b. Riley and Kay own Speedy Packages, a courier service. Both are personally liable for the debts of the business. C. Lannister owns Wealth Management. The business is a separate legal entity and pays an additional business income tax. d Vera is the sole owner of Tech Solutions. The business is a separate legal entity and does not pay an additional business income tax. e. Ownership of Zander Company is divided into 1,000 shares of stock. The company pays a business income tax. f. Russell is the sole owner of Wilson Sports. The business is not a separate legal entity from Russell and the business ends with his death. g. Trent Company is owned by Trent Malone, who is personally liable for the company's debts. Sole proprietorship h. Harvey and Louis own NYC Law. Harvey and Louis are jointly liable for partnership debts.Match each of the numbered descriptions with the principle or assumption it best reflects. Description Principle/Assumption 1. A company reports details behind financial statements that would impact users' decisions. 2. Financial statements reflect the assumption that the business continues operating. 3. A company records the expenses incurred to generate the revenues reported. 4 Concepts, assumptions, and guidelines for preparing financial statements. 5. Each business is accounted for separately from its owner or owners. 6. Revenue is recorded when products and services are delivered. 7. Detailed rules used in reporting events and transactions. 8. Information is based on actual costs incurred in transactions.Lita Lopez started Biz Consulting, a new business, and completed the following transactions during its first year of operations. a. Lita Lopez invested $62,000 cash and office equipment valued at $35,000 in the company. b. The company purchased an office suite for $43,000 cash. c. The company purchased office equipment for $5,800 cash. d. The company purchased $3,800 of office supplies and $1,500 of office equipment on credit. e. The company paid a local newspaper $880 cash for printing an announcement of the office's opening. f. The company completed a financial plan for a client and billed that client $4,800 for the service. g. The company designed a financial plan for another client and immediately collected a $8,000 cash fee. h. Lita Lopez withdrew $800 cash from the company for personal use. i. The company received $3,800 cash as partial payment from the client described in transaction f. j. The company made a partial payment of $750 cash on the equipment purchased in transaction d. k. The company paid $2,300 cash for the office secretary's wages for this period. Required: 1. Enter the amount of each transaction on individual items of the accounting equation. (Reductions in account balances should be indicated with a minus sign.)Assets Liabilities Equity Accounts Office Office Accounts L. Lopez, L. Lopez, Cash Receivable + Supplies + Equipment + Office Suite = Payable Capital Withdrawals + Revenues Expenses a + + + + = + h + + + + + + Bal 0 + + 0+ 0 + 0 = + 0 0 + 0 + + + + = + + Bal + 0 + 0 + 0| + = 0 + 0 Ul + d + + + + = + + Bal 0 + + + + O = + 0 0 + 0 - + + + + + + Bal 0 + 0 + 0+ 0 + = 0 + 0- D + 0 - t. + + + 1I + + + Bal 0 + 0 + 0 + 0 + L= + 0 0 + 0 - + + + + + + Bal 0 + 0 + 0 + O = 0 + 0 - 0 - h + + + + + + 11 1I Bal + + + 0 + 0 0 - i. + + + + II + + + Bal + 0 - 0 + + 0 - 0 + + + + + + + Ba + 0 + = K + + + II + + Bal $ 0 + 0 + $ 0 + 0 + $ 0= 0 $ 0 $ 0 + $ 0 $ 2. Determine the company's net income. Net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts